City of London Investment Group And 2 Other Leading Dividend Stocks

As the FTSE 100 shows signs of extending its gains amidst a looming Bank of England policy decision, investors are closely monitoring the dynamic landscape of London's financial markets. In this context, understanding the characteristics that define leading dividend stocks becomes crucial, particularly as market conditions evolve and central bank policies potentially impact investor strategies.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

Record (LSE:REC) | 8.12% | ★★★★★★ |

Impax Asset Management Group (AIM:IPX) | 6.97% | ★★★★★☆ |

Keller Group (LSE:KLR) | 3.55% | ★★★★★☆ |

DCC (LSE:DCC) | 3.48% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 5.89% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.89% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.33% | ★★★★★☆ |

NWF Group (AIM:NWF) | 4.25% | ★★★★★☆ |

James Latham (AIM:LTHM) | 3.01% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.72% | ★★★★★☆ |

Click here to see the full list of 59 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

City of London Investment Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: City of London Investment Group PLC, a publicly owned investment manager, operates with a market capitalization of approximately £181.38 million.

Operations: City of London Investment Group PLC generates its revenue primarily from asset management, contributing approximately $73.72 million.

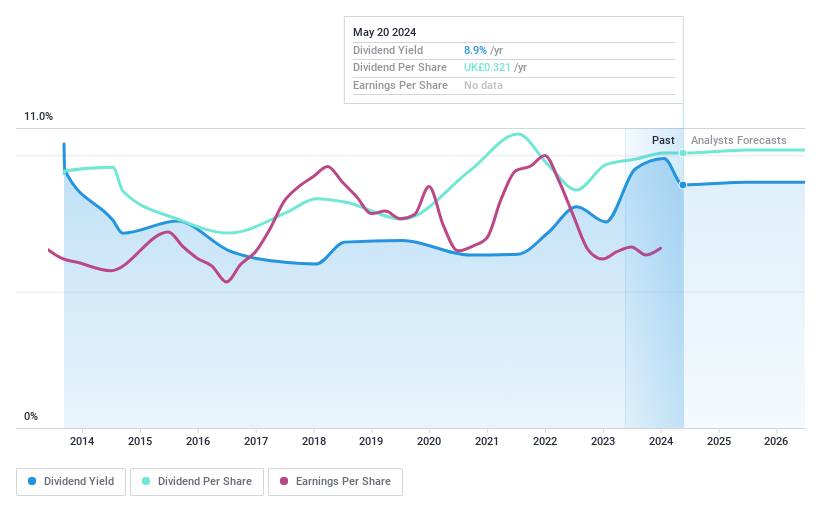

Dividend Yield: 8.6%

City of London Investment Group offers a high dividend yield at 8.64%, placing it in the top 25% of UK dividend payers. However, its dividends have shown volatility and unreliability over the past decade, with significant annual drops exceeding 20%. Currently trading at 21.3% below estimated fair value, CLIG appears financially attractive relative to its peers. Yet, challenges remain as both earnings and cash flows do not adequately cover the high payout ratio of 112.5%, signaling potential sustainability issues despite recent earnings growth projections of 17.4% per year.

Games Workshop Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Games Workshop Group PLC operates globally, specializing in the design, manufacture, distribution, and sale of miniature figures and games, with a market capitalization of approximately £3.39 billion.

Operations: Games Workshop Group PLC generates revenue primarily through its core business of £468.70 million and licensing activities totaling £23.20 million.

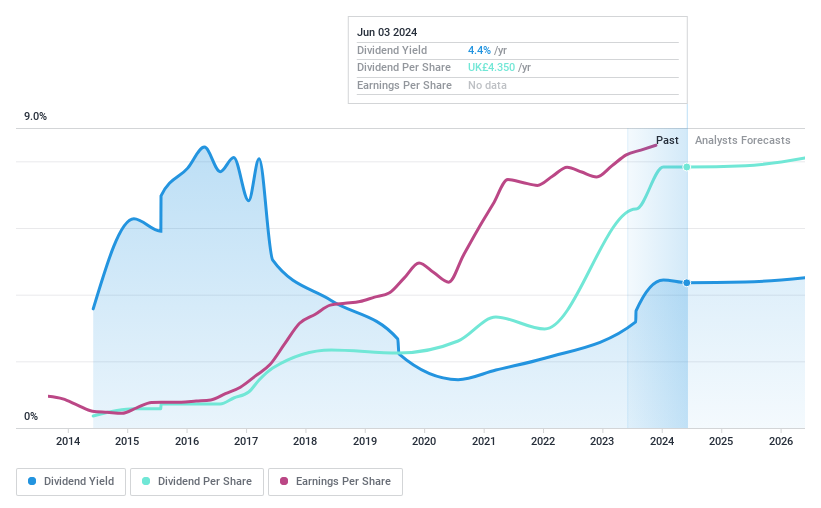

Dividend Yield: 4.2%

Games Workshop Group PLC has seen a dividend yield of 4.22%, below the top quartile in the UK market. While dividends have grown steadily over the past decade, they are currently not well covered by earnings or cash flows, with a payout ratio exceeding 100%. Recent board changes and a slight increase in annual dividend payments suggest some level of commitment to maintaining payouts. However, significant insider selling raises concerns about confidence in sustaining these dividends long-term.

IG Group Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IG Group Holdings plc is a fintech company that operates globally in the online trading sector, with a market capitalization of approximately £3.03 billion.

Operations: IG Group Holdings generates its revenue primarily through its brokerage services, totaling £954.70 million.

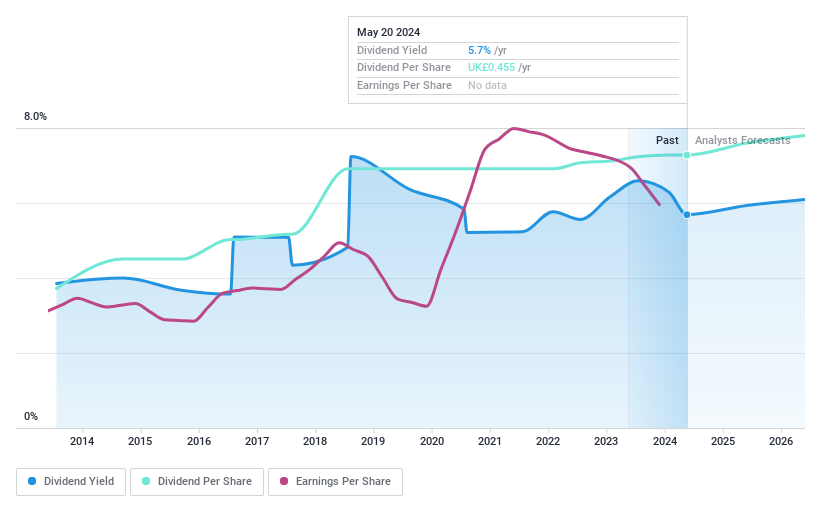

Dividend Yield: 5.6%

IG Group Holdings offers a dividend yield of £5.58%, slightly below the top UK payers. Despite a history of reliable and growing dividends over the past decade, current dividends are not well-supported by cash flows, with a high cash payout ratio of 152.9%. The stock trades at 57.4% below estimated fair value, suggesting potential undervaluation relative to earnings growth forecasts of 6.09% per year and its market position.

Make It Happen

Take a closer look at our Top Dividend Stocks list of 59 companies by clicking here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:CLIG LSE:GAW and LSE:IGG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance