City Holding (CHCO) Announces Buyback Plan for 1M Shares

City Holding Company CHCO recently cheered investors by announcing that its board has authorized the company to buy back up to 1 million shares of its common stock.

CHCO has 14.9 million outstanding common shares at present and the repurchase authorization indicates roughly 7% of the company’s outstanding shares. The buyback has no expiry date.

Simultaneously, the company has canceled the previous share repurchase plan approved on Mar 31, 2021. Under this program, it repurchased 826,330 shares through May 25, 2022.

Management noted, “As of May 25, 2022, the Company was very well capitalized and capital continues to grow due to our exceptional earnings. As a result, we view this repurchase plan as part of an ongoing strategy to build value for our stockholders while maintaining appropriate capital levels”.

Hence, supported by its earnings strength and robust capital position, City Holdinghas been enhancing shareholder value through efficient capital deployment activities. In addition to having a sustainable repurchase program, the company regularly pays dividends.

The latest dividend was announced on Mar 30, 2022, when it declared a quarterly cash dividend of 60 cents per share. The dividend was paid out on Apr 29 to shareholders of record as of Apr 13.

On Nov 29, 2021, CHCO hiked its quarterly dividend by 3.4% to 60 cents per share from 58 cents.

Also, the company’s debt/equity ratio is nil, comparing favorably with the industry average of 0.13. This highlights that City Holding is better positioned than its peers. The company will be financially stable, even in adverse economic conditions.

Hence, the company’s repurchase activities seem sustainable.

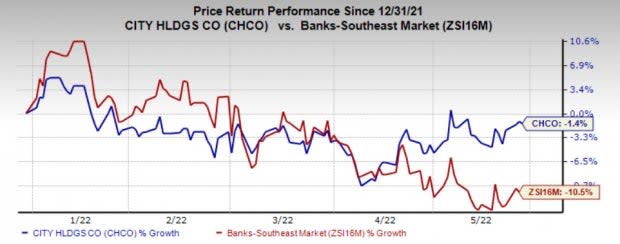

So far this year, shares of CHCO have lost 1.4% compared with a 10.5% decline of the industry it belongs to.

Image Source: Zacks Investment Research

Currently, City Holding carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Share Buyback Plans of Other Finance Companies

Flushing Financial Corporation FFIC announced that its board of directors approved the repurchase of up to 1 million shares of FFIC’s outstanding stock. The buyback program, effective immediately, has no expiration date and is in addition to the existing authorization. Under the existing plan, Flushing Financial repurchased 0.4 million shares in the first quarter.

South Plains Financial, Inc. SPFI announced a share repurchase program. SPFI’s board of directors approved the repurchase of up to $15 million worth of SPFI’s outstanding common stock.

The new buyback plan will begin when the existing stock repurchase program (announced on Nov 1, 2021) expires due to the depletion of funds previously allocated to South Plains and will conclude on May 21, 2023, subject to earlier termination or extension.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Flushing Financial Corporation (FFIC) : Free Stock Analysis Report

City Holding Company (CHCO) : Free Stock Analysis Report

South Plains Financial, Inc. (SPFI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance