Chemed (CHE) Q2 Earnings Surpass Estimates, Margins Grow

Chemed Corporation CHE reported second-quarter 2022 adjusted earnings per share (EPS) of $4.84, up 5.2% year over year. The figure surpassed the Zacks Consensus Estimate by 1.3%.

Our model projected an adjusted EPS of $4.77 in Q2.

The company’s GAAP EPS was $4.40, increasing 25.4% year over year.

Revenues in Detail

Revenues in the reported quarter plunged 0.2% year over year to $531.3 million. The metric also missed the Zacks Consensus Estimate by 1.3%.

The second-quarter revenues compare to our own estimate of $539.1 million.

Segmental Details

Chemed operates through two wholly-owned subsidiaries — VITAS (a major provider of end-of-life care) and Roto-Rooter (a leading commercial and residential plumbing plus drain cleaning service provider).

In the second quarter, net revenues at VITAS totaled $298 million, down 4.5% year over year. This revenue decline was primarily led by a 3.8% decline in days of care, partially offset by a geographically weighted average Medicare reimbursement rate increase of nearly 0.8%.

This figure compared with our VITAS segment’s Q2 projection of $281.8 million.

Roto-Rooter reported sales of $233 million in the second quarter, up 6% year over year.

For the Roto-Rooter segment, we projected $257.3 million of revenues in the second quarter.

Total Roto-Rooter branch commercial revenues rose 7.5% on an 8.4% increase in drain cleaning revenues, a 10.4% rise in plumbing, 4.2% growth in excavation revenues and a 4.1% hike in water restoration revenues.

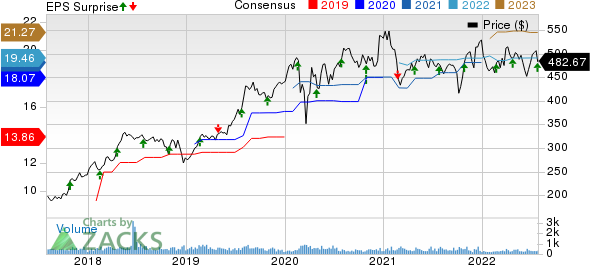

Chemed Corporation Price, Consensus and EPS Surprise

Chemed Corporation price-consensus-eps-surprise-chart | Chemed Corporation Quote

Total Roto-Rooter branch residential revenues registered growth of 5% on a 9.3% improvement in plumbing, 0.1% decline in excavation, 14% growth in residential water restoration and drain cleaning revenues remaining roughly similar to the year-ago period’s levels.

Margin in Detail

Gross profit rose 6.9% year over year to $194.5 million in the second quarter of 2022. Gross margin expanded 245 basis points (bps) year over year to 36.6%, while the cost of products and services fell 3.9% in the second quarter of 2022.

We also projected gross margin of 36.6% for Q2.

Adjusted operating profit increased 21.3% from the year-ago period to $106.6 million. The adjusted operating margin expanded 345 bps to 20.1% on a 6.4% decline in adjusted operating expenses.

Adjusted operating margin, according to our model, was 16.6% for Q2.

Liquidity & Capital Structure

Chemed exited the second quarter of 2022 with cash and cash equivalents of $9.6 million, marking a significant decline from $18.2 million at the end of first quarter 2022. Meanwhile, long-term debt at Q2 2022-end was $111.8 million, slightly down from the company’s long-term debt of $120 million on its balance sheet at the end of first-quarter 2022.

Cumulative net cash provided by operating activities at the end of the second quarter of 2022 was $157.7 million compared with $132 million of cumulative net cash provided by operating activities a year ago.

In the second quarter, Chemed’s management repurchased stocks for $49.9 million. As of Jun 30, 2022, approximately $125 million remained under the existing share repurchase plan.

The company has a consistent dividend-paying history, with five-year annualized dividend growth being 6.23%.

2022 Guidance

Chemed has updated its financial guidance for 2022, considering the rapidly changing business environment created by the COVID-19 pandemic, uncertainty regarding forward-looking inflation and a potential economic recession that may affect the company’s business segments.

For 2022, VITAS revenues, prior to Medicare Cap, are estimated to decline in the range of 4.5-5.0% from the prior year (versus the earlier-projected decline in the range of 1.5-2.5%). Roto-Rooter is forecast to achieve 2022 revenue growth in the range of 5.5-5.7% (down from the earlier projected range of 8.0-9.5%). The current Zacks Consensus Estimate for total revenues is pegged at $2.17 billion, suggesting 1.5% growth from the 2021 reported figure.

Full-year 2022 adjusted EPS is estimated in the range of $19.30 to $19.50 (compared to the earlier projected range of $19.10 to $19.50). The Zacks Consensus Estimate for the metric is pegged at $19.46, indicating a 0.7% rise over the year-ago reported figure. We estimate an adjusted EPS of $19.48 for 2022.

Our Take

Chemed ended the second quarter of 2022 with better-than-expected earnings. The year-over-year growth in adjusted EPS appears promising. Robust performance by the Roto-Rooter segment drove the top line. The company recorded substantial increases in drain cleaning, plumbing, excavation and water restoration revenues in the quarter under review. Expansion of both margins instills optimism. The decline in operating costs is encouraging too.

However, the lower sales performance in the VITAS segment is discouraging. A decline in short-term cash level is worrisome. The persistent macroeconomic headwinds related to the volatility in COVID-19 trends, rising inflationary pressure and other challenges continue to hamper business performance.

Zacks Rank and Other Key Picks

Chemed currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space that have announced quarterly results are Quest Diagnostics Incorporated DGX, Medpace Holdings, Inc. MEDP and Alkermes plc ALKS.

Quest Diagnostics, carrying a Zacks Rank #2 (Buy), reported second-quarter 2022 adjusted EPS of $2.36, which beat the Zacks Consensus Estimate by 9.8%. Revenues of $2.45 billion outpaced the consensus mark by 7.5%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Quest Diagnostics has an earnings yield of 7.1% compared with the industry’s 3.2%. DGX’s earnings surpassed estimates in three of the trailing four quarters and missed the same in one, the average being 12.1%.

Medpace Holdings, having a Zacks Rank #2, reported second-quarter 2022 adjusted EPS of $1.46, which beat the Zacks Consensus Estimate by 8.9%. Revenues of $351.2 million outpaced the consensus mark by 1.3%.

Medpace Holdings has an estimated growth rate of 22.7% for full-year 2022. MEDP’s earnings surpassed estimates in the trailing four quarters, the average being 17.3%.

Alkermes reported second-quarter 2022 adjusted earnings of 6 cents per share, beating the Zacks Consensus Estimate by 50%. Revenues of $276.2 million beat the Zacks Consensus Estimate by 1.2%. It currently has a Zacks Rank #2.

Alkermes has a long-term estimated growth rate of 25.1%. ALKS’ earnings surpassed estimates in all of the trailing four quarters, the average surprise being 325.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alkermes plc (ALKS) : Free Stock Analysis Report

Quest Diagnostics Incorporated (DGX) : Free Stock Analysis Report

Chemed Corporation (CHE) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance