Chipotle (CMG) Stock Surges 35% YTD: What's Next for Investors?

Chipotle Mexican Grill, Inc. CMG has demonstrated resilience amid market volatility, providing substantial returns to investors. The stock has notably outperformed its industry peers and the broader S&P 500 index.

This success is driven by robust same-store sales growth, digitalization efforts, expansion initiatives and effective advertising strategies. Additionally, the company has been benefiting from increased transaction growth.

Chipotle’s stock has surged 34.6% year to date, in stark contrast to the industry's 7.4% decline. As of Jul 3, the stock closed at $61.58, which is below its 52-week high of $69.26 but significantly higher than its 52-week low of $35.37.

Stock Performance

Image Source: Zacks Investment Research

Chipotle’s Growth Drivers

Robust Comps

Impressive comps performance continues to drive growth. During the first quarter of 2024, comparable restaurant sales increased 7% year over year, following growth of 8.4% (in fourth quarter 2023), 5% (in third-quarter 2023), 7.4% (in second-quarter 2023) and 10.9% (in first-quarter 2023). The consistent performance can be largely attributed to increased transactions and higher average checks. These, along with robust digital sales and a strong recovery in in-store sales, bolstered the company’s performance.

For the second quarter of 2024, the company anticipates comparable sales to benefit from an extra day due to Easter. For 2024, Chipotle anticipates comps growth in the mid to high single-digit range, driven by its transaction growth and strong comps growth trends.

Strengthening Digital Capabilities

Chipotle is intensifying its efforts to expand its digital initiatives as a cornerstone of its growth strategy. The company is enhancing the appeal and efficiency of digital ordering for customers and restaurants alike. This includes redesigning and streamlining its online ordering platform, introducing online payment options for catering and customizable meals, and partnering with established third-party providers for delivery services. Also, there has been a significant increase in digital orders and guest satisfaction since the rollout of its “Smarter Pickup Times” technology.

The resultant improvement in guest access and convenience, as well as the contribution from Chipotlanes, increased digital sales contribution in the first quarter to 36.5%. The company focuses on improving order accuracy and timing for its digital business.

Product Branding

Chipotle's emphasis on advertising initiatives is proving successful. The marketing team has effectively increased the brand's visibility, relevance and popularity. In the first quarter of 2024, the company launched promotions to bring barbacoa under the spotlight, following consumer insights that revealed a lack of awareness about it. Thus, it rebranded it as Braised Beef Barbacoa, highlighting its slow-cooked, responsibly prepared beef seasoned with garlic and cumin and hand-shredded. The campaign yielded positive results, driving increased transactions and spending.

Strong Liquidity

Chipotle's robust balance sheet positions the company well to navigate the current economic environment. As of Mar 31, 2024, the company reported cash and cash equivalents of $727.4 million compared with $560.6 million as of Dec 31, 2023. At the end of the first quarter of 2024, the company stated that it had no debt, which reflected its strong financial position.

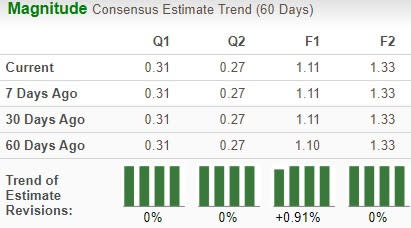

CMG Estimate Movement

Estimates for CMG’s 2024 earnings have moved up from $1.10 to $1.11 over the past 60 days.

Image Source: Zacks Investment Research

What May Hinder the Stock's Momentum?

Like other industry players, the company has been facing wage inflation and higher costs across most commodities and categories. Beef and produce inflation and a challenge in protein mix resulting from the Braised Beef Barbacoa marketing initiative drove costs higher.

For second-quarter 2024, the company anticipates the cost of sales to be in the mid 29% range owing to higher costs across several line items, most notably avocados. For the quarter, the company anticipates its labor expenses to remain around the mid-24% range, with wage inflation increasing to approximately 6% due to the minimum wage hike in California. For 2024, the cost of sales is expected to be in the low to mid-single-digit range.

From the valuation point of view, the stock is trading at a premium. Chipotle’s forward 12-month price-to-earnings ratio stands at 50.5, significantly higher than the industry’s ratio of 22.07 and the S&P 500's ratio of 21.50. This suggests that investors may be paying a high price relative to the company's expected earnings growth. The company is also trading currently at a premium compared to other industry players like Darden Restaurants, Inc. DRI, Domino's Pizza, Inc. DPZ and Restaurant Brands International Inc. QSR.

Conclusion

Chipotle is poised to benefit from robust digitalization, strategic initiatives and strong financial fundamentals in the long run. However, economic headwinds persist. Additionally, Chipotle's stock has pulled back over the past month and is now trading below its 50-day moving average.

Existing stakeholders should maintain their position in this Zacks Rank #3 (Hold) stock, while potential new investors may want to wait for a better entry point, given the stock's stretched valuation.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chipotle Mexican Grill, Inc. (CMG): Free Stock Analysis Report

Domino's Pizza Inc (DPZ): Free Stock Analysis Report

Darden Restaurants, Inc. (DRI): Free Stock Analysis Report

Restaurant Brands International Inc. (QSR): Free Stock Analysis Report

Yahoo Finance

Yahoo Finance