City of London Investment Group And Two More Top Dividend Stocks To Consider

Amidst a dynamic backdrop where the FTSE 100 shows promising signs of growth and political shifts hint at potential economic changes, investors are keenly observing market trends and indices. In such an evolving environment, selecting robust dividend stocks could be a prudent strategy for those looking to stabilize their portfolios with consistent income streams.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

James Latham (AIM:LTHM) | 6.30% | ★★★★★★ |

Impax Asset Management Group (AIM:IPX) | 7.00% | ★★★★★☆ |

Epwin Group (AIM:EPWN) | 5.75% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.92% | ★★★★★☆ |

Keller Group (LSE:KLR) | 3.48% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 5.70% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.83% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.17% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.82% | ★★★★★☆ |

NWF Group (AIM:NWF) | 4.52% | ★★★★★☆ |

Click here to see the full list of 56 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

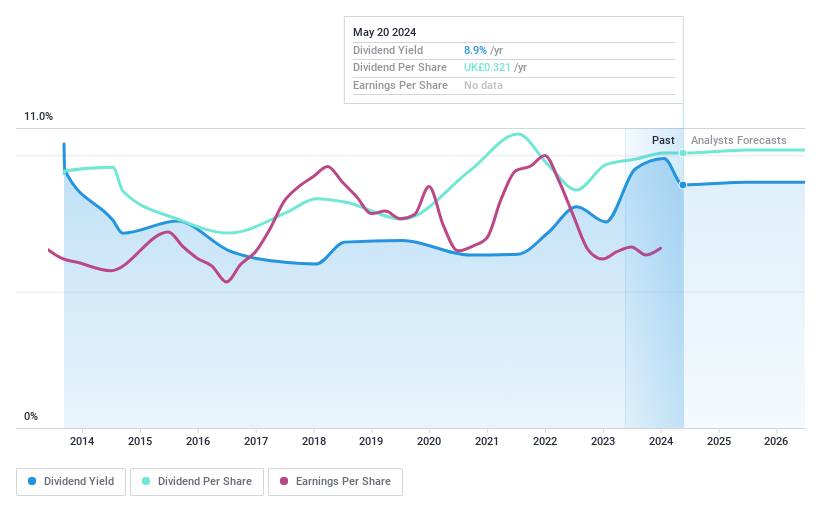

City of London Investment Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: City of London Investment Group PLC is a publicly owned investment manager with a market capitalization of approximately £184.80 million.

Operations: City of London Investment Group PLC generates its revenue primarily through asset management, contributing approximately $73.72 million.

Dividend Yield: 8.5%

City of London Investment Group offers a high dividend yield at 8.45%, ranking in the top 25% of UK dividend payers. Despite this, its dividends are not well supported, with a payout ratio of 112.5% and coverage issues evident from both earnings and cash flow perspectives. The firm's earnings have grown by 6.1% over the past year and are expected to increase by 17.4% annually, yet its dividend history shows volatility without consistent growth over the last decade. Currently, it trades at a significant discount to estimated fair value, suggesting potential undervaluation relative to peers.

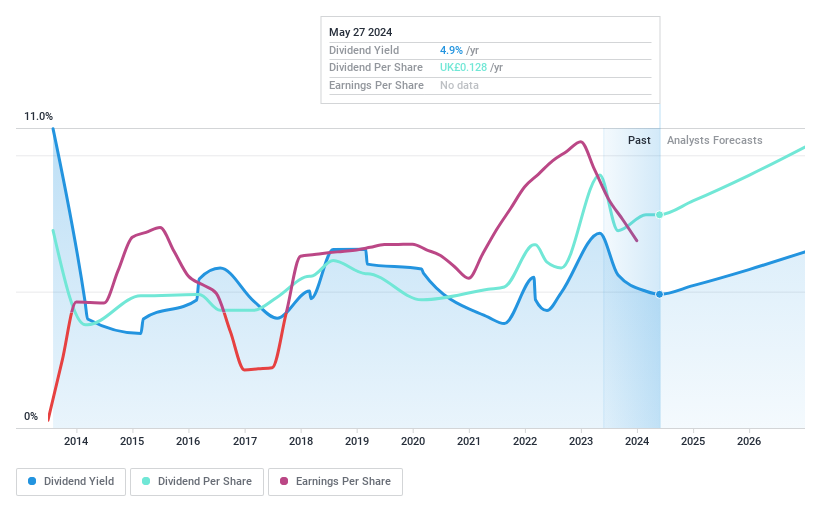

Man Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Man Group Limited is a publicly owned investment manager with a market capitalization of approximately £2.87 billion.

Operations: Man Group Limited generates its revenue primarily through its Investment Management Business, which reported earnings of $1.17 billion.

Dividend Yield: 5.1%

Man Group's dividend yield at 5.13% is modest compared to leading UK dividend stocks, yet it has shown a capacity for growth over the past decade. Currently trading at 57.4% below its estimated fair value, the stock offers potential upside according to analysts who predict a 22% price increase. Dividends are well-supported with an earnings payout ratio of 82% and cash flow payout ratio of 61.9%. However, dividends have experienced instability and Man Group's profit margins have declined from last year’s 35.1% to 20%. Recent strategic appointments suggest bolstering of governance and risk management capabilities.

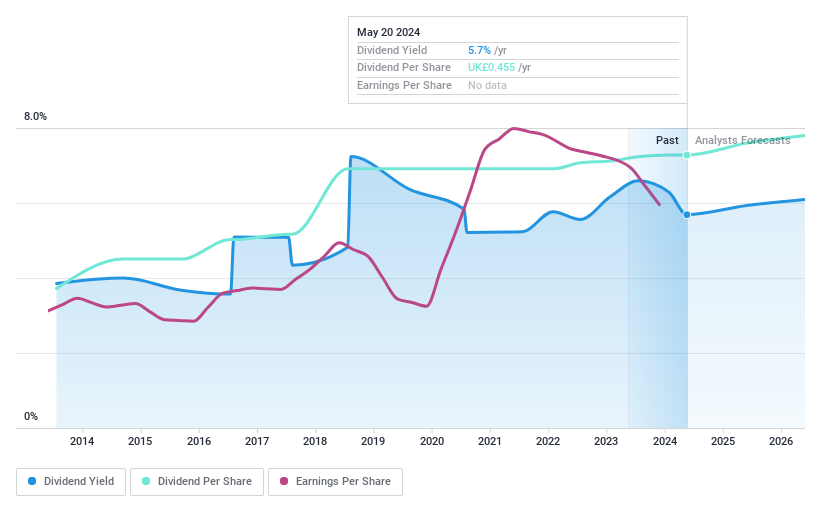

IG Group Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IG Group Holdings plc is a fintech company that operates globally in the online trading sector, with a market capitalization of approximately £3.10 billion.

Operations: IG Group Holdings generates its revenue primarily through its brokerage segment, which amounted to £954.70 million.

Dividend Yield: 5.4%

IG Group Holdings offers a dividend yield of 5.44%, slightly below the upper quartile for UK dividend stocks. Despite consistent dividends over the last decade, their sustainability is questionable as they are not well covered by cash flows, with a high cash payout ratio of 152.4%. The stock is currently undervalued, trading at 56.5% below its estimated fair value, indicating potential upside. Recent board enhancement with Marieke Flament could bring fresh strategic insights to bolster future performance.

Delve into the full analysis dividend report here for a deeper understanding of IG Group Holdings.

Our valuation report unveils the possibility IG Group Holdings' shares may be trading at a discount.

Next Steps

Click this link to deep-dive into the 56 companies within our Top Dividend Stocks screener.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:CLIGLSE:EMG and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance