Charles River's (CRL) New Cloud Platform Offers Real-Time Data

Charles River Laboratories International, Inc.CRL recently launched its cloud-based platform Apollo, which provides secure access for drug developers to study data, milestones, documents, cost estimates, and program planning tools to save time and enhance the client experience. This new-generation platform is efficiently designed to support clients with safety assessment and toxicology studies.

The company’s new customer portal reimagines the traditional dynamic, where the data-sharing between a customer and CRO relies on a study director’s capacity to proactively provide program updates.

About Apollo

The design of the platform delivers high impact technology. By providing broader access to study milestones and data, Apollo minimizes the friction in preclinical studies, which contributes to a more efficient and effective process.

Image Source: Zacks Investment Research

The cloud-based platform allows clients to gain access to self-service tools that are designed to reduce barriers, obtain the status of studies, data insights and analysis, and instantly download study documents. Additionally, Apollo permits enhanced budget forecasting by giving access to a self-service quoting tool.

Per management at Charles River, through the Apollo platform, the clients can get hold of real-time data and analysis which empowers them to make effective data-driven decisions and strengthen the partnership between the organizations. This also caters to the company’s goal of creating efficiencies in the drug development process.

Industry Prospects

Per a Research report, the global healthcare cloud computing market size was valued at $39.4 billion in 2022 and is expected to grow at a compound annual growth rate of 17.8% by 2027.

The increasing adoption of healthcare IT solutions due to COVID-19, big data analytics, the proliferation of new payment models, the cost-efficiency of the cloud and the dynamic nature of health benefit plan designs are driving the market growth.

Recent Developments

In March 2023, Charles River launched its off-the-shelf Helper plasmids (pHelper), which is designed to secure supply and streamline adeno-associated virus-based gene therapy programs from early discovery through commercial manufacturing. It is presently available in Research Grade, High Quality, and Good Manufacturing Practice grades.

In the last month, the company announced a multi-program agreement with Pioneering Medicines, which is a strategic initiative within Flagship Pioneering. Through the agreement, Pioneering Medicines will have access to Logica, an Artificial Intelligence (AI) powered drug solution that translates biological insights into optimized preclinical assets by leveraging Valo Health’s AI-powered Opal Computational Platform and Charles River’s leading preclinical expertise.

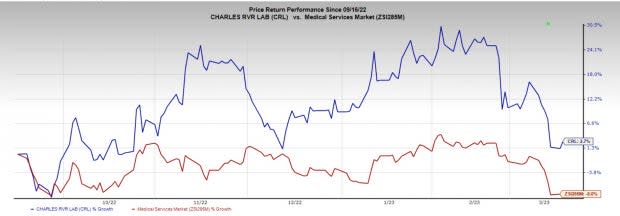

Price Performance

In the past six months, Charles River has mostly outperformed its industry. Shares of the company have gained 2.7% against the industry’s fall of 8.0%.

Zacks Rank and Key Picks

Charles River carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the overall healthcare sector are Haemonetics Corporation HAE, TerrAscend Corp. TRSSF and Akerna Corp. KERN. Haemonetics and TerrAscend sport a Zacks Rank #1 (Strong Buy), while Akerna carries a Zack Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Haemonetics’ stock has risen 40.2% in the past year. Earnings estimates for Haemonetics have increased from $2.91 per share to $2.94 for 2023, and from $3.28 per share to $3.29 for 2024 in the past 30 days.

HAE’s earnings beat estimates in all the last four quarters, delivering an average surprise of 10.98%. In the last reported quarter, it reported an earnings surprise of 7.59%.

Estimates for TerrAscend in 2023 have decreased from a loss of 10 cents per share to a loss of 9 cents per share in the past 30 days. Shares of TerrAscend have declined 66.5% in the past year.

TerrAscend’s earnings beat estimates in one of the last three quarters and missed the mark in the other two, the average negative surprise being 136.11%. In the last reported quarter, TRSSF delivered an earnings surprise of 216.67%.

Akerna’s stock has declined 96.3% in the past year. Its estimates for 2023 have remained constant at a loss of $1.91 per share over the past 30 days.

Akerna missed earnings estimates in all the last four quarters, delivering a negative earnings surprise of 15.49%, on average. In the last reported quarter, KERN delivered a negative earnings surprise of 13.33%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Charles River Laboratories International, Inc. (CRL) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Akerna Corp. (KERN) : Free Stock Analysis Report

TerrAscend Corp. (TRSSF) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance