Carlyle Aviation Tests Rekindled Aircraft ABS Market After Two-Year Pause

(Bloomberg) -- After a two-year absence from the asset-backed securities market, Carlyle Aviation Partners is returning with a bond sale backed by commercial aircraft, a market where issuance could keep climbing as new plane sales come under pressure.

Most Read from Bloomberg

What to Know About the Deadly Flesh-Eating Bacteria Spreading in Japan

Stocks Rise as Bullish Nvidia Call Boosts AI Trade: Markets Wrap

‘I Live in Hell’: Anti-Growth Fervor Grips US South After Pandemic Boom

Citi Pitches Money-Moving ‘Crown Jewel’ as Central to Revamp

Flesh-Eating Bacteria That Can Kill in Two Days Spreads in Japan

In early June, Carlyle priced a more than $400 million deal — the investment firm’s first debt sale from its historically active aviation platform since June 2022. Carlyle’s return bodes well for aviation companies as they look to raise funds backed by aircraft leases.

A post-Covid travel boom helped airlines return to profitability last year and the companies are set to make historically high revenues in 2024, according to the International Air Transport Association. At the same time, Boeing Co. is seeing plane deliveries come under pressure as it tries to overcome a safety crisis engulfing its most popular aircraft, the 737.

Fewer new planes makes existing aircraft more valuable, a boon for debt backed by the leases in general. PK AirFinance is premarketing its own $622 million aviation loan offering.

“We’ve heard that there’s a number of lessors that have portfolios ready that they will be bringing to market,” said Javier Meireles, chief financial and operating officer of Carlyle Aviation. “I expect that there will be more issuance later this year.”

Carlyle’s aircraft-backed deal joins a spate of transactions bundling all manner of exotic collateral and sold in the ABS market this year, including art, music royalties and commodity trade receivables, marking a major rebound from the quiet of recent years.

Proceeds from the Carlyle transaction will be used to purchase 12 planes, according to documents seen by Bloomberg News. The deal would be Carlyle Aviation Partners’ fifteenth aircraft portfolio transaction, the documents showed.

Of the fourteen prior deals, three of the bonds issued between 2014 and 2016 and were paid off with no downgrades, according to Kroll Bond Rating Agency data. Nine of the remaining 11 deals were affected by downgrades. Disruptions from Covid-19 and the Russia-Ukraine conflict hurt the entire industry, the credit grader said.

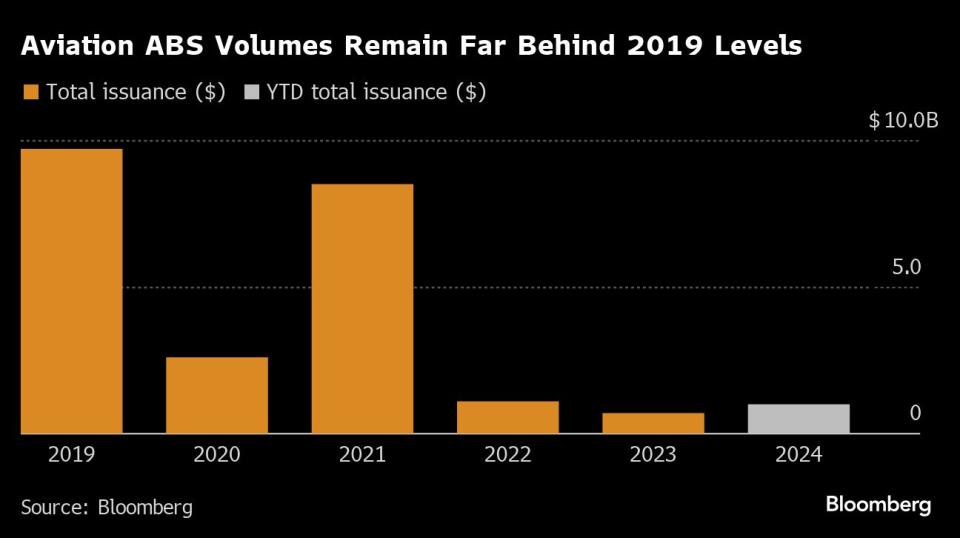

An imbalance between supply and demand has led to aircraft values and lease rates increasing, helping to spark the reopening of the aircraft ABS market, Meireles said. Aviation loan and lease annual deal volumes averaged more than $7 billion between 2018 and 2021, but the Federal Reserve’s interest rate hiking regime helped drive that total to less than $1 billion in 2023, according to Kroll.

“We’re operating in an environment where you have a supply and demand imbalance,” Carlyle Aviation’s Meireles said. “You have passengers wanting to fly, airlines need aircraft, but there’s not enough capacity in our ecosystem to satisfy that demand.”

--With assistance from Charles Williams.

Most Read from Bloomberg Businessweek

Google DeepMind Shifts From Research Lab to AI Product Factory

Coke—and Dozens of Others—Pledged to Quit Russia. They’re Still There

Trump’s Planned Tariffs Would Tax US Households, Economists Warn

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance