Carvana (NYSE:CVNA) Is Making Moderate Use Of Debt

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Carvana Co. (NYSE:CVNA) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Carvana

How Much Debt Does Carvana Carry?

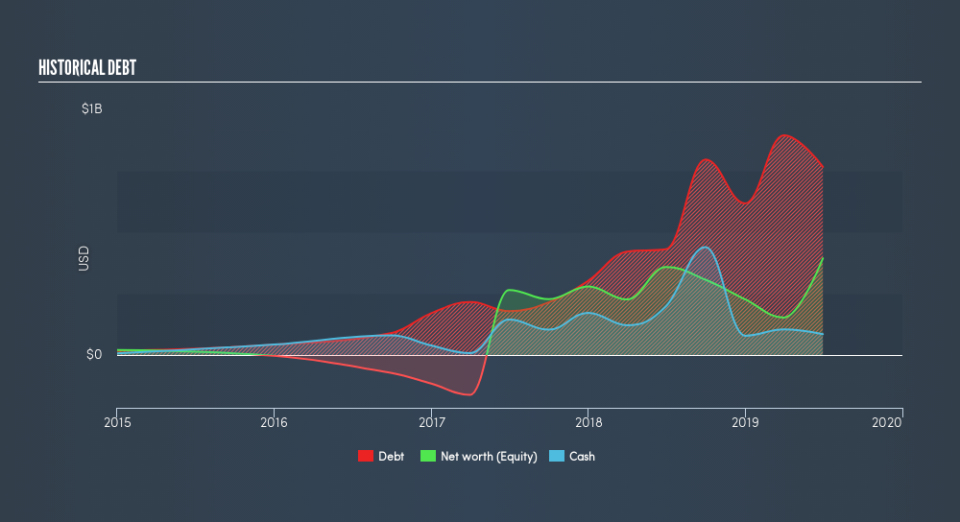

As you can see below, at the end of June 2019, Carvana had US$766.3m of debt, up from US$430.6m a year ago. Click the image for more detail. However, it also had US$85.4m in cash, and so its net debt is US$681.0m.

A Look At Carvana's Liabilities

We can see from the most recent balance sheet that Carvana had liabilities of US$249.8m falling due within a year, and liabilities of US$830.8m due beyond that. On the other hand, it had cash of US$85.4m and US$42.1m worth of receivables due within a year. So it has liabilities totalling US$953.1m more than its cash and near-term receivables, combined.

Given Carvana has a humongous market capitalization of US$12.3b, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Carvana's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Carvana managed to grow its revenue by 116%, to US$2.9b. So there's no doubt that shareholders are cheering for growth

Caveat Emptor

While we can certainly savour Carvana's tasty revenue growth, its negative earnings before interest and tax (EBIT) leaves a bitter aftertaste. To be specific the EBIT loss came in at US$232m. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. Another cause for caution is that is bled US$688m in negative free cash flow over the last twelve months. So in short it's a really risky stock. For riskier companies like Carvana I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance