Trump's trade war is slowing China's new silk dream

China has promised more than a trillion dollars to 150 countries as part of its ambitious Belt and Road Initiative (BRI) — but as the trade war rages on, the effort could sputter.

“China is already facing financial strain,” American Enterprise Institute China scholar Derek Scissors told Yahoo Finance. “When the BRI was launched, China’s foreign exchange reserves had been rising for more than 20 years. They fell 2014-16. Now they are stable, but China is in a considerably worse position than five years ago.”

Before U.S. President Donald Trump first slapped tariffs on China in January last year, Chinese foreign reserves were at $3.14 trillion. Those fell dramatically in October to around $3.05 trillion — an 18-month low — but have recovered modestly, settling at $3.098 trillion in April.

More recently, the Trump administration said it would prepare tariffs on an additional $300 billion in Chinese imports and announced restrictions on Chinese tech company Huawei’s ability to access American technology.

In the meantime, as China pushes the sprawling infrastructure project dubbed the new Silk Road — and aiming to gain influence and prestige across Africa, Asia, and Europe — Beijing is being forced to choose between spending money on rejuvenating its domestic economy or continuing to finance projects in far-flung places like Pakistan and Zimbabwe.

‘The value of new Chinese-led BRI contracts and direct investment falling significantly’

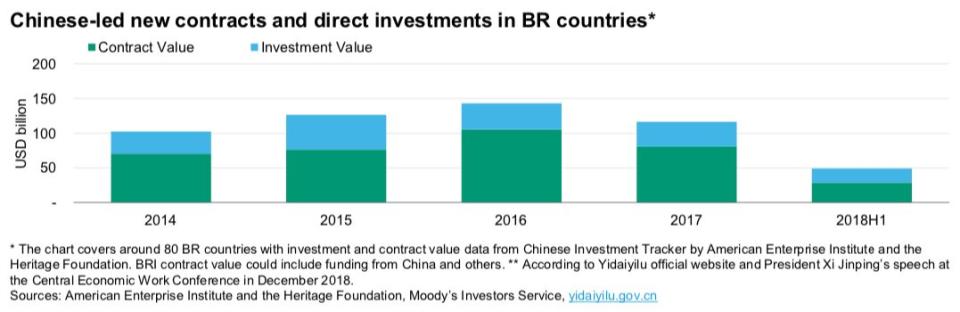

China has become increasingly “selective in which BRI projects that it will pursue, as seen by the value of new Chinese-led BRI contracts and direct investment falling significantly for the first time in 2017," Moody’s Investor Service’s Michael Taylor said in January.

BRI spending has slowed from a peak of around $143 billion in 2016 to $116 billion in 2017, and in the first half of 2018, the total value of BRI projects was only 42% of what it was the previous year, their data revealed.

So “while Beijing has deep pockets, certainly, they aren’t deep enough to finance the trillions of dollars of infrastructure that Chinese leaders have promised at one time or another,” Bloomberg Opinion columnist Mihir Sharma wrote in an op-ed.

Sharma emphasized the point that domestic development will take precedence, and that the cash crunch effectively meant that “China’s ambitions overshot its purse.”

His sentiments were echoed by hedge fund manager Kyle Bass.

This is KEY. china is running out of US dollars. A massive fiscal deficit -10% GDP and a secular decline in their current account leaves china vulnerable to a usd funding crisis in the future. Western capital wields the cards for china’s future. #china https://t.co/sKqHUZsYsb

— Kyle Bass (@Jkylebass) May 5, 2019

‘Risk that China will finance some bad projects’

The other problem was the state of the existing loans. Aside from the fact that the Chinese are running out of money for new projects, old projects could come back to haunt the country if repayment obligations are not met.

“It is difficult to implement big infrastructure projects, so there is a risk that China will finance some bad projects with the result that some borrowing countries will have unpayable debts,” Brookings Institution senior fellow David Dollar told Yahoo Finance. “Chinese banks would then have to write off some of these debts and that could contribute to financial vulnerabilities in China.”

The idea behind these risky loans was born out of an infrastructure spending binge across continents that China hoped would help it gain considerable power over smaller, fragile countries, which have led many to term it as a means for the country to practice “debt-trap diplomacy.”

Specifically through by the way it negotiates, disburses, and structures the loan repayments with its borrowers, China has demonstrated that it can pressure countries into policy positions — such as when it persuaded Cambodia and the Philippines to reevaluate military or diplomatic ties with the U.S., according to a report by Center for International and Strategic Studies.

‘If you thought we were bad ...’

But as China “continues to print money to expand the [BRI] on very risky loans, sometimes in excess of borrowers entire GDP, any kind of adverse economic effect… will greatly hinder the [BRI’s] short term progress,” short seller and GeoInvesting Co-Founder Dan David told Yahoo Finance.

At the same time, David, who referred to the BRI by its old name “One Belt, One Road” or OBOR, added that while the entire project “may be scaled back” because of the trade war, at the end of the day, Chinese eyes were on a larger prize.

“The tariffs are much worse for China which only have another 10 [billion] in goods it can levy tariffs on us, but we have another 300 [billion] in goods we can add to tariff list,” David said. Yet “China will instead choose to harass American companies within China by imposing arbitrary fines, fees and investigations, and/or step up efforts on IP theft, force tech transfers, and financial fraud abroad.

“In other words, their tact will be if you thought we were bad … let’s see what you think when we have no economic incentive to not be worse.”

And while Scissors of the American Enterprise Institute China maintained that a breaking point exists for China and that the BRI is financially unsustainable, David was a lot more skeptical about China’s big project truly faltering.

“Other than over extending its own nations debts there are no ‘failures’ on China’s part in the OBOR initiative so far,” said David. “If or when China is or not paid back their loans, according onerous terms, China can take the land and expand military presence which arguably could be what the OBOR is in part intended to do.”

Aarthi is a writer for Yahoo Finance. Follow her on Twitter @aarthiswami.

Read more:

EU on the New Silk Road: China is both a 'partner' and a 'systemic rival'

The new Silk Road is China's 'second pillar of legitimacy' — and Europe is starting to buy in

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance