Chuck Royce's Firm Boosts OneWater Marine Inc Holding

Introduction to the Transaction

On June 30, 2024, Chuck Royce (Trades, Portfolio), through Royce & Associates, executed a notable transaction by acquiring 205,766 additional shares of OneWater Marine Inc (NASDAQ:ONEW). This purchase increased the firm's total holdings in the company to 1,492,452 shares. The transaction was conducted at a price of $27.57 per share, reflecting a strategic move by the firm to bolster its investment in the retail - cyclical sector. This acquisition has a modest impact of 0.05% on the firm's portfolio, bringing the position size to 0.37% of the total portfolio, or 10.23% of the company's outstanding shares.

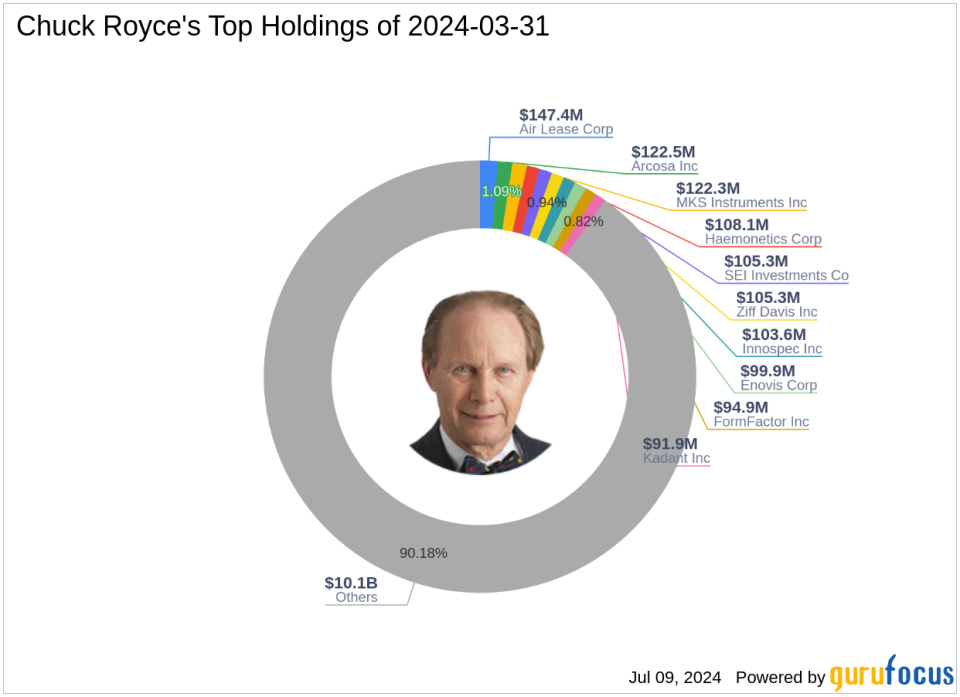

Profile of Chuck Royce (Trades, Portfolio)

Charles M. Royce, a distinguished figure in the investment world, is renowned for pioneering small-cap investing. Leading the Royce Pennsylvania Mutual Fund since 1972, Royce's investment philosophy centers on identifying undervalued small-cap companies with strong financials and potential for future profitability. With a focus on companies with market capitalizations up to $10 billion, Royce's strategy is deeply rooted in fundamental analysis and a long-term perspective. The firm currently manages an equity portfolio valued at approximately $11.2 billion, with top holdings in diverse sectors such as industrials and technology.

Overview of OneWater Marine Inc

OneWater Marine Inc, based in the United States, operates as a recreational marine retailer. Since its IPO on February 7, 2020, the company has expanded its operations across various regions including the Southeast, Gulf Coast, and Northeast. OneWater Marine primarily generates revenue through new and pre-owned boat sales, alongside offering finance, insurance, repair, and maintenance services. Despite a challenging market, the company has maintained a focus on growth and diversification within the marine sector.

Analysis of the Trade Impact

The recent acquisition by Chuck Royce (Trades, Portfolio) represents a significant endorsement of OneWater Marine's business model and market position. Holding 10.23% of the company's shares, Royce's firm is now a major investor, suggesting a strong belief in the company's value proposition and future prospects. This move aligns with Royce's strategy of investing in companies with solid financials and potential for profitable growth, despite the current market valuation indicating a possible value trap, with a GF Value of $34.72 and a price to GF Value ratio of 0.68.

Market Context and Stock Performance

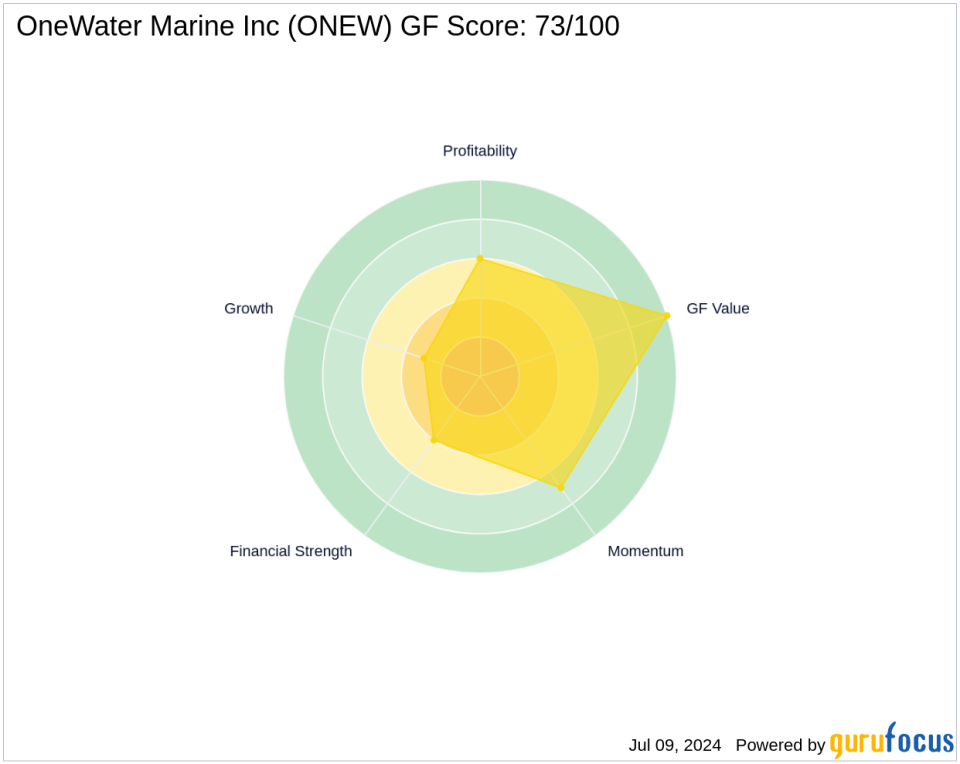

Currently, OneWater Marine Inc's stock is trading at $23.72, down 13.96% since the transaction date. This decline reflects broader market trends and possibly investor skepticism about the company's future performance. However, with a GF Score of 73, indicating likely average performance, and a strong GF Value Rank of 10, there may be underlying value not yet recognized by the market.

Sector and Industry Analysis

The retail - cyclical sector, where OneWater Marine operates, is highly sensitive to economic cycles, influencing the company's performance. Despite these challenges, OneWater has managed to maintain a competitive stance within the industry, supported by its diversified service offerings and strategic market positioning.

Investment Risks and Opportunities

Investing in OneWater Marine Inc carries certain risks, such as its current financial health indicated by a low Financial Strength rank of 4 and a interest coverage ratio of 1.84. However, opportunities exist in the firm's potential to capitalize on market recoveries and its robust service and product offerings in the marine sector.

Conclusion

Chuck Royce (Trades, Portfolio)'s recent investment in OneWater Marine Inc underscores a strategic approach to value investing in the small-cap sector. Despite current market undervaluations and financial challenges, Royce's significant stake in the company highlights a confidence in its long-term growth and profitability. Investors should closely monitor OneWater's financial health and market performance, considering both the potential risks and opportunities presented by this investment.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance