Cautious Investors Not Rewarding Comcast Corporation's (NASDAQ:CMCSA) Performance Completely

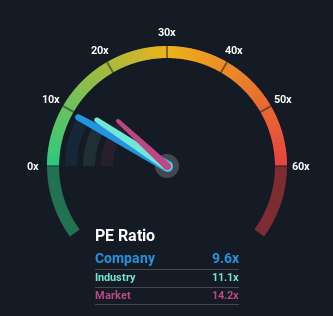

Comcast Corporation's (NASDAQ:CMCSA) price-to-earnings (or "P/E") ratio of 9.6x might make it look like a buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 15x and even P/E's above 27x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent earnings growth for Comcast has been in line with the market. One possibility is that the P/E is low because investors think this modest earnings performance may begin to slide. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

See our latest analysis for Comcast

Keen to find out how analysts think Comcast's future stacks up against the industry? In that case, our free report is a great place to start.

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Comcast would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a worthy increase of 14%. The latest three year period has also seen a 20% overall rise in EPS, aided somewhat by its short-term performance. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Looking ahead now, EPS is anticipated to climb by 9.3% each year during the coming three years according to the analysts following the company. With the market predicted to deliver 9.3% growth per year, the company is positioned for a comparable earnings result.

In light of this, it's peculiar that Comcast's P/E sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On Comcast's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Comcast currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Having said that, be aware Comcast is showing 1 warning sign in our investment analysis, you should know about.

If you're unsure about the strength of Comcast's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance