China's Chip Companies Just Can't Excite the NYSE

(Bloomberg Opinion) -- A decision by Semiconductor Manufacturing International Corp. to delist its New York-traded depositary receipts was quickly linked to the U.S.-China trade war, as if it were a victim of the growing tensions.

That’s not the case. If anything, the move underlines a simple fact: China currently lacks a viable and international semiconductor industry. That second adjective is important. This trade spat highlights the country’s deficiencies in technology.

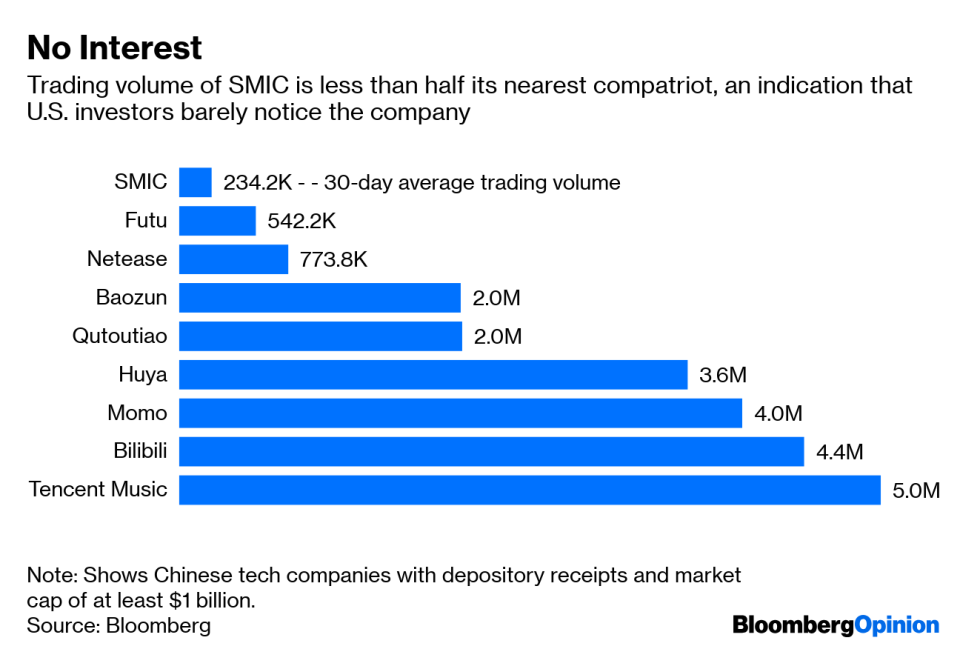

On May 24 the Shanghai-based company announced plans to take its ADRs off the NYSE because of low trading volume and the administrative costs of keeping them there. Such a move makes sense. The average 30-day trading volume of 234,190 shares puts it at the bottom of Chinese technology companies with receipts listed in New York and a market cap of at least $1 billion, according to data compiled by Bloomberg.

SMIC is so little known outside of China that it's sometimes mistakenly called Shanghai Semiconductor. It operates on the foundry business model pioneered by Taiwan’s United Microelectronics Corp. and Taiwan Semiconductor Manufacturing Co. Its clients design chips, then SMIC makes them.

Except that SMIC has historically been such a laggard on technology that a key strategy is to feed off the leftovers of TSMC, UMC and GlobalFoundries Inc. I expect pushback on this assertion, but the reality is that clients generally won’t choose SMIC if TSMC or UMC have the capacity and a competitive price at the technology-node they need.

Founded with money and land from the Chinese government, SMIC was behind on technology from day one. So desperate was it to catch up that the company found itself on the losing side of a trade-secrets lawsuit brought by TSMC in a U.S. court more than a decade ago. With barely enough money to pay the settlement, it was reduced to giving a stake to its larger rival along with cash. Ironically, TSMC had to apply to the Taiwan government to hold a stake in a lowly rival that it didn’t even want.

It got a bit of a boost in 2014 when Qualcomm Inc. agreed to collaborate (and send some orders its way). That was an important seal of approval from one of the world’s most important semiconductor designers, but also likely a move by the U.S. company to keep Chinese authorities happy in the face of an antitrust suit there. Yet SMIC still remains behind. Its most advanced technology last year – making chips at 28-nanometer geometries(1) – was first rolled out by TSMC eight years ago. Its 14nm technology will be introduced this year, whereas TSMC was offering something similar back in 2013.

You could be forgiven for thinking that a new silicon Iron Curtain would work in SMIC’s favor. And it probably would if its technology was up to par. But the fact is that if companies like Huawei Technologies Co. are going to catch up to their U.S. counterparts they need to manufacture chips to equivalent standards. To do that they’ve got no choice but to look to overseas foundries such as TSMC, UMC and Globalfoundries.

For Western investors, SMIC’s perpetual also-ran status wasn’t very endearing. Fund managers have dozens of other chip companies to invest in, while those enamored with China tech are more likely to gravitate toward blue chips like Alibaba Group Holding Ltd. or Baidu Inc., or fast-growing upstarts such as Momo Inc. or Pinduoduo Inc.

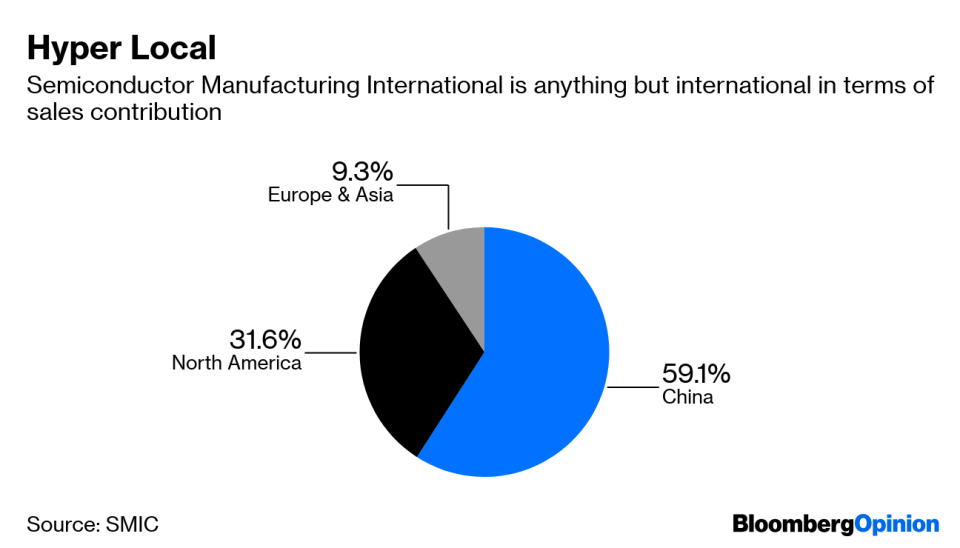

China’s creeping nationalization of SMIC and the fact that 59 percent of its revenue comes from Chinese chip designers highlighted the fact that this was not a stock for the internationally minded investor. A NYSE delisting for SMIC was the obvious next step, and there may be more to come.

(1) A nanometer measures the size of connections within a chip; the smaller the better

To contact the author of this story: Tim Culpan at tculpan1@bloomberg.net

To contact the editor responsible for this story: Rachel Rosenthal at rrosenthal21@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Tim Culpan is a Bloomberg Opinion columnist covering technology. He previously covered technology for Bloomberg News.

For more articles like this, please visit us at bloomberg.com/opinion

©2019 Bloomberg L.P.

Yahoo Finance

Yahoo Finance