Central Bank Rate Hikes Force Oil Prices Lower

Macro-economic headwinds continue to plague the oil markets, and central bank action this week has turned the sentiment decidedly bearish.

Friday, June 23rd, 2023

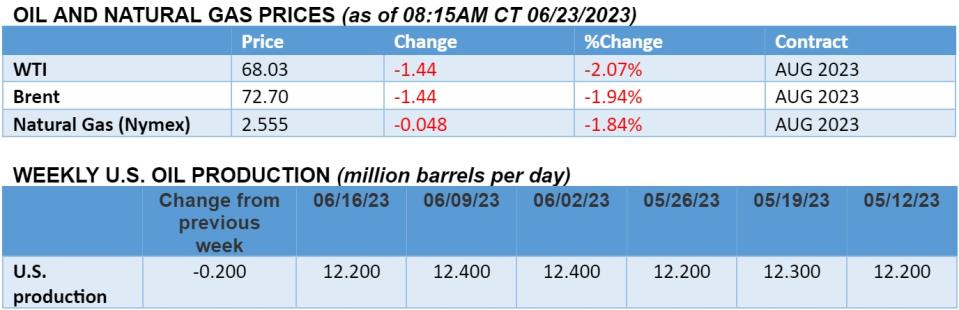

The reign of central banks over the oil markets continued this week as the Bank of England surprised markets by a 0.5pp interest rate hike, stoking fears that Europe’s recession is just as real as it is for the US. Seeing Norway and Switzerland hike interest rates on the same day, macroeconomic headwinds have pushed Brent futures to $73 per barrel whilst WTI is down at $68 per barrel.

Petrobras Rises as Fears of Leftists Policies Subside. Petrobras (NYSE:PBR) shares have risen more than 50% this year, with leading investment banks such as Goldman Sachs (NYSE:GS) or JPMorgan (NYSE:JPM) upgrading price targets as the Lula administration’s leftist tendencies had only limited impact on the company.

Equinor Signs Up for Sabine Pass LNG. US LNG developer Cheniere Energy (NYSEAMERICAN:LNG) signed a 15-year term supply agreement with Norway’s Equinor (NYSE:EQNR) for the delivery of 1.75 mtpa of LNG from the Sabine Pass LNG expansion, with first supplies to start in 2027.

Guyana Seeks to Carve Out More Offshore Acreage. The government of Guyana is in talks with ExxonMobil (NYSE:XOM) to reclaim unexplored offshore areas in blocks controlled by the US oil major, arguing that under the original 2016 production deal some 20% of acreage remains untapped.

New US Biofuels Mandates Disappoint Corn Producers. With rumors emerging that the US Environmental Protection Agency is set to finalize biofuel blending volumes at 20.94 billion gallons in 2023, agricultural producers have voiced their discontent with stagnating ethanol mandates.

Ecuador Weighs Future Without Amazon Oil. According to Ecuador’s energy minister, the Latin American country is set to lose $1.2 billion in oil income per year if a proposed bill that aims to ban oil production in the Yasuni region of the Amazon passes in the upcoming August referendum.

Russian Company Seeks to Dethrone Gazprom. Russia’s LNG producer Novatek (MCX:NVTK) is lobbying for legislative changes that would allow it to start building its 20.4 mtpa Murmansk LNG plant, expected to start operation in 2027, in a blow to the country’s main exporter Gazprom.

Cyprus Seeks to Become the Med’s LNG Hub. Backtracking on its earlier plan to lay the 1,250-mile EastMed subsea pipeline to Italy, Cyprus is now proposing to link Israel’s offshore fields to an onshore liquefaction terminal to be built on its territory and export LNG from the island country.

Norway Seeks to Legalize Deep-Sea Mining. Blazing the trail amidst minimal progress on a global deep-sea mining pact, Norway has outlined this week its plan to open the sea floor in its territorial waters to metals extraction, presenting the move as part of a diversification policy away from oil.

Nigeria Slaps Massive Fines on Shipowners. Nigeria’s new governments issued multi-million fines to several shipping companies for allegedly not paying company income tax during 2010-2019, prompting some shipowners to boycott Nigeria as long as the payment notice is not withdrawn.

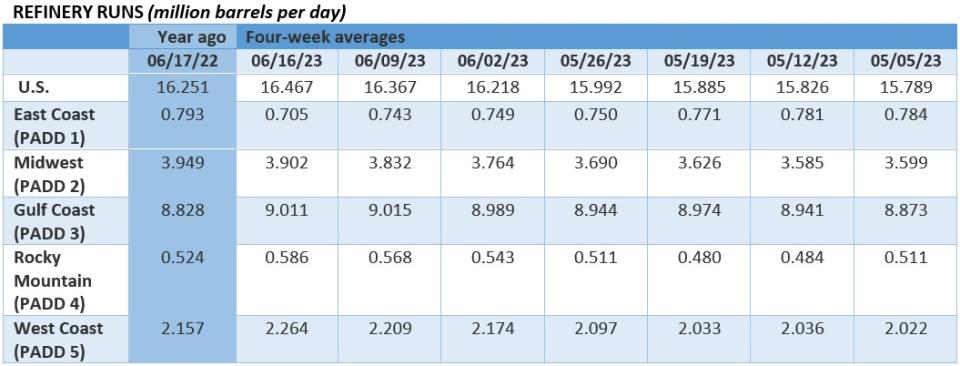

US Cushing Inventories Soar to 2-Year High. With US Midwest downstream runs hampered by outages at BP’s (NYSE:BP) Toledo refinery and Phillips 66’s (NYSE:PSX) Borger refinery, crude inventories at the Cushing storage hub rose to 42.1 million barrels, the highest since June 2021.

EU Pushes for Global Carbon Pricing. As the price of carbon in the EU moved back above €95 per metric tonne of CO2, European Commission president Ursula von der Leyen called for a global carbon price, arguing the current percentage of emissions covered by a carbon price is “almost nothing”.

Chinese Firms Eye Tanzania’s Offshore Resources. According to Tanzanian authorities, China’s state-owned explorer CNOOC (HKG:0883) is nearing a deal with the African country to carry out seismic studies and other exploration works in deepwater blocks next to the Tanzania LNG project.

No Second Chance for Lake Charles LNG 2. The US Department of Energy announced it would not rehear the request of midstream operator Energy Transfer (NYSE:ET) for a second extension of the Lake Charles LNG project, probably leading to the end of the project despite the $350 million spent and 7.9mtpa allocated under offtake deals.

Saudi Floater Buildup Starts to Clear. The buildup in Saudi Arabian VLCCs off the Egyptian port of Ain Sukhna, with 10 very large tankers totaling more than 20 million barrels of oil idling there for several weeks, has finally started to clear amidst speculation that Saudi Aramco has been running out of storage.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

Yahoo Finance

Yahoo Finance