Cencora (COR) Stock Nosedives: Here's What Caused the Decline

Shares of Cencora COR lost 3.9% on Jun 27, followed by another 1.3% decline during the after-hours trading. This was likely due to the invalidation of a previously-settled opioid litigation by the Supreme Court. Meanwhile, an assumed softness in the retail pharmacy market is likely to have added to the pressure.

However, Cencora has the ability to turn around with a multinational distribution footprint and a global platform of commercialization services that make it a natural partner for manufacturers bringing their products to the market. Moreover, improving patient access to medical care, enhanced economic conditions and population demographics are likely to favor the pharmaceutical segment in the upcoming quarters.

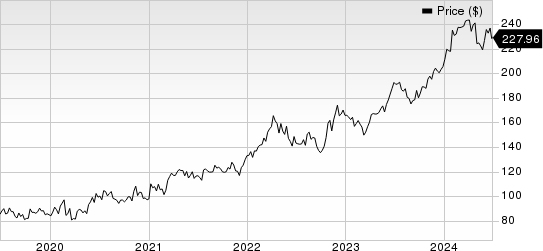

Cencora’s shares have risen 11% year to date compared with the industry’s growth of 4.1%. the S&P 500 Index has increased 15.2% in the same period.

Image Source: Zacks Investment Research

More on the Factors

Per a CNN article, the recent Supreme Court ruling invalidated the $6 billion settlement related to the primary alleged entity in opioid abuse litigation, Purdue Pharma, which would have shielded its owner, the Sackler family, from future financial claims.

The recent court ruling is separate from the 2021 settlement, wherein Johnson & Johnson and the three major drug distributors — Cencora (formerly AmerisourceBergen), McKesson MCK and Cardinal Health CAH — agreed to a $26 billion settlement to resolve allegations that helped fuel the opioid crisis. However, with the invalidation of one settlement raises concern for further court rulings in favor of opioid-abuse victims.

The recent Supreme Court ruling may allow families hurt by the opioid crisis to once again pursue legal claims, especially against the Sackler family. This may have a spillover effect on other related companies.

Moreover, four states opted not to join the national settlement in 2021 and were able to continue their legal fight.

Cencora, McKesson, J&J and Cardinal Health have already set aside a reserve to meet the multi-year $26 billion settlement. Any invalidation of the settlement or a new settlement ruling may increase the burden for these companies. Moreover, this may lead to higher legal expenses.

The stock’s decline is likely to have reflected the rising concern related to the opioid-abuse litigation. It may also have reflected an assumed weakness in the retail pharmacy market following lower-than-expected results of the largest global pharmaceutical wholesaler, Walgreens Boots WBA, leading to more than 22% decline in its share price on Jun 27. WBA is the biggest customer of Cencora. It accounted for nearly a quarter of Cencora’s total revenues in 2023. The weakness in Walgreens Boots’ quarterly performance should get reflected in COR’s third-quarter fiscal 2024 results.

Apart from Cencora, the Supreme Court ruling and Walgreens Boots’ weak results have also led to a decline in the shares of other related companies like McKesson and Cardinal Health. Shares of MCK and CAH were down 1.1% and 1.5%, respectively, on Jun 27.

Cencora, Inc. Price

Cencora, Inc. price | Cencora, Inc. Quote

Zacks Rank

Cencora currently carries a Zacks Rank #3 (Hold). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report

Walgreens Boots Alliance, Inc. (WBA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance