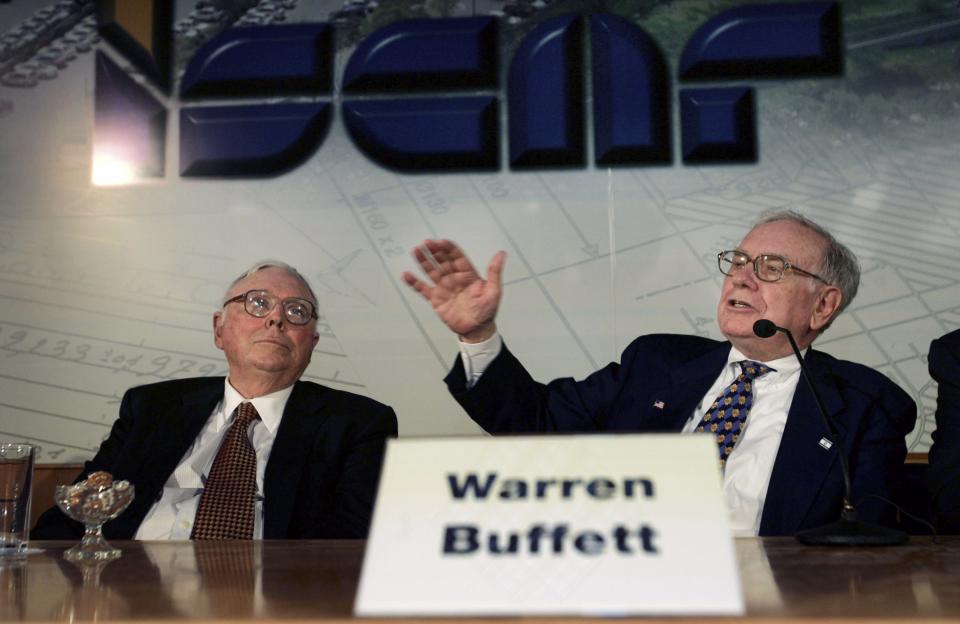

Charlie Munger first met Warren Buffett in 1959. Here's how the lawyer became an investing legend.

Charlie Munger died at the age of 99 on Tuesday.

The Berkshire Hathaway vice-chairman became an investor after meeting Warren Buffett at a dinner party.

He also served in the US Army Air Corps, and lost an eye to failed cataract surgery.

Charlie Munger, the vice-chairman of Berkshire Hathaway and Warren Buffett's righthand man, died at the age of 99 on Tuesday.

"Berkshire Hathaway could not have been built to its present status without Charlie's inspiration, wisdom and participation," Buffett said in a press release.

Things could have turned out differently for Munger if he didn't meet Buffett at a 1959 dinner party in their hometown of Omaha, Nebraska.

Munger was a successful lawyer before Buffett convinced him to try out finance, and then to join Berkshire Hathaway in 1978.

Here's the story behind the investing legend.

Charlie Munger was born in Omaha, Nebraska on January 1, 1924.

As a teenager, one of his first jobs was at a grocery store called Buffett & Son, owned by Warren Buffett's grandfather.

In 1941, Munger left Omaha to enroll at the University of Michigan, studying math. He would later donate millions of dollars to his alma mater.

By 1943, shortly after turning 19, he joined the US Army Air Corps as a second lieutenant.

After scoring highly on an army intelligence test, Munger was sent to study meteorology at Caltech in Pasadena.

Through the G.I. Bill, he took several other classes. And in 1945, he married his first wife Nancy Huggins.

Munger then applied to Harvard Law School, which his father attended, but was rejected because he didn't have an undergraduate degree.

The former dean, Roscoe Pound, was a Munger family friend and intervened on his behalf. Munger graduated summa cum laude – the highest honor – in 1948.

Munger moved with his family to California and worked in law. He divorced his first wife in 1953 and met Nancy Borthwick on a blind date, marrying her in 1956.

Source: Stanford Magazine

Munger and Warren Buffett first met in 1959 at a dinner party in their hometown of Omaha, and quickly got along.

"About five minutes into it, Charlie was sort of rolling on the floor laughing at his own jokes, which is exactly the same thing I did," Buffett told CNBC. "I thought, 'I'm not going to find another guy like this.' And we just hit it off."

Back in California, he cofounded the law firm Munger, Tolles & Olson in 1962, where he worked as a real estate attorney.

The two stayed in touch, and on Buffett's advice, Munger gave up law to concentrate on managing investments.

Munger was successful, as Buffett pointed out in a 1984 essay. `He generated compound annual returns of 19.8% between 1962 and 1975.

"He was willing to accept greater peaks and valleys of performance, and he happens to be a fellow whose whole psyche goes toward concentration, with the results shown," Buffett wrote.

In his 50s, Munger lost his left eye after cataract surgery failed. A doctor warned he could lose his right eye too, so he began learning braille, but the condition improved.

Buffett became CEO of Berkshire Hathaway in 1965, and convinced Munger to join him as vice-chairman in 1978.

The pair became the face of the company, with Munger known as the pragmatic and witty righthand man.

Munger stayed in California while Buffett worked from Omaha, speaking frequently by phone.

Source: Bloomberg

Buffett credited Munger with swaying him away from the "cigar-butt" style of value investing, which involves buying low-priced stock in struggling companies.

"It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price," Buffett told shareholders in 1989. "Charlie understood this early – I was a slow learner."

When Munger missed a shareholders meeting in 2010, Buffett brought a cardboard cutout on stage, and mimicked him saying: "I couldn't agree more."

Source: Bloomberg

Munger was known for his one-liners, calling crypto "rat poison" and a "venereal disease." In May, he rebuffed AI: "I think old-fashioned intelligence works pretty well."

Source: Yahoo Finance

When he died Munger was worth $2.6 billion.

Source: Forbes

Munger died in a California hospital on November 28, aged 99.

Charlie Munger, investing legend and right hand to Warren Buffett, dies at 99

Read the original article on Business Insider

Yahoo Finance

Yahoo Finance