The Chemours Co (CC) Q1 2024 Earnings: Challenges Persist as Financials Trail Analyst Expectations

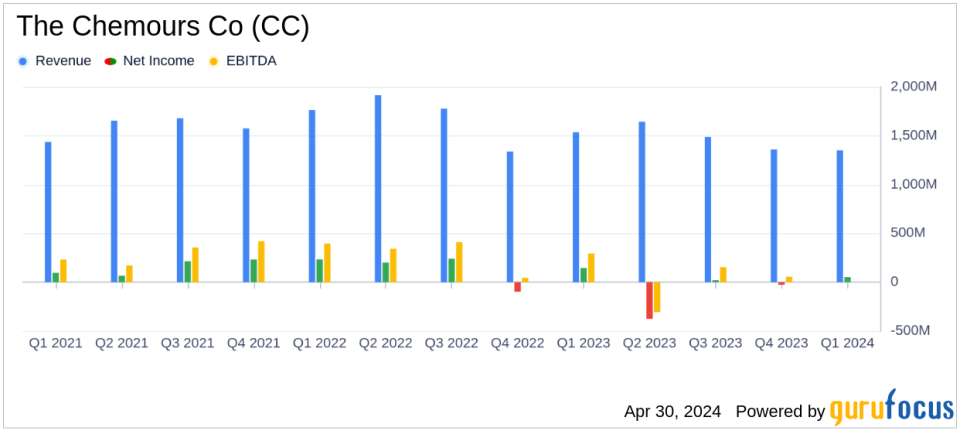

Net Sales: Reported at $1.35 billion, a decrease of 12% year-over-year, falling short of estimates of $1.349 billion.

Net Income: Achieved $52 million, significantly exceeding the estimated $19.02 million.

Earnings Per Share (EPS): Recorded at $0.34 per diluted share, surpassing the estimated $0.18.

Adjusted EBITDA: Amounted to $193 million, down 37% from the previous year's $304 million.

Operational Cash Flow: Cash used in operations reached $290 million, marking an increased cash use compared to the previous year.

Dividends: Returned $37 million to shareholders through dividends during the quarter.

Capital Expenditures: Capital spending was $102 million, an increase from $91 million in the prior-year quarter.

On April 30, 2024, The Chemours Company (NYSE: CC) disclosed its financial outcomes for the first quarter of 2024 through its 8-K filing. The company, a prominent global chemistry entity known for its leading positions in Titanium Technologies, Thermal & Specialized Solutions, and Advanced Performance Materials, reported a notable year-over-year decline in both net sales and net income.

The reported net sales of $1.35 billion fell short of analyst expectations of $1.349 billion, marking a 12% decrease from the previous year's $1.536 billion. Net income also significantly declined to $52 million, or $0.34 per diluted share, from $145 million, or $0.96 per diluted share in the first quarter of 2023, underperforming against the estimated earnings per share of $0.18.

Segment Performance and Corporate Challenges

Each of Chemours' operating segments experienced declines in net sales. The Advanced Performance Materials (APM) segment saw the steepest drop of 23%, with net sales totaling $299 million. The Titanium Technologies (TT) and Thermal & Specialized Solutions (TSS) segments also reported decreases of 7% and 8%, respectively. Despite these challenges, the company highlighted its strategic initiatives, including the TT Transformation Plan, which aims to position Chemours as one of the lowest-cost TiO2 producers globally.

Corporate expenses increased by $10 million compared to the prior year, primarily due to costs associated with internal reviews and remediation of material weaknesses in financial reporting. This increase in corporate expenses negatively impacted the overall financial performance.

Financial Statements Insights

The balance sheet remains robust with total assets of $7.978 billion as of March 31, 2024. However, the company used $290 million in operating activities during the quarter, a significant increase from the previous year, primarily due to working capital adjustments. Capital expenditures were also up, totaling $102 million compared to $91 million in the prior-year quarter.

Chemours returned $37 million to shareholders through dividends, affirming its commitment to shareholder returns despite financial headwinds.

Outlook and Strategic Focus

Looking ahead, Chemours anticipates improvements in the TT segment with expected sequential net sales growth of approximately 15% in the second quarter of 2024. The TSS and APM segments are also projected to show growth based on seasonal trends and product demand recovery. However, corporate expenses are expected to increase, potentially impacting profitability.

The company remains focused on strategic initiatives to enhance operational efficiency and cost-effectiveness across its segments. These efforts are crucial as Chemours navigates through the challenges of fluctuating market demands and internal operational hurdles.

For detailed financial figures and future projections, interested parties are encouraged to view the full earnings report and listen to the upcoming earnings call scheduled for May 1, 2024.

For more information, visit Chemours' investor relations page at investors.chemours.com.

Explore the complete 8-K earnings release (here) from The Chemours Co for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance