Carl Icahn's Strategic Moves in Q1 2024: Spotlight on CVR Partners LP

Insight into Icahn's Latest 13F Filings and Investment Adjustments

Carl Icahn (Trades, Portfolio), known for his assertive investment style, recently disclosed his first quarter 2024 portfolio via a 13F filing. As an activist investor, Icahn is renowned for acquiring substantial stakes in undervalued companies, aiming to enhance their value through active involvement in their management and strategic decisions. His investment vehicles include Icahn Partners, American Real Estate Partners, and Icahn Management LP, with GuruFocus tracking the latter. Icahn's approach often involves purchasing assets at a low, improving them, and selling at a peak, typically focusing on sectors that are out of favor.

Summary of New Buys

During the first quarter of 2024, Carl Icahn (Trades, Portfolio) expanded his portfolio with new stocks, notably:

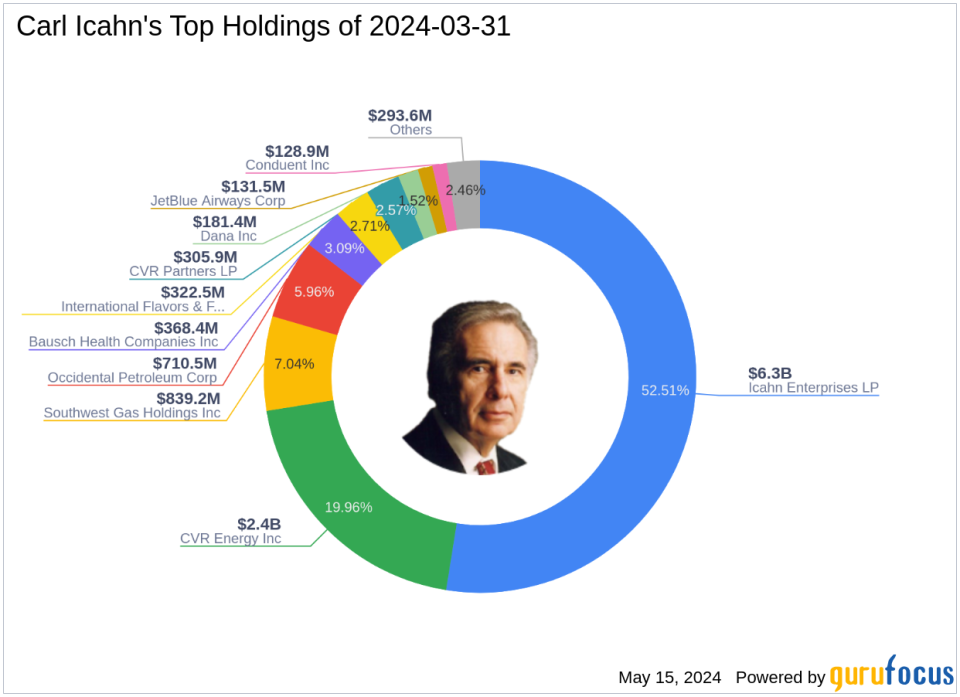

CVR Partners LP (NYSE:UAN), acquiring 3,892,000 shares, which now represent 2.57% of his portfolio, amounting to approximately $305.87 million.

JetBlue Airways Corp (NASDAQ:JBLU), with 17,727,029 shares, making up about 1.1% of the portfolio, valued at around $131.53 million.

Key Position Increases

Icahn also strategically increased his holdings in:

International Flavors & Fragrances Inc (NYSE:IFF), where he added 3,105,490 shares, bringing his total to 3,750,000 shares. This adjustment marks a significant 481.84% increase in share count and impacts 2.24% of his current portfolio, with a total value of $322.46 million.

Summary of Sold Out Positions

In the same quarter, Icahn liquidated his positions in:

FirstEnergy Corp (NYSE:FE), selling all 5,887,171 shares, which had a -1.98% impact on his portfolio.

Newell Brands Inc (NASDAQ:NWL), disposing of all 5,940,744 shares, affecting the portfolio by -0.47%.

Portfolio Overview

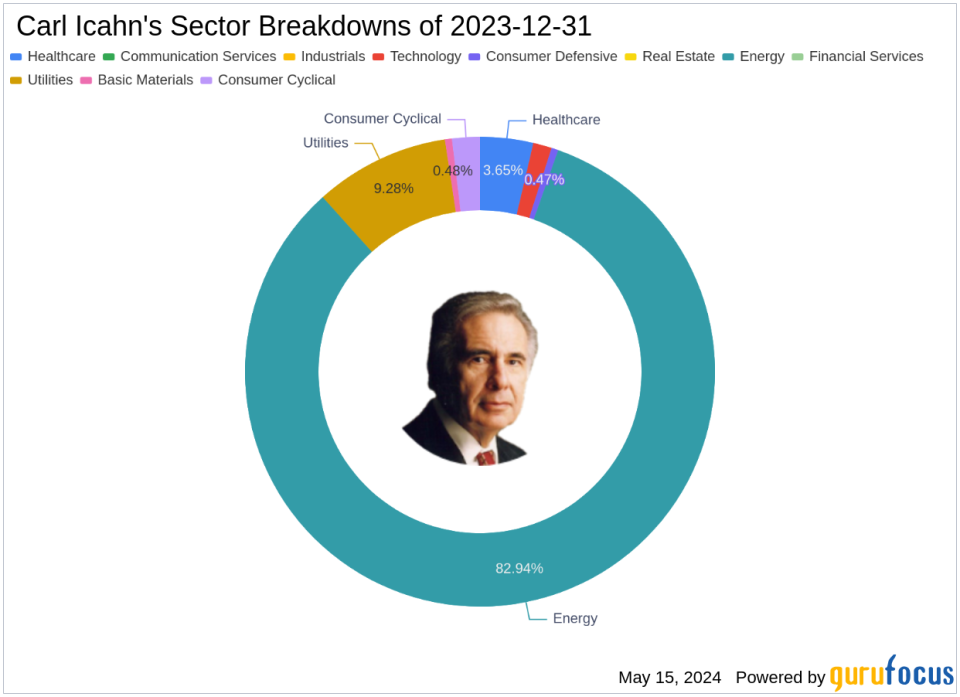

As of the first quarter of 2024, Carl Icahn (Trades, Portfolio)'s investment portfolio comprised 14 stocks. His top holdings included 52.51% in Icahn Enterprises LP (NASDAQ:IEP), 19.96% in CVR Energy Inc (NYSE:CVI), and smaller percentages in other significant companies across various industries. The portfolio shows a heavy concentration in sectors such as Energy, Utilities, Basic Materials, Healthcare, Consumer Cyclical, Industrials, and Technology.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance