China’s Trina Solar Looks to Double Down on US Factory Investments

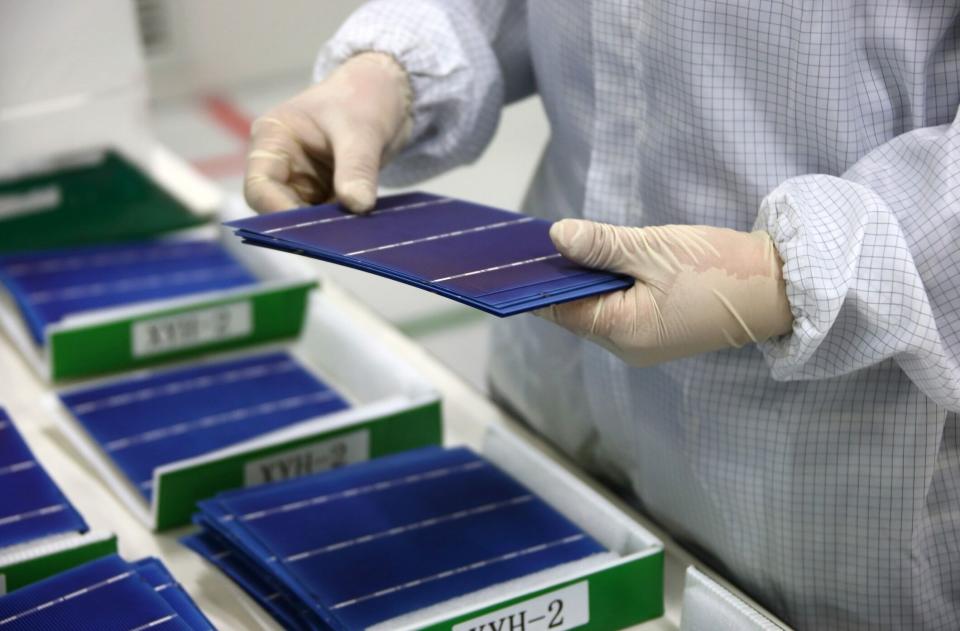

(Bloomberg) -- China’s Trina Solar Co. is considering setting up a factory in the US to produce the cells that are used to make solar panels, as Washington raises trade barriers on imports.

Most Read from Bloomberg

Wells Fargo Fires Over a Dozen for ‘Simulation of Keyboard Activity’

Tesla Investors Get Behind Musk’s Fight for $56 Billion Pay Deal

Apple to ‘Pay’ OpenAI for ChatGPT Through Distribution, Not Cash

Hunter Biden Was Convicted. His Dad’s Reaction Was Remarkable.

Luxury Labels Slash Prices 50% to Lure Wary Chinese Shoppers

Trina is evaluating a facility that could produce 5 gigawatts of cells a year to supply its panel manufacturing plant in Wilmer, Texas, according to Steven Zhu, the chief executive officer of the company’s North American business. The Wilmer factory is set to reach full production at the end of 2024, creating 1,500 local jobs.

The Texan plant will first use solar cells from Southeast Asia, but Trina wants to act fast in building up capacity in the US in light of Washington’s push for more local production, Zhu said in an interview on Thursday. The company will make a final decision on the new factory by the end of the year, which would come online at the end of 2025 or the beginning of 2026.

“We are doing the investigation, we are searching for the opportunities,” he said.

Trina, based in Changzhou in Jiangsu province, is the world’s third-largest manufacturer of solar panels. It’s one of many Chinese firms adding capacity in the US to escape slumping profits at home, after the Biden administration’s 2022 bill to provide incentives to boost domestic clean energy manufacturing.

Chinese solar equipment has been subject to US tariffs for more than a decade, which led manufacturers to set up shop in Southeast Asia. But new measures announced by the US government last month to strengthen import controls, and the likelihood of higher duties on Southeast Asian products, are prompting a rethink, and Trina is among the companies that are shutting capacity in countries like Thailand and Vietnam.

The US for its part is lacking cell-manufacturing capacity, which leaves a hole to fill for Chinese firms.

“The US is big enough and the demands for renewables are big enough,” Zhu said. “The customer is willing to pay higher prices if it’s made in the US.”

--With assistance from Jennifer A. Dlouhy.

Most Read from Bloomberg Businessweek

Israeli Scientists Are Shunned by Universities Over the Gaza War

Grieving Families Blame Panera’s Charged Lemonade for Leaving a Deadly Legacy

The World’s Most Online Male Gymnast Prepares for the Paris Olympics

China’s Economic Powerhouse Is Feeling the Brunt of Its Slowdown

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance