CenterPoint Energy's (NYSE:CNP) Dividend Will Be Increased To $0.19

The board of CenterPoint Energy, Inc. (NYSE:CNP) has announced that it will be paying its dividend of $0.19 on the 9th of March, an increased payment from last year's comparable dividend. Despite this raise, the dividend yield of 2.4% is only a modest boost to shareholder returns.

See our latest analysis for CenterPoint Energy

CenterPoint Energy's Earnings Easily Cover The Distributions

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Prior to this announcement, CenterPoint Energy's earnings easily covered the dividend, but free cash flows were negative. In general, we consider cash flow to be more important than earnings, so we would be cautious about relying on the sustainability of this dividend.

The next year is set to see EPS grow by 17.7%. If the dividend continues on this path, the payout ratio could be 39% by next year, which we think can be pretty sustainable going forward.

Dividend Volatility

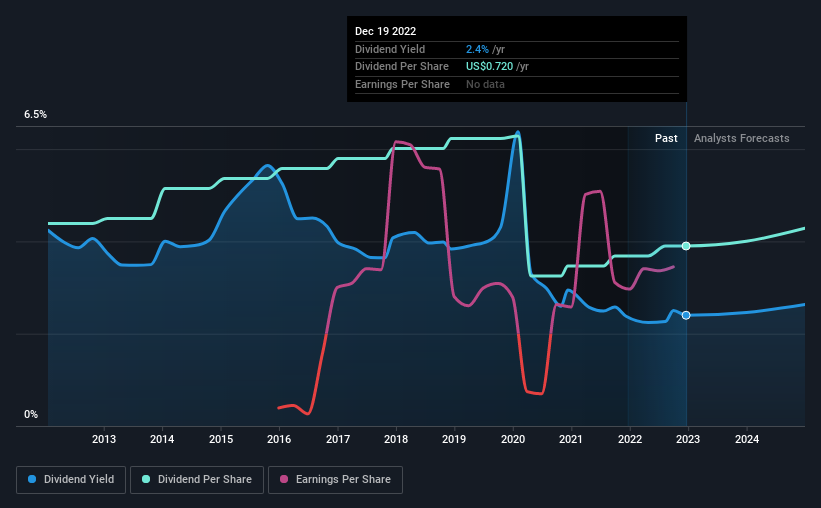

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. Since 2012, the annual payment back then was $0.81, compared to the most recent full-year payment of $0.72. The dividend has shrunk at around 1.2% a year during that period. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

The Dividend's Growth Prospects Are Limited

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Although it's important to note that CenterPoint Energy's earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time. CenterPoint Energy is struggling to find viable investments, so it is returning more to shareholders. This isn't bad in itself, but unless earnings growth pick up we wouldn't expect dividends to grow either.

In Summary

In summary, while it's always good to see the dividend being raised, we don't think CenterPoint Energy's payments are rock solid. While CenterPoint Energy is earning enough to cover the payments, the cash flows are lacking. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. Case in point: We've spotted 3 warning signs for CenterPoint Energy (of which 1 is concerning!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance