Canopy Rivers' (TSE:RIV) Stock Price Has Reduced 61% In The Past Year

Taking the occasional loss comes part and parcel with investing on the stock market. Anyone who held Canopy Rivers Inc. (TSE:RIV) over the last year knows what a loser feels like. The share price has slid 61% in that time. Because Canopy Rivers hasn't been listed for many years, the market is still learning about how the business performs. Shareholders have had an even rougher run lately, with the share price down 28% in the last 90 days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

View our latest analysis for Canopy Rivers

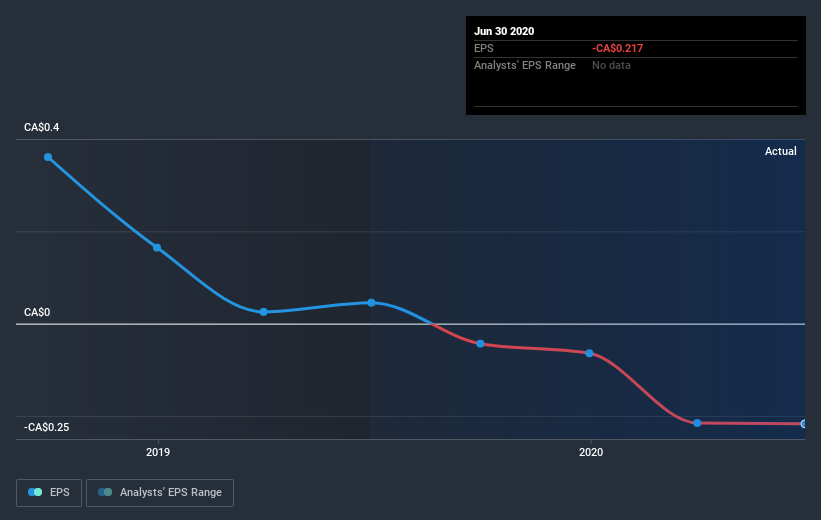

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Canopy Rivers fell to a loss making position during the year. Some investors no doubt dumped the stock as a result. However, there may be an opportunity for investors if the company can recover.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

We doubt Canopy Rivers shareholders are happy with the loss of 61% over twelve months. That falls short of the market, which lost 0.5%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock down 28% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 1 warning sign we've spotted with Canopy Rivers .

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance