Carolina home inspector points out major problems in new builds — how to make sure you don’t buy a money pit

If you’re buying a new build, it’s fair to assume that the entire home is in great condition.

However, some home inspectors have taken to TikTok to show people how wrong that assumption may be.

One Carolina-based home inspector, ClearVUE Home Inspection, gave a behind-the-scenes look at newly built homes from their professional perspective.

Don't miss

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here's how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

Cost-of-living in America is still out of control — use these 3 'real assets' to protect your wealth today, no matter what the US Fed does or says

These 5 magic money moves will boost you up America's net worth ladder in 2024 — and you can complete each step within minutes. Here's how

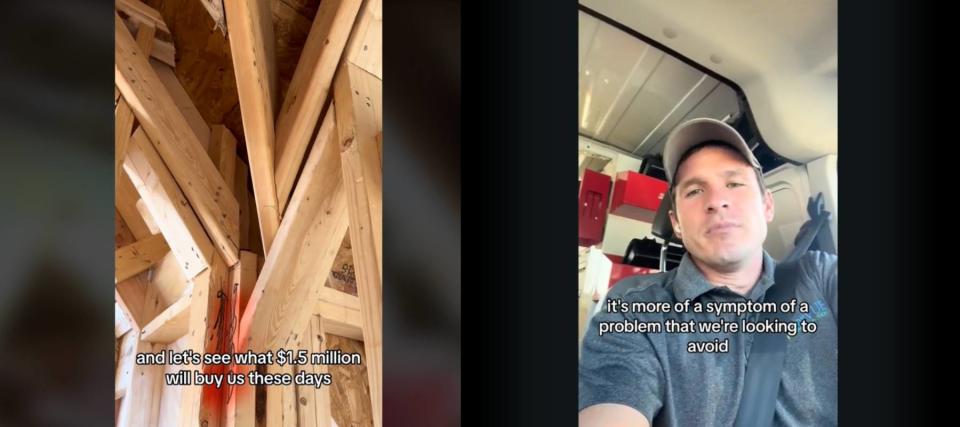

In a video that went viral in January, a ClearVUE inspector shows the shoddy craftsmanship behind a $1.5 million new build. There was also evidence of heavy water leakage and wooden slats sloppily laying atop one another.

“I was more impressed at the fifth grade gingerbread house contest than I am right now,” the ClearVUE inspector says in the video. In another video, the inspector points out that there are three things you should consider as a potential buyer before ever even submitting an offer or paying for an inspection: gutters, cracks in the walls, and the age of the home.

Yet, 22% of home buyers waive the home inspection contingency when purchasing a property, according to the National Association of Realtors’ May 2024 report.

However, many real estate professionals across the board say skipping out on an inspection is a surefire way to find yourself saddled with a money pit.

Why new homes are in bad shape

In the first quarter of 2024, a third (33.4%) of houses for sale were newly built, single-family homes, according to Redfin’s latest numbers. That’s nearly double the pre-pandemic levels.

The huge demand for homes during the COVID-19 pandemic hasn’t gone down much, even as mortgage rates continue to hover around 7%. This may be the reason newly built homes have some structural issues.

“There was a marked drop from 2019 to 2020 in terms of quality construction,” Michael Cholewa, a Portland, Oregon-based home inspector, told MarketWatch. He added that builders were “just trying to build enough housing” and they “couldn’t keep up.”

The housing demand, in general, is the main reason so many people skipped out on a home inspection, according to MarketWatch. They wanted to “sweeten their offer” by skipping the cost and the time to do one.

Read more: Car insurance rates have spiked in the US to a stunning $2,150/year — but you can be smarter than that. Here's how you can save yourself as much as $820 annually in minutes (it's 100% free)

‘You’re always going to find something’

The average cost of a home inspection ranges between $300 to $500, according to the U.S. Department of Housing and Urban Development website.

While that adds another pesky cost to the already expensive home buying process, it’s definitely worth the time and money, says Joe Hunt, a Phoenix-based market manager for Redfin.

“You’re always going to find something, whether it’s brand new or whether it’s 100 years old,” Hunt told MarketWatch.

There are certain things that come up in a home inspection that can be fixed easily and at a relatively low cost. But there are others that aren’t worth the sales tag.

Manny Angelo Varas, the CEO of a Miami homebuilding firm, told CNBC that a leaky roof or a dilapidated foundation can put you in the $15,000 to $25,000 ballpark range.

Dishonest inspectors

Even if you get a home inspection, you never know if you’re going to get an honest practitioner.

For instance, Samantha Barker bought a 1940s-era ranch style house in North Carolina in 2023, after a home inspector told her everything was fine. But according to her since-deleted viral video (which has also been reported on by other news outlets), the inspector lied and she ended up shelling out $65,000 to fix up the home’s electrical system and foundation, amongst other things.

“Buying a house has ruined me financially,” Barker said in her video.

Although there are many honest home inspectors out there, it’s still nerve-racking to trust a stranger with the assessment of a huge financial purchase.

If you’re still a little nervous, there are other ways you can still invest in the real estate market without buying a home.

You can purchase real estate investment trusts (REITs), which are essentially a pool of real estate assets that are traded freely on the stock market exchange. It’s possible to invest in REITs with small amounts of money, making it highly beginner-friendly.

Sure, there won’t be a roof over your head, but it also means you won’t have to worry about a faulty home inspection or paying for major repairs.

What to read next

Car insurance premiums in America are through the roof — and only getting worse. But 5 minutes could have you paying as little as $29/month

Jeff Bezos and Oprah Winfrey invest in this asset to keep their wealth safe — you may want to do the same in 2024

Stop crushing your retirement dreams with wealth-killing costs and headaches — here are 10 'must-haves' when choosing a trading platform (and 1 option that has them all)

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Yahoo Finance

Yahoo Finance