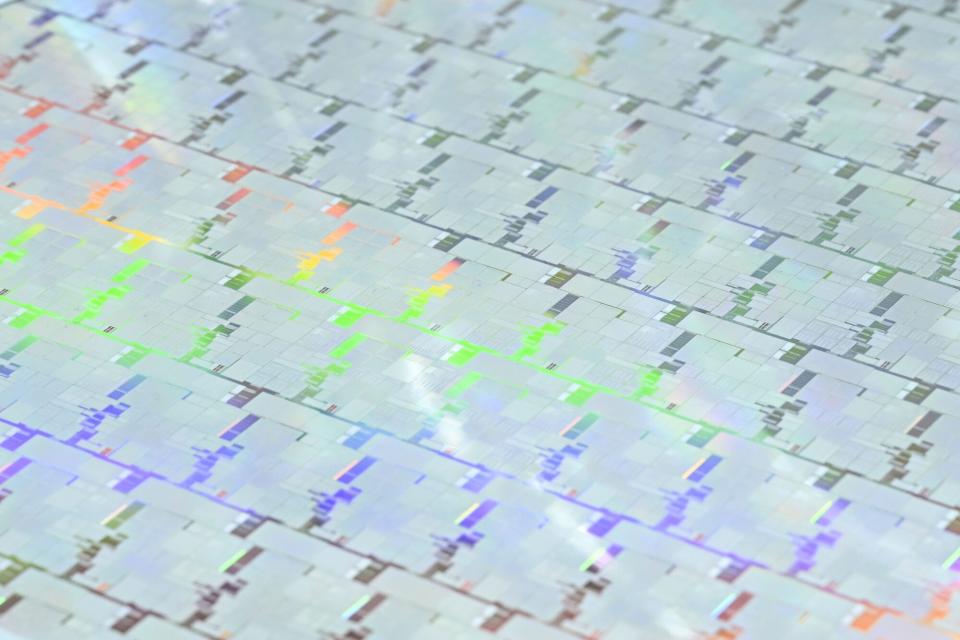

China’s Big Chip Fund to Exceed $47.5 Billion Goal, Adviser Says

(Bloomberg) -- China’s main national chip fund should wind up raising more than the $47.5 billion originally disclosed, a senior adviser to Beijing said, reflecting the government’s resolve to close a technology gap with the US.

Most Read from Bloomberg

Russia Is Sending Young Africans to Die in Its War Against Ukraine

Investment Bank Moelis Probes Incident After Video of Employee Appearing to Punch Woman

Macron Gambles on Snap French Election in Bid to Stop Le Pen

New York Fed Is Losing Talent and ‘Street Cred’ Under John Williams

Stocks Eke Out Gains in Fed Run-Up as Euro Falls: Markets Wrap

More state-backed firms are likely to join investors such as Industrial and Commercial Bank of China Ltd. in contributing capital, Li Ke, a member of the committee that advises the fund, told Bloomberg News. That reflects the government’s resolve to create a self-sufficient domestic semiconductor industry, said Li, who is also deputy general manager of CCID Consulting Co., an agency backed by a research arm of the Ministry of Industry and Information Technology.

Chinese government agencies have stepped up efforts since 2023 to overcome US sanctions and propel local players from Semiconductor Manufacturing International Corp. to Huawei Technologies Co. Key to that thrust is the National Integrated Circuit Industry Investment Fund — known colloquially as the Big Fund — which funnels state capital into important chip projects and companies.

The Big Fund’s third vehicle was set up just last month and will operate under a 10-year timeframe, longer than the five years the first two were accorded, Li said. That means, in effect, there could be a “Big Fund 3.5,” he added.

“The technology gap still exists, that’s why we needed the third phase. There’s still work to do since the issue of chokepoints hasn’t been resolved,” Li said in an interview on the sidelines of the World Semiconductor Conference in Nanjing. “The third fund remains open and more capital could be injected during its 10-year window.”

--With assistance from Gao Yuan.

Most Read from Bloomberg Businessweek

As Banking Moves Online, Branch Design Takes Cues From Starbucks

Legacy Airlines Are Thriving With Ultracheap Fares, Crushing Budget Carriers

Sam Altman Was Bending the World to His Will Long Before OpenAI

David Sacks Tried the 2024 Alternatives. Now He’s All-In on Trump

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance