Cerner (CERN) Q1 Earnings in Line, Revenues Lag Estimates

Cerner Corporation CERN reported first-quarter 2022 adjusted earnings of 89 cents per share, which came in line with the Zacks Consensus Estimate. The bottom line improved 17% from the prior-year quarter.

GAAP EPS in the quarter was 70 cents, up 25% from the prior-year quarter.

Revenue Details

The company reported revenues of $1.43 billion, which missed the Zacks Consensus Estimate by 2.5%. However, the top line increased 3% from the year-ago quarter.

Segmental Performance

Licensed software revenues were $189.4 million, which rose 17.2% from the year-ago quarter.

Technology resale revenues were $47.5 million, down 3.9% on a year-over-year basis.

Revenues from Subscriptions were $94.4 million, down 5.4%.

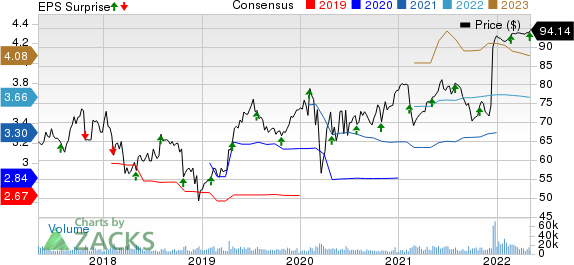

Cerner Corporation Price, Consensus and EPS Surprise

Cerner Corporation price-consensus-eps-surprise-chart | Cerner Corporation Quote

Professional services’ revenues totaled $525.3 million, up 6.3% from the prior-year quarter figure.

Revenues at the Managed services unit amounted to $324.6 million, up 2.3%.

Support and maintenance revenues were $242.9 million, down 7.8% year over year.

Reimbursed travel revenues amounted to $5.7 million, reflecting an increase of 3.6%.

Margins

In the quarter under review, gross profit was $1.19 billion, up 2.5% on a year-over-year basis. Gross margin was 82.9%, down 50 basis points (bps).

General and administrative expenses declined 2.7% to $109.3 million. Software development expenses rose 1.4% to $195.1 million.

Operating income totaled $251.9 million, up 15.6% from the prior-year quarter. Operating margin expanded 240 bps to 21.2%.

Financial Position

The company exited the first quarter with cash and cash equivalents of $709.5 million compared with $589.8 million in the previous quarter.

Net cash from operating activities in the first quarter totaled $375.1 million compared with $450.4 million in the year-ago period.

Free cash flow amounted to $276.4 million, down from $290.9 million a year ago.

Wrapping Up

Cerner exited the first quarter on a mixed note, wherein earnings matched the Zacks Consensus Estimate while revenues missed the same. Solid gains in four of the company’s business units buoy optimism. Expansion in operating margin in the quarter under review deserves mention.

The company saw a decrease in revenues in Technology resale, Subscriptions and Support and maintenance segments. Contraction in gross margin is a headwind. Competition in the global MedTech space remains a concern.

Zacks Rank

Currently, Cerner carries a Zacks Rank #3 (Hold).

Key Picks

Some better-ranked stocks in the broader medical space that have announced quarterly results are Omnicell, Inc. OMCL, UnitedHealth Group Incorporated UNH and Alkermes plc ALKS.

Omnicell, carrying a Zacks Rank #2 (Buy), reported first-quarter 2022 adjusted EPS of 83 cents, which beat the Zacks Consensus Estimate by 16.9%. Revenues of $318.8 million outpaced the consensus mark by 0.7%. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Omnicell has an estimated long-term growth rate of 16%. OMCL's earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 13.4%

UnitedHealth, carrying a Zacks Rank #2, reported first-quarter 2022 adjusted EPS of $5.49, which beat the Zacks Consensus Estimate by 1.7%. Revenues of $80.1 billion outpaced the consensus mark by 1.9%.

UnitedHealth has an estimated long-term growth rate of 14.8%. UNH's earnings surpassed estimates in each of the trailing four quarters, the average surprise being 3.7%.

Alkermes reported first-quarter 2022 adjusted EPS of 12 cents, which beat the Zacks Consensus Estimate of a penny. First-quarter revenues of $278.6 million outpaced the Zacks Consensus Estimate by 6.2%. It currently sports a Zacks Rank #1.

Alkermes has an estimated long-term growth rate of 25.1%. ALKS' earnings surpassed estimates in each of the trailing four quarters, the average surprise being 350.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

Alkermes plc (ALKS) : Free Stock Analysis Report

Cerner Corporation (CERN) : Free Stock Analysis Report

Omnicell, Inc. (OMCL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance