China Could Hinder BHP’s Bid to Become Copper’s Top Producer

(Bloomberg) -- BHP Group Ltd.’s $39-billion bid to create a global copper giant risks irking its biggest customer China, where authorities have a history of intervening to stymie or water down international mergers.

Most Read from Bloomberg

Plunging Home Prices, Fleeing Companies: Austin’s Glow Is Fading

Javier Milei Fuels Wild Rally That Makes Peso No. 1 in World

Fed’s Preferred Core Inflation Gauge Rose at Brisk Pace in March

Billionaire Stephen Ross Believes in South Florida—and Is Spending Big to Transform It

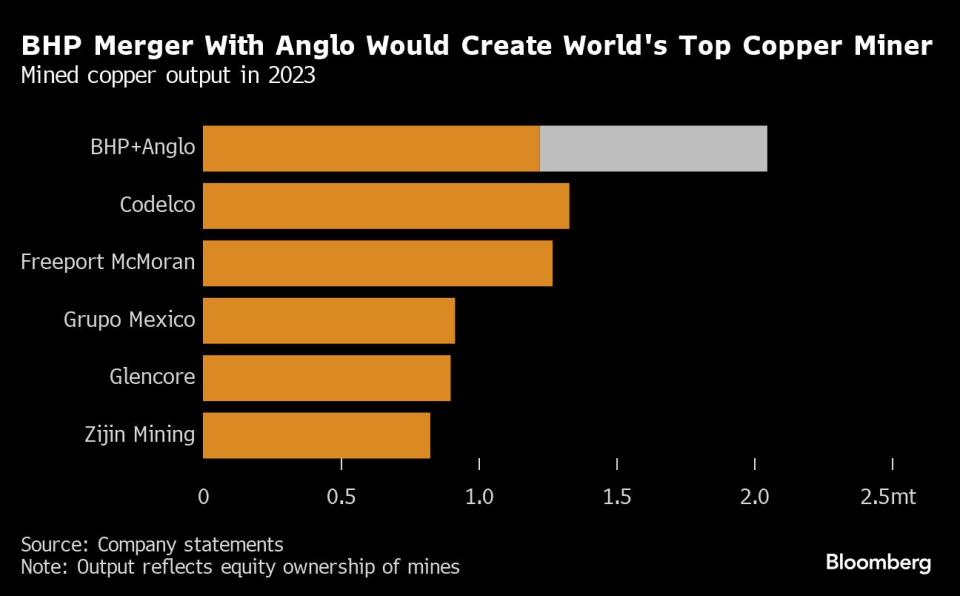

A takeover of Anglo American Plc. would catapult BHP into the top spot for copper producers, with 10% or more of the world’s output. That could be a red flag for Beijing, which has long bemoaned China’s weak purchasing power against the miners that dominate trade in raw materials.

“This may invite close scrutiny from a competition perspective, specifically China’s smelting industry,” Bloomberg Intelligence analysts Grant Sporre and Alon Olsha wrote in a note. The deal comes just as Chinese copper processors are struggling to turn a profit on supplies from miners like BHP.

China’s State Administration For Market Regulation didn’t immediately respond to a faxed request for comment.

The potential for Chinese involvement, perhaps by forcing asset sales in exchange for approval, is among a swathe of challenges that BHP Chief Executive Officer Mike Henry faces in pulling off an ambitious but complex deal. Foremost, of course, is Anglo’s rejection of the bid, which it says significantly undervalues the company.

In 2013, Chinese regulators ordered Glencore Plc to offload a major new copper project in Peru to get approval for its $30 billion takeover of Xstrata Plc. Before that, Beijing helped frustrate BHP’s mega-bid to buy rival Rio Tinto Plc, a $147 billion deal that ultimately collapsed.

The Glencore-Xstrata case offers a precedent, according to Ying Song, partner at Anjie Broad Law Firm who has advised international clients in cases involving China’s antitrust authorities.

“For copper production, the Chinese market relies on global supply to a great extent, so my preliminary impression is that this case would be scrutinized under what’s called the normal procedure,” Song said.

The State Administration for Market Regulation, which oversees competition cases, would seek opinion from industry regulators like the Ministry of Industry and Information Technology, as well as experts, downstream consumers and industry bodies such as the China Nonferrous Metals Association.

Copper’s applications in advanced manufacturing and items crucial to the energy transition, such as solar panels and batteries, are likely to sharpen Beijing’s interest in the acquisition, given China’s dominance of the world’s clean energy and electric vehicle sectors.

Other aspects may draw less attention. Although a combined BHP-Anglo steelmaking coal business could account for as much as 19% of all seaborne shipments — most of which end up in China — that’s still less than BHP’s share in 2022, according to Bloomberg Intelligence.

--With assistance from Yujing Liu and William Clowes.

(Updates with comments from lawyer in seventh paragraph)

Most Read from Bloomberg Businessweek

US White-Collar Job Growth Stalls, Even in Pandemic Boomtowns

Caught Between the US and China, a Powerful AI Upstart Chooses Sides

How North Korea’s Man in the West Ran Afoul of US Authorities

Studio Behind Dune Eyes Growth, Even Without a Paramount Merger

A Hedge Fund Billionaire’s Cash Helped Fund a ‘Predatory’ Lender

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance