Carpenter Technology (CRS) Q2 Earnings Miss Estimates, Up Y/Y

Carpenter Technology CRS reported adjusted net income of $52.8 million or 83 cents per share in the second quarter of fiscal 2020 (ended Dec 31, 2019), missing the Zacks Consensus Estimate of 87 cents. The figure, however, comes in higher than the year-ago quarter’s net income of $46.4 million or 76 cents per share.

Including one-time items, earnings per share came in at 79 cents compared with the prior-year quarter’s 73 cents.

Net sales of $573 million for the quarter were up 3% year over year. However, the reported figure missed the Zacks Consensus Estimate of $576 million. Volumes were down 7% on a year-over-year basis.

Cost of goods sold in the fiscal second quarter was up 2.4% year over year to $460.4 million. Gross profit rose 5.2% year over year to $112.6 million. Operating profit in the quarter remained flat at $55 million from the year-ago quarter. Operating margin was 9.6% in the quarter compared with the year-earlier quarter’s 9.9%.

The quarterly results mark the 12th consecutive quarter of year-on-year earnings growth, backlog expansion and record operating performance at Specialty Alloys Operations (SAO) business. The company generated double-digit year-over-year revenue growth in the Aerospace and Defense end-use market. Additionally, the company witnessed double-digit growth in the Medical end-use market compared with the prior-year level, as demand for high-value solutions remains robust.

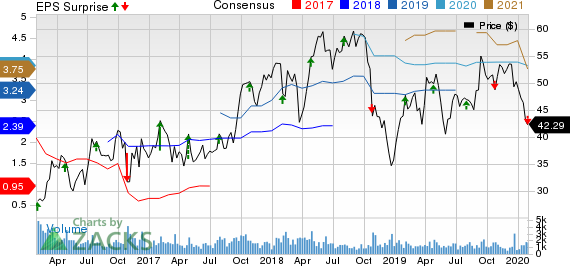

Carpenter Technology Corporation Price, Consensus and EPS Surprise

Carpenter Technology Corporation price-consensus-eps-surprise-chart | Carpenter Technology Corporation Quote

Segment Performance

The SAO segment reported sales of $483 million, reflecting year-over-year growth of 4.6%. The segment sold 56,564 pounds, 8.2% lower than the prior-year quarter. Operating profit climbed 10.5% year over year to $76.3 million. The segment delivered record fiscal second-quarter operating income on richer product mix.

The Performance Engineered Products’ net sales declined 6.2% year over year to $106 million in the December-end quarter. The segment sold 3,424 pounds, 3.7% higher than the year-ago quarter figure. The segment reported operating profit of $0.4 million in the fiscal second quarter compared with the $4.4 million recorded in the prior-year quarter.

Financials

The company had cash and cash equivalents of $29.9 million in the fiscal second quarter, up from the $28.5 million recorded at the prior-year quarter’s end. Long-term debt was $550.6 million as of Dec 31, 2019, remain flat with the end of fiscal 2019. Cash provided by operating activities decreased to $21.8 million for the quarter from the year-earlier quarter’s $37.8 million.

Price Performance

Carpenter Technology’s shares have declined 11.5% over the past year compared to the industry's decline of 26%.

Zacks Rank & Key Picks

Carpenter Technology currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the basic materials space include Daqo New Energy Corp. DQ, Royal Gold, Inc. RGLD and Pretium Resources Inc. PVG. While Daqo New Energy and Royal Gold flaunts a Zacks Rank #1 (Strong Buy), Pretium Resources carry a Zacks Rank of #2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Daqo New Energy has a projected earnings growth rate of a whopping 326.3% for 2020. Shares of the company have rallied nearly 33% over the past year.

Royal Gold has an estimated earnings growth rate of 83.5% for fiscal 2020. The stock has appreciated roughly 30% in a year’s time.

Pretium Resources has projected earnings growth rate of 106.9% for the ongoing year. The company’s shares have surged around 40% in the past year.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DAQO New Energy Corp. (DQ) : Free Stock Analysis Report

Pretium Resources, Inc. (PVG) : Free Stock Analysis Report

Royal Gold, Inc. (RGLD) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance