China’s Industrial Profits Climb Even as Warning Signs Flash

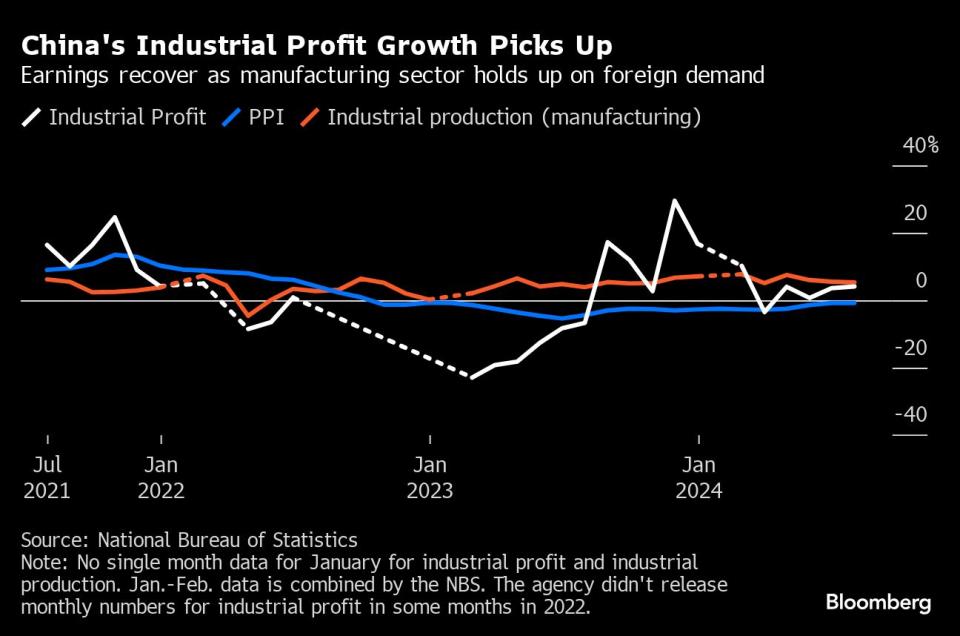

(Bloomberg) -- Profits at China’s industrial companies rose at the fastest pace in five months in July, though weak domestic demand is calling into question whether their resilience can last.

Most Read from Bloomberg

Nazi Bunker’s Leafy Makeover Turns Ugly Past Into Urban Eyecatcher

Sydney Central Train Station Is Now an Architectural Destination

How the Cortiços of São Paulo Helped Shelter South America’s Largest City

Industrial profits at large Chinese companies expanded 4.1% on year, the National Bureau of Statistics said in a statement Tuesday, after a 3.6% gain the previous month.

For the first seven months of 2024, profit increased 3.6% to 4.099 trillion yuan ($575 billion). Bloomberg Economics had forecast profit growth would come in at 3.5%, maintaining its first-half pace.

The earnings haul is a key gauge of the financial health of factories, mines and utilities across China that can affect their investment decisions in the months to come.

Listen to the Bloomberg Daybreak Europe podcast on Apple, Spotify or anywhere you listen.

Though China’s export growth unexpectedly slowed in July, overseas orders have underpinned a recovery in industrial profits this year, even as trade disputes and new tariffs emerge as a threat to manufacturer profits. A low comparison base in the first few months of 2023 also helped.

NBS analyst Yu Weining said in a statement that profit growth this year has been driven by a double-digit increase in earnings of high-tech manufacturing and stable gains at equipment makers.

Consumer goods providers also saw profits rebound on “steady recovery” of domestic demand and a continued jump in exports, Yu added.

The equipment and consumer goods manufacturing sectors account for around 57% of total industrial profits, Pantheon Macroeconomics economists including Duncan Wrigley wrote in a note last month.

In the absence of stronger stimulus measures from the government, Beijing’s push for technology innovation and manufacturing competitiveness will go a long way toward dictating the outlook for industry, alongside an official program to encourage companies and households to buy new equipment.

Also weighing on profits is protracted industrial deflation. The producer price index fell 0.8% on year in July, the 22nd straight month of decline.

Headwinds are growing, as demand in China stays stubbornly weak, squeezing the profit margins of companies and worsening the challenge of overcapacity in some industries.

“Domestic demand has remained relatively weak and the external environment is turning complicated and prone to changes,” the NBS’s Yu said. “The foundation of industrial profit recovery still needs to be consolidated.”

China has suspended its system for approving new steel plants. That is part of an effort to address a demand slump that’s prompted a warning by the nation’s top producer, China Baowu Steel Group Corp., of a crisis more severe than the downturns of 2008 and 2015.

Sluggish consumption of diesel during a deep housing slump has sent oil processing of Sinopec — China’s largest crude oil refiner — down by 38% in the first half.

Also, China’s soymeal inventories have climbed to their highest level in seven years as weak domestic feed demand fails to absorb sustained imports, creating headaches for the country’s crushers.

(Updates with comments and more details.)

Most Read from Bloomberg Businessweek

Hong Kong’s Old Airport Becomes Symbol of City’s Property Pain

Losing Your Job Used to Be Shameful. Now It’s a Whole Identity

FOMO Frenzy Fuels Taiwan Home Prices Despite Threat of China Invasion

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance