Chairman James Wirth Acquires Shares of InnSuites Hospitality Trust (IHT)

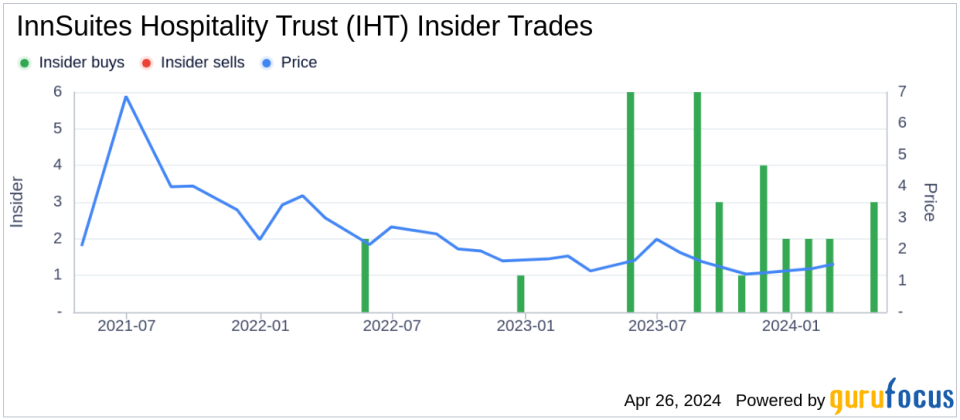

In a recent transaction filed with the SEC, Chairman James Wirth of InnSuites Hospitality Trust (IHT) has purchased 400 shares of the company. The transaction took place on April 22, 2024, as indicated in the SEC Filing. This insider buying activity adds to the series of purchases made by James Wirth over the past year, totaling 20,461 shares acquired and no shares sold.InnSuites Hospitality Trust is a real estate investment trust (REIT) that focuses on hotel ownership, management, and branding. The trust operates through its subsidiary, InnSuites Hotels, Inc., which provides hospitality services and manages a portfolio of hotel properties.Insider buying and selling trends can provide valuable insights into a company's financial health and management's perspective on the stock's value. Over the past year, InnSuites Hospitality Trust has seen a total of 29 insider buys and no insider sells, suggesting a positive sentiment among the insiders regarding the company's stock.

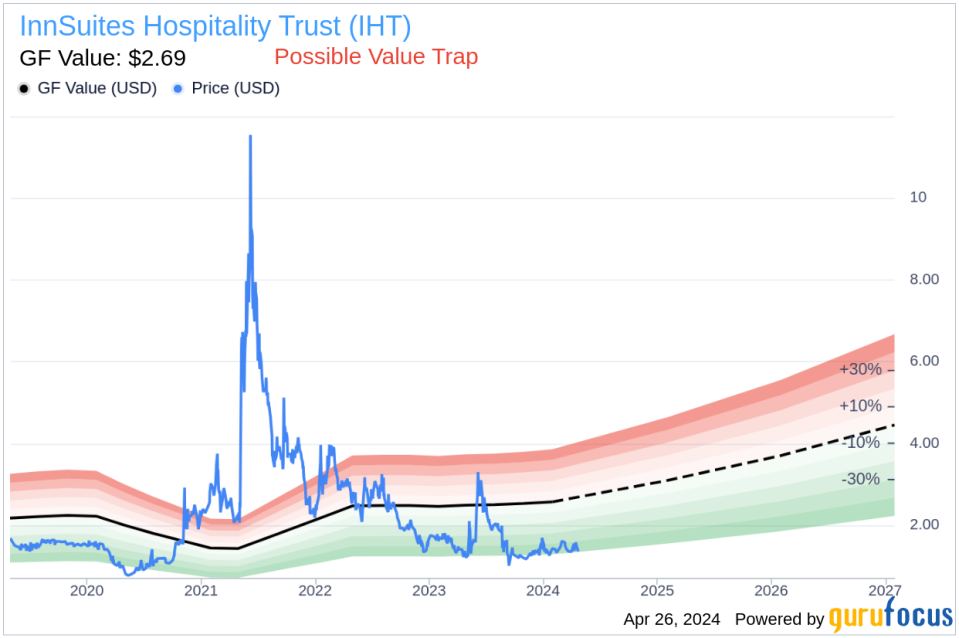

On the valuation front, shares of InnSuites Hospitality Trust were trading at $583.45 on the day of the insider's recent purchase, resulting in a market cap of $12.769 million. The price-earnings ratio stands at 44.22, which is above both the industry median of 16.8 and the company's historical median price-earnings ratio.The stock's price-to-GF-Value ratio is currently at 216.9, with a GF Value of $2.69, indicating that the stock is considered a "Possible Value Trap, Think Twice" according to GuruFocus' valuation model. The GF Value is calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts.

The recent insider buying activity by Chairman James Wirth may be of interest to investors monitoring insider trends and evaluating the stock's current valuation in the context of its historical performance and future prospects.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance