CEO and 10% Owner James Ballengee Acquires 102,000 Shares of Vivakor Inc (VIVK)

James Ballengee, CEO and 10% Owner of Vivakor Inc (NASDAQ:VIVK), has recently increased his stake in the company. According to a SEC Filing dated 2024-04-24, the insider purchased 102,000 shares of the company's stock.

Over the past year, the insider has been actively accumulating shares, with a total of 270,000 shares bought and no shares sold. This latest transaction continues the trend of insider buying activity for the company.

Vivakor Inc specializes in the acquisition and development of technologies and assets for the natural resources sector, focusing on precious metals extraction and remediation of natural resources. The company's approach includes the deployment of proprietary, environmentally friendly technologies to extract valuable resources from waste and other feedstocks.

The insider transaction history for Vivakor Inc shows a pattern of insider confidence, with 2 insider buys recorded over the past year and no insider sells during the same period.

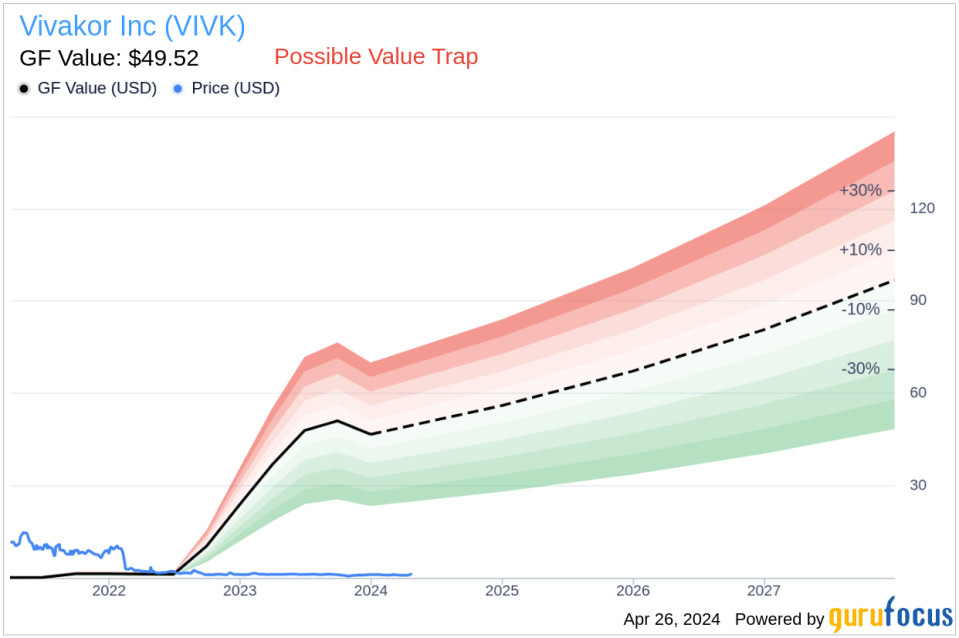

On the date of the recent insider buy, shares of Vivakor Inc were trading at $1.51, resulting in a market cap of $36.023 million. The company's stock is currently valued significantly below the GuruFocus Value (GF Value) of $49.52, with a price-to-GF-Value ratio of 0.03, indicating that the stock may be a Possible Value Trap, and investors should think twice before making an investment decision.

The GF Value is a proprietary intrinsic value estimate from GuruFocus, which is derived from historical trading multiples, an adjustment factor based on the company's historical performance, and future business performance estimates provided by Morningstar analysts.

The GF Value assessment suggests caution, as the current price is significantly below the estimated intrinsic value, which could imply that the market is not recognizing the company's potential or that there are underlying challenges not reflected in the GF Value.

Investors and stakeholders will be watching closely to see how this insider activity aligns with Vivakor Inc's future performance and market valuation.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance