Celsius Holdings (CELH) Down 28% in a Month: Should You Buy the Dip?

Celsius Holdings, Inc. CELH has witnessed a significant decline over the past month, with its shares plummeting 27.7%, underperforming the industry's drop of 5.1%. The company also trailed the broader Zacks Consumer Staples sector's decrease of 2.1% and the S&P 500's growth of 3.7% during the same period. This downturn in the stock price can largely be attributed to the slowing growth of the company and intense competition in the energy drinks market.

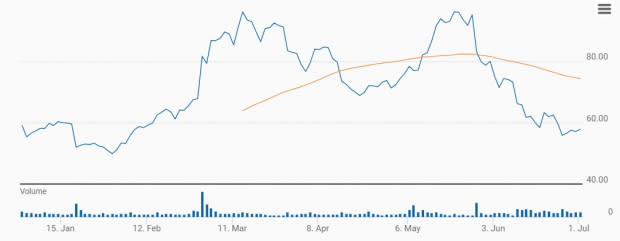

Closing at $57.84 in the last trading session, the stock stands almost 42% below its 52-week high of $99.62. Furthermore, CELH is trading below its 50-day moving average, signaling potential bearish sentiment in maintaining recent performance levels.

Despite the downside, Celsius Holdings is currently trading at a forward 12-month P/E ratio of 47.2, which significantly exceeds the industry average of 15.44. This valuation discrepancy indicates that while investors have high expectations for Celsius Holdings' future growth, the stock's current performance and the broader market challenges could pose risks.

CELH Stock Trades Below 50-Day Average

Image Source: Zacks Investment Research

Unpacking the Stock's Recent Slide

A key factor behind CELH’s recent bearish performance could be the slowing down of its revenue growth. While Celsius Holdings has consistently reported strong year-over-year growth, recent quarters have shown signs of deceleration. The company's first-quarter 2024 earnings report highlighted a 37% year-over-year increase in revenues, which slowed down considerably from the triple-digit surge witnessed in previous years. Revenues in the quarter were affected by inventory movements by the company’s largest customer.

The year-over-year inventory variation is attributed to elevated restocking in the first quarter of 2023, which was absent this year. Ongoing inventory fluctuations are anticipated in subsequent quarters as Celsius Holdings’ largest distributor accounts for about 62% of the total North America business.

Apart from this, stiff competition from major players like Monster Beverage MNST and Red Bull could hamper the company’s ability to maintain its robust market share. Additionally, macroeconomic headwinds such as underlying inflation and higher interest rates, which have been impacting consumers’ budgets, create a challenging backdrop for consumer goods companies.

While Celsius Holdings is committed to increasing its marketing and promotional initiatives, these investments come at the cost of margins. The company also remains troubled by the rising cost of fuel and several commodities.

The Zacks Consensus Estimate for earnings per share (EPS) for 2024 and 2025 has declined 3.6% to $1.07 and 5.5% to $1.38, respectively, over the past 30 days.

Estimate Revision Chart

Image Source: Zacks Investment Research

Is the Show Really Over for CELH?

While the high valuation and recent performance issues raise caution, long-term investors might see the recent fall as a buying opportunity, given Celsius Holdings' strong market presence, innovative product offerings and strategic partnerships.

Undoubtedly, Celsius Holdings remains a strong player in the energy drink market with a loyal customer base and a growing international presence. The company's health-focused beverages resonate well with millennials increasingly seeking wellness-oriented alternatives.

A key driver of Celsius Holdings’ growth has been its expanding distribution network. The company has secured shelf space in major retail chains, convenience stores and online platforms, significantly enhancing its market reach. Partnerships with leading distributors and retailers, such as Walmart WMT, Target and Amazon, have provided a strong platform for future growth.

Moving on, the company continues to innovate with new product launches that cater to evolving consumer preferences. Its product line includes a variety of flavors and formulations, including carbonated and non-carbonated options, as well as powdered supplements. This commitment to innovation ensures Celsius Holdings’ relevance in the dynamic beverage industry.

Celsius Holdings' strategic acquisitions and partnerships, including collaborations with industry giants like PepsiCo PEP and influential fitness brands, further underscore its proactive approach to boosting brand awareness, consumer engagement and sustaining growth.

Wrapping Up

While CELH faces near-term challenges, including market pressures and operational hurdles, its strategic initiatives and innovative approach could pave the way for recovery and sustained growth in the future. All said, current investors should hold their positions in the stock, while potential new investors should consider waiting for a more favorable entry point.

Celsius Holdings currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Walmart Inc. (WMT) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Monster Beverage Corporation (MNST) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance