Cisco (CSCO) to Buy ThousandEyes to Boost Software Offerings

Cisco Systems CSCO recently announced its plans to acquire San Francisco, CA-based startup — ThousandEyes, Inc. The deal will enable Cisco to address the growing demand for software solutions that can help enterprises deal with the uncertainty and chaos stemming from COVID-19 outbreak, triggered dependence on the Internet and accelerated cloud adoption.

However, the exact financial terms of the deal have not been disclosed by the company. Notably, ThousandEyes has raised about $110 million in financing. According to PitchBook, the company was valued at $670 million in 2019, after its last round of funding. Per a Bloomberg report, Cisco has agreed to pay $1 billion for the deal.

The acquisition of ThousandEyes is expected to strengthen Cisco’s software and services offerings as well as enable it to diversify its portfolio. Markedly, ThousandEyes’ Internet and Cloud intelligence platform provides customers with deep insight into the digital delivery of applications and services over the Internet. This allows customers to have a comprehensive view of the service delivery process. It also addresses potential problems and boost customer experience.

Moreover, Cisco will gain access to ThousandEyes’ strong client base that includes Microsoft, Slack, PayPal and Lyft. This is expected to boost the company’s top line in the coming quarters. Cisco expects the deal to be completed by the end of first-quarter fiscal 2021.

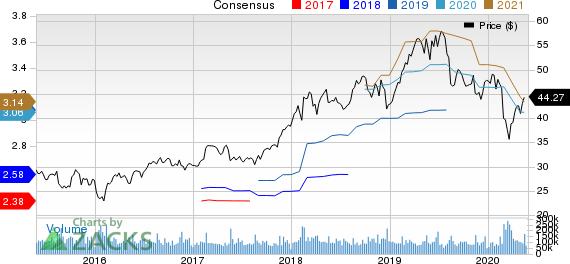

Cisco Systems, Inc. Price and Consensus

Cisco Systems, Inc. price-consensus-chart | Cisco Systems, Inc. Quote

Strengthening Software Portfolio Holds Promise

The ThousandEyes buyout is part of Cisco’s focus on expanding its presence in the software and services space through various acquisitions.

Notably, under CEO Charles Robbins, the company has been trying to reduce its dependence on the networking hardware business and instead move to the recurring revenue model of software and services.

ThousandEyes’ capabilities will be integrated across Cisco’s AppDynamics business, which the company acquired in 2017 to bolster its application monitoring and analysis capabilities. Moreover, it will be a part of Cisco’s new Networking Services business unit.

Other notable software acquisitions include the buyout of CloudCherry and Ensoft in 2019. With the acquisition of CloudCherry, Cisco gained access to robust customer experience management (CXM) capabilities, which enables it to provide journey mapping and predictive analytics services to its customers. The Ensoft buyout strengthened networking software offerings and accelerated its software strategy.

These endeavors have given a significant boost to Cisco’s software offerings and are likely to aid the company in acquiring more customers. In the fiscal third quarter, Service revenues increased 5% to $3.39 billion, driven by growth in software and solution services. Moreover, software subscriptions, which account for 34% of Cisco’s software revenues, increased 9% on a year-over-year basis.

Further, the company’s software offerings are likely to witness consistent momentum driven by the digital transformations taking place across all industries. Moreover, the COVID-19 outbreak has increased the adoption of Software-as-a-Service (SaaS) applications that can support the growth in work-from-home trends. This bodes well for the company’s prospects over the long haul.

Zacks Rank & Key Picks

Cisco currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks worth considering in the broader sector are Bandwidth Inc. BAND, Nutanix Inc. NTNX and Nice Ltd. NICE. All three stocks flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Bandwidth, Nutanix and Nice is currently pegged at 13.6%, 8.9% and 10%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Nice Ltd. (NICE) : Free Stock Analysis Report

Nutanix Inc. (NTNX) : Free Stock Analysis Report

Bandwidth Inc. (BAND) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance