Clariant And Two More Top Swiss Dividend Stocks

The Swiss market recently concluded on a high note, buoyed by optimism surrounding potential monetary policy easing by the European Central Bank. This positive momentum saw the benchmark SMI index climb significantly, reflecting robust investor confidence across various sectors. In such a thriving economic environment, dividend stocks like Clariant can appeal to investors seeking stable returns, as they often represent well-established companies with the potential for consistent income distribution amidst favorable market conditions.

Top 10 Dividend Stocks In Switzerland

Name | Dividend Yield | Dividend Rating |

Cembra Money Bank (SWX:CMBN) | 5.45% | ★★★★★★ |

Vontobel Holding (SWX:VONN) | 5.57% | ★★★★★★ |

Compagnie Financière Tradition (SWX:CFT) | 4.26% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.51% | ★★★★★★ |

St. Galler Kantonalbank (SWX:SGKN) | 4.35% | ★★★★★★ |

Novartis (SWX:NOVN) | 3.39% | ★★★★★☆ |

Roche Holding (SWX:ROG) | 4.07% | ★★★★★☆ |

EFG International (SWX:EFGN) | 4.41% | ★★★★★☆ |

Julius Bär Gruppe (SWX:BAER) | 4.78% | ★★★★★☆ |

Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.68% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

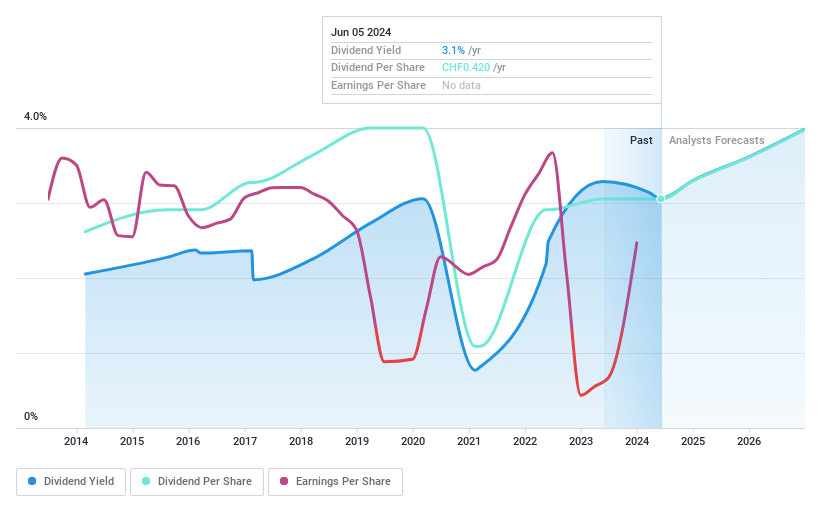

Clariant

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Clariant AG is a global company specializing in the development, manufacture, distribution, and sale of specialty chemicals, with a market capitalization of approximately CHF 4.52 billion.

Operations: Clariant AG generates revenue through three primary segments: Catalysis at CHF 1 billion, Care Chemicals at CHF 2.32 billion, and Adsorbents & Additives at CHF 1.06 billion.

Dividend Yield: 3.1%

Clariant AG, despite its unstable dividend track record and volatility in payments over the past decade, maintains a covered dividend with an 82.2% payout ratio from earnings and a 64.2% cash payout ratio. The company's recent reiteration of its full-year 2024 earnings guidance for low single-digit sales growth underscores a cautious but steady operational outlook. However, its dividend yield at 3.06% remains below the top quartile of Swiss dividend payers, reflecting moderate attractiveness to income-focused investors.

Take a closer look at Clariant's potential here in our dividend report.

Our valuation report unveils the possibility Clariant's shares may be trading at a premium.

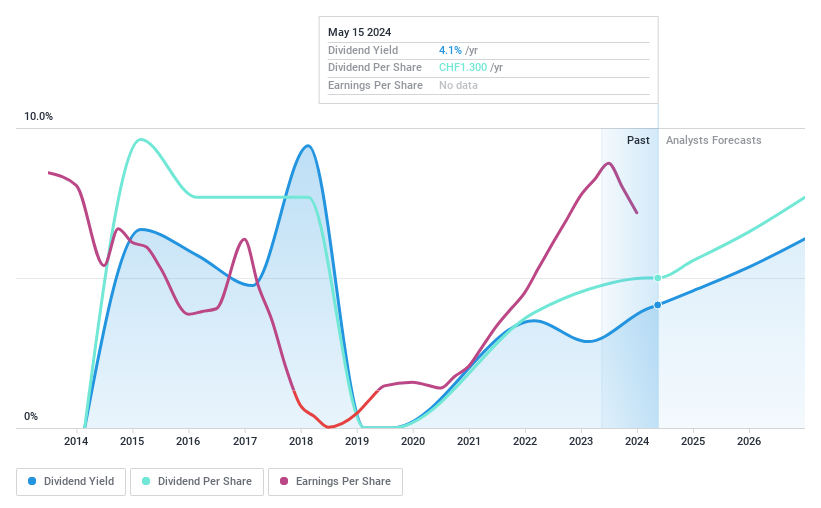

Meier Tobler Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Meier Tobler Group AG is a trading and services company specializing in heat generation and air conditioning systems, with a market capitalization of CHF 386.06 million.

Operations: Meier Tobler Group AG generates CHF 104.67 million from its service segment and CHF 441.25 million from distribution activities.

Dividend Yield: 3.8%

Meier Tobler Group exhibits a mixed dividend profile with a 10-year history of fluctuating payments. Despite this, the dividends are well-supported by both earnings and cash flows, with payout ratios at 54.8% and 50.7%, respectively. Trading significantly below its estimated fair value, MTG offers potential value but its dividend yield of 3.8% trails behind the top quartile in the Swiss market, indicating limited appeal for high-yield seekers.

Get an in-depth perspective on Meier Tobler Group's performance by reading our dividend report here.

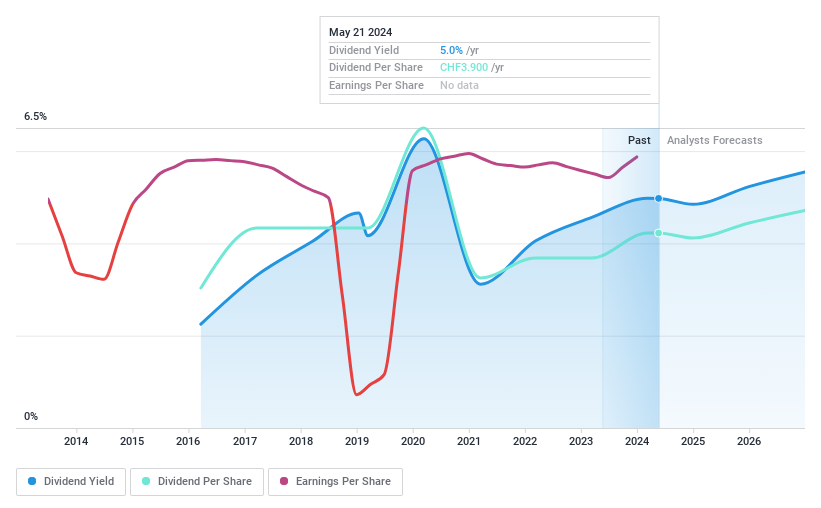

Orell Füssli

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Orell Füssli AG operates in security solutions and book retailing, serving both Swiss and international markets, with a market capitalization of CHF 149.74 million.

Operations: Orell Füssli AG generates CHF 117.48 million from its book trade, CHF 77.15 million from security printing, and CHF 21.59 million from industrial systems.

Dividend Yield: 5.1%

Orell Füssli offers a dividend yield of 5.1%, ranking in the top 25% in Switzerland, supported by a payout ratio of 63.5% and cash flow coverage at 61.6%. Despite trading below its fair value, the dividend history is less reliable, with significant fluctuations over its 8-year payment period. Earnings have grown by 41.8% last year and are expected to increase annually by 6.91%, yet the volatility in dividends presents a caution for stability-focused investors.

Dive into the specifics of Orell Füssli here with our thorough dividend report.

Our valuation report here indicates Orell Füssli may be undervalued.

Key Takeaways

Unlock our comprehensive list of 28 Top Dividend Stocks by clicking here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:CLNSWX:MTG and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance