City Office REIT Inc (CIO) First Quarter 2024 Earnings Overview

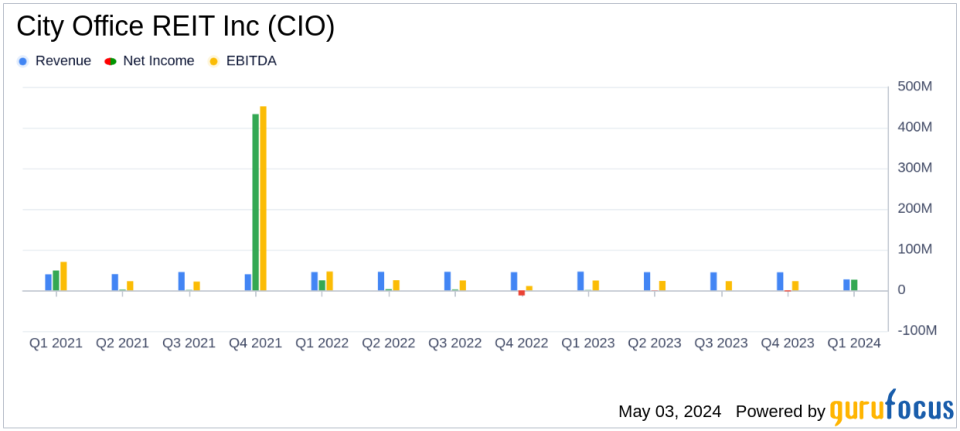

Revenue: Reported at $44.49 million for the first quarter of 2024, slightly above the estimated $43.35 million.

Net Income: Registered a net loss of $454,000, outperforming against the estimated net loss of $3.96 million.

Earnings Per Share (EPS): Recorded a loss of $0.06 per share, outperforming against the estimated loss of $0.13 per share.

Occupancy Rate: Achieved 83.0% physical occupancy and 86.0% including signed leases not yet occupied as of March 31, 2024.

Same Store Cash NOI: Experienced a decrease of 1.0% compared to the same period last year.

Dividends: Declared a quarterly cash dividend of $0.10 per common share and $0.4140625 per share for 6.625% Series A Preferred Stock.

Leasing Activity: Total leasing activity amounted to approximately 191,000 square feet, including 110,000 square feet of new leases.

On May 3, 2024, City Office REIT Inc (NYSE:CIO) disclosed its financial results for the first quarter ended March 31, 2024, through its 8-K filing. The company, a real estate investment trust focused on high-quality office properties in Sun Belt markets, reported earnings that aligned closely with its projections, despite facing a challenging leasing environment.

Company Overview

City Office REIT Inc operates primarily in metropolitan areas such as Dallas, Denver, Orlando, Phoenix, Portland, Raleigh, San Diego, Seattle, and Tampa. The company's strategic focus is on owning and operating office buildings in these key markets.

Quarterly Performance Highlights

For Q1 2024, City Office REIT reported a net operating income of approximately $26.7 million, with adjusted cash NOI at around $26.0 million. This performance includes $0.9 million from termination fee income. The company's leasing activity was robust, with around 191,000 square feet leased, including significant new leases in Raleigh and Orlando, leading to full occupancy at certain properties.

Despite these achievements, the company faced a slight decline in Same Store Cash NOI, which decreased by 1.0% compared to the same period last year. This reflects some of the ongoing challenges in the market, particularly with larger tenant prospects returning more slowly than anticipated.

Financial Position and Dividends

As of March 31, 2024, City Office's total debt stood at approximately $671.2 million, with a significant portion being fixed rate or effectively fixed rate due to interest rate swaps. The company declared dividends of $0.10 per share for common stock and $0.4140625 per share for Series A Preferred Stock, underscoring its commitment to delivering shareholder value.

2024 Outlook and Strategic Adjustments

The company's 2024 outlook remains largely unchanged, although adjustments have been made regarding the expected performance of co-working tenant WeWork. These adjustments are anticipated to reduce Core FFO in 2024 by $1.8 million, or $0.04 per fully diluted share, primarily due to non-cash write-offs.

Analysis and Future Prospects

City Office REIT's ability to maintain high occupancy rates and secure long-term leases speaks to its strong position in the market, despite the broader challenges facing the office space sector. The strategic focus on high-quality properties in desirable locations continues to be a prudent approach, potentially cushioning the company against market volatility.

The company's performance this quarter demonstrates resilience, with strategic lease agreements and occupancy achievements highlighting its operational strengths. However, the slight decrease in Same Store Cash NOI and the ongoing adjustments with WeWork leases suggest areas where the company must navigate carefully to sustain growth and profitability.

Conclusion

Overall, City Office REIT Inc's first quarter results for 2024 reflect a company effectively managing its portfolio in a complex market environment. With strategic property enhancements and a focus on diversifying tenant base, City Office is poised to continue its pattern of stable performance, aligning closely with its projected financial targets for the year.

Explore the complete 8-K earnings release (here) from City Office REIT Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance