Chrysos And 2 Other ASX Growth Stocks With Strong Insider Ownership

Despite a flat performance over the last week, the Australian market has shown a healthy increase of 6.7% over the past year, with earnings expected to grow by 14% annually. In this context, stocks like Chrysos that combine strong insider ownership with growth potential are particularly compelling for investors looking for aligned interests and informed leadership.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 30.1% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Change Financial (ASX:CCA) | 26.6% | 76.4% |

Botanix Pharmaceuticals (ASX:BOT) | 11.4% | 120.9% |

Liontown Resources (ASX:LTR) | 16.4% | 63.9% |

DUG Technology (ASX:DUG) | 28.1% | 43.2% |

CardieX (ASX:CDX) | 12.2% | 115.3% |

Underneath we present a selection of stocks filtered out by our screen.

Chrysos

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chrysos Corporation Limited focuses on developing and supplying technology for the mining industry with a market capitalization of approximately A$640.40 million.

Operations: The company generates revenue primarily from its mining services segment, totaling A$34.24 million.

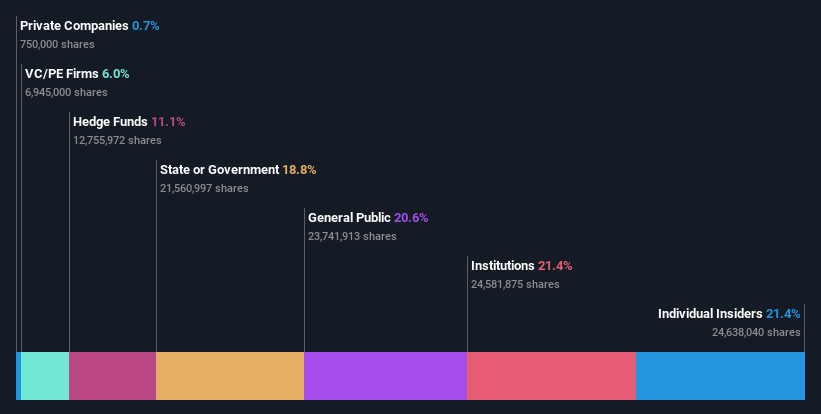

Insider Ownership: 21.4%

Chrysos Corporation, despite recent insider selling and shareholder dilution, is anticipated to see robust growth. The company's revenue is expected to increase significantly at 35.3% per year, outpacing the Australian market average of 5.5%. While its Return on Equity might remain low at 7.8%, Chrysos is forecasted to become profitable within three years with earnings growth projected at a very large rate of 63.48% annually. Analysts also suggest a potential stock price increase of 34.2%.

Take a closer look at Chrysos' potential here in our earnings growth report.

The valuation report we've compiled suggests that Chrysos' current price could be inflated.

Capricorn Metals

Simply Wall St Growth Rating: ★★★★★☆

Overview: Capricorn Metals Ltd is an Australian company focused on the evaluation, exploration, development, and production of gold properties, with a market capitalization of approximately A$1.83 billion.

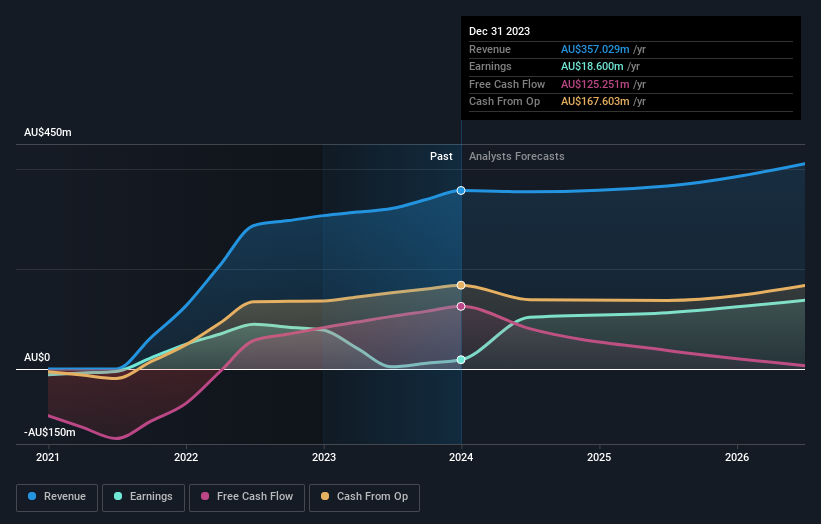

Operations: The company's revenue is primarily derived from its Karlawinda segment, totaling A$356.94 million.

Insider Ownership: 12.3%

Capricorn Metals, with its high insider ownership, is poised for significant growth. While there has been notable insider selling recently, the company's earnings are expected to grow at 26.5% annually, outpacing the Australian market average of 13.8%. However, revenue growth projections are moderate at 14.1% per year and profit margins have declined from last year's 25.4% to 5.2%. The forecasted Return on Equity is high at 30.6%, indicating strong future profitability despite current challenges in earnings quality due to one-off items.

Flight Centre Travel Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Flight Centre Travel Group Limited operates as a travel retailer serving both leisure and corporate sectors across Australia, New Zealand, the Americas, Europe, the Middle East, Africa, and Asia with a market capitalization of A$4.36 billion.

Operations: The company generates revenue primarily through its leisure and corporate travel services, with the leisure segment bringing in A$1.28 billion and the corporate segment contributing A$1.06 billion.

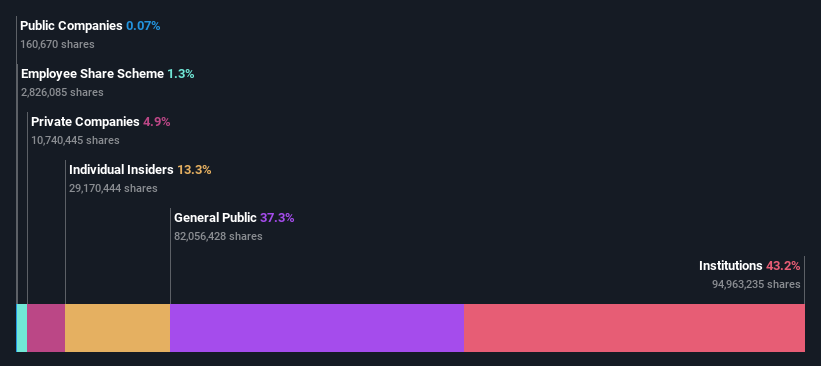

Insider Ownership: 13.3%

Flight Centre Travel Group, with substantial high insider ownership, is trading at A$20.9% below its fair value, indicating potential undervaluation. The company recently turned profitable and is expected to see steady growth; its revenue is forecasted to increase by 9.7% annually, surpassing the Australian market's 5.5%. While earnings growth isn't very large at 18.8% per year, it still exceeds the market average of 13.8%. The anticipated Return on Equity is strong at 21.7%, reflecting efficient profitability management.

Turning Ideas Into Actions

Click through to start exploring the rest of the 87 Fast Growing ASX Companies With High Insider Ownership now.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:C79 ASX:CMM and ASX:FLT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance