Cardinal Health (CAH) to Post Q2 Earnings: What's in Store?

Cardinal Health, Inc. CAH is scheduled to report second-quarter fiscal 2023 results on Feb 2, before the opening bell.

In the last reported quarter, the company delivered a negative earnings surprise of 25.00%. Its earnings beat the Zacks Consensus Estimate in two of the trailing four quarters and missed twice, the average earnings surprise being 3.04%.

Q2 Estimates

For the fiscal second quarter, the Zacks Consensus Estimate for earnings is pegged at $1.13 per share, indicating a decline of 11% from the prior-year quarter. The same for revenues stands at $49.88 billion, suggesting growth of 9.7% from the year-ago reported figure.

Factors to Note

Cardinal Health's Pharmaceutical segment is the second-largest pharmaceutical distributor in the United States. In the first quarter of fiscal 2023, pharmaceutical revenues amounted to approximately $45.8 billion, up 15% on a year-over-year basis. The performance reflects branded pharmaceutical sales growth from Pharmaceutical Distribution and Specialty Solutions customers. This momentum is likely to have continued in the fiscal second quarter.

The company’s generics program sales were strong during the last reported quarter. The company's to-be-reported quarter results are likely to gain from this trend.

Last year, the company announced the addition of a new distribution center in the Columbus, OH area, lending support to Cardinal Health’s at-Home Solutions business.

These developments are likely to have favored the company's fiscal second-quarter performance.

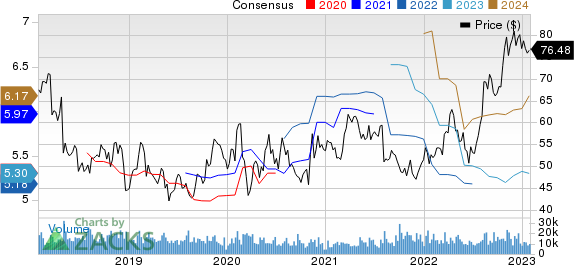

Cardinal Health, Inc. Price and Consensus

Cardinal Health, Inc. price-consensus-chart | Cardinal Health, Inc. Quote

It is worth mentioning here that in the fiscal first quarter, Cardinal Health's Medical segment displayed considerable weakness due to the divestiture of the Cordis business as well as a decrease in products and distribution volumes. The trend is expected to have continued in the soon-to-be-reported quarter.

Cardinal Health’s Medical segment has been facing declining sales, following the divestiture of the Cordis business in 2021. Moreover, a decrease in products and distribution volumes hurt the segment’s top line during first-quarter fiscal 2023.

During the same quarter, the segment’s bottom line was hurt primarily due to net inflationary impacts and global supply chain restrictions in products and distribution. The company’s segment is expected to record a loss in second-quarter fiscal 2023.

Earnings Beat Likely

Our proven model predicts an earnings beat for Cardinal Health this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate ($1.20 per share) and the Zacks Consensus Estimate ($1.13 per share), is +5.75% for Cardinal Health.

Zacks Rank: Cardinal Health currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Other Stocks Worth a Look

Here are a few other medical stocks worth considering, as these also have the right combination of elements to beat on earnings this reporting cycle:

McKesson MCK has an Earnings ESP of +0.21% and a Zacks Rank of 2. MCK has an estimated long-term growth rate of 10.1%.

McKesson’s earnings surpassed estimates in two of the trailing four quarters and missed twice, with the average surprise being 4.79%.

Laboratory Corp. of America LH has an Earnings ESP of +2.67% and a Zacks Rank #2 at present. LH has an earnings yield of 7%, which compares favorably with the industry’s yield of 4.5%.

Laboratory Corp. of America ‘s earnings surpassed estimates in three of the trailing four quarters and missed once, with the average surprise being 6.06%.

Becton, Dickinson and Company BDX has an Earnings ESP of +0.26% and a Zacks Rank of 3 at present. BDX has an estimated long-term growth rate of 9.5%.

Becton, Dickinson and Company’s earnings surpassed estimates in all the trailing four quarters, with the average surprise being 10.39%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Laboratory Corporation of America Holdings (LH) : Free Stock Analysis Report

Becton, Dickinson and Company (BDX) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance