Carlyle Group co-CEO: 'It's still hip to be private'

Being a public company is never easy. Citing pressure from Wall Street and short sellers, Tesla CEO Elon Musk recently tweeted about wanting to take the electric car company private. At Yahoo Finance All Markets Summit on Thursday, Kewsong Lee, co-CEO of The Carlyle Group (CG), explained why companies prefer to be private.

“There’s a lot of regulatory scrutinies. There is a certain cost to being public. It also potentially forces you to be more short-term oriented whereas we like to be in a very long-term oriented in terms of how to help partner with these companies to enable them to grow,” said Lee, who runs one of the world’s largest private equity firms. “I do think there are soft and some hard costs involved with being public.”

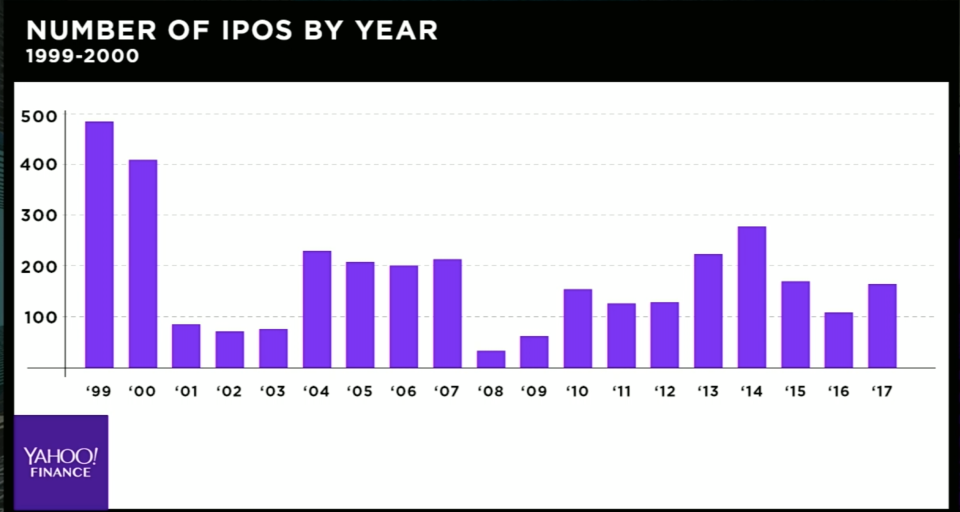

With an influx of capital, companies tend to stay private longer. The number of public companies that exist today is about half of what existed 20 years ago. This year, there are about 120 IPOs so far, while that number peaked at 486 in 1999 during the dot-com bubble.

Even when companies go public, they tend to wait longer. The average age of a private company going public is about 11 years now, which used to be eight years.

“I think entrepreneurs and private and management teams are understanding they can actually grow and build their company for a lot longer with private capitalist partners than they could if they were public,” said Lee. Washington DC-based Carlyle Group owns over 200 portfolio companies across the world.

The private market allows investors to invest and trade company shares before they go public, but it’s only available to institutional investors and accredited investors. Even with limited access, private markets have become a crowded place for investors to park their cash, according to Lee, who thinks the capital that flows into private companies has pushed valuations ‘“exceptionally high”.

“There’s probably a trillion dollars of available capacity to invest in our industry,” Lee said. “It’s a combination of that, versus the fact that our returns in the industry have been so successful over the past three to five years. Currently, on average, for every dollar of capital that we call from our limited partners to invest in new deals. we’re already returning $1.03 of profit.”

The high valuation in the private market also tends to push a company’s valuation higher after an IPO. Spotify’s shares (SPOT), for example, were red-hot in the private market. Its market value soared to $26.5 billion after its debut on the New York Stock Exchange.

Lee said the private markets have been outperforming the stock market by 500 basis points to 1000 basis points. “Our investors are flush with cash, our returns have been great and they’re looking to continue deploying our asset class,” he said.

Krystal Hu covers technology and economy for Yahoo Finance. Follow her on Twitter.

Read more:

China is pretending like the trade war isn’t happening

Why the $375 billion US-China trade deficit can be totally misleading

Yahoo Finance

Yahoo Finance