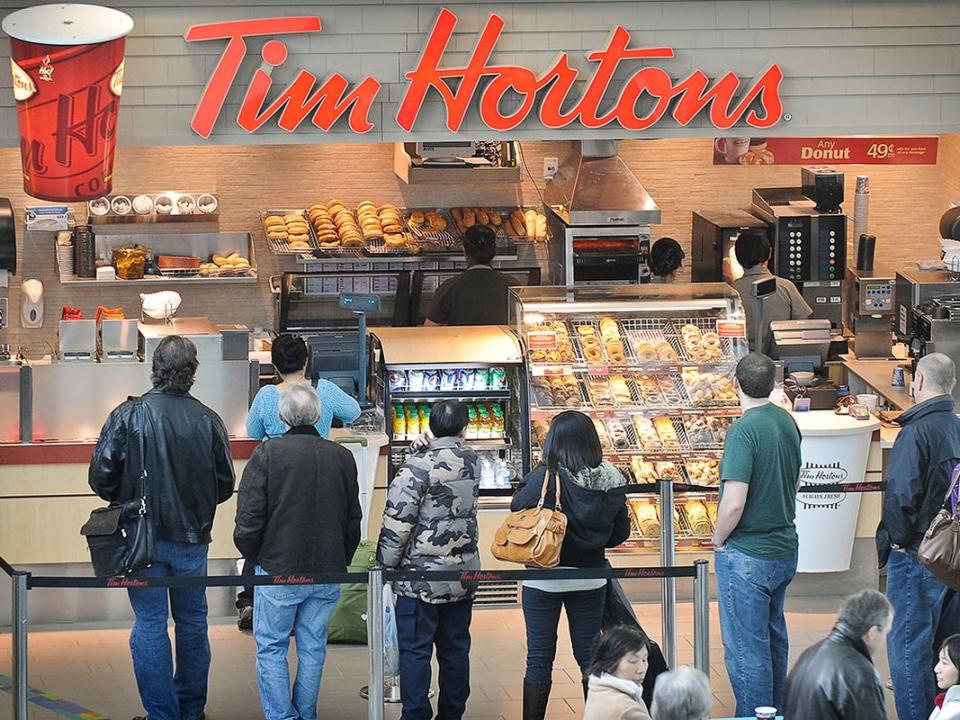

'Canadians are coming back more and more to Tim Hortons': executives upbeat despite revenue miss

Executives at Tim Hortons’ parent company Restaurant Brands International Inc. said investors should know it has upward growth momentum despite industry and macroeconomic volatility, and what’s more, consumers are still buying and eating.

Yet the company missed analyst estimates for quarterly sales. Analysts had expected US$1.87 billion in total revenue for the quarter ended Sept. 30, but Toronto-based RBI came in at US$1.84 billion, according to its results released on Nov. 3. The company posted a US$364-million profit, down from US$530 million in the same quarter last year.

Per diluted share, profits dropped to US$0.79 from US$1.17 in the same period a year ago due to increases in commodity, labour and energy expenses for the owner of Tim Hortons, Burger King, Popeyes Louisiana Kitchen and Firehouse Subs.

But unlike its competitors, who fear the impact on sales from the much-touted weight-loss drug Ozempic and similar drugs, Tim Hortons president Axel Schwan and chief corporate officer Duncan Fulton remain positive.

“We don’t see any impact on our business,” Schwan said on a video call with Fulton. “For 60 years, there’s been a lot of trends that come and go … different weight-loss efforts, and over time we’ve always just been here to give people great food, great products.”

Nor are the executives worried about high interest rates, stubborn inflation, uncertain labour markets and consumers’ dwindling spending appetite.

Schwan said there’s been a strong post-pandemic recovery in Canada, with consumers enticed back by novel afternoon treats such as Dream Cookies and espresso beverages, as well as faster drive-thru times.

“We have now 10 quarters of system-wide sales growth here in Canada, we have significant traffic growth,” he said. “So, Canadians are coming back more and more to Tim Hortons after the pandemic.”

Analysts on an earnings call pressed RBI chief executive Joshua Kobza, chief financial officer Matthew Dunnigan and executive chair Patrick Doyle about the myriad threats facing the company.

Those include higher-for-longer interest rates, which would make the company’s planned digital and operational transformations more costly, as well as the effect of growing geopolitical disturbances, inflation, franchisee woes and waning consumer demand, but senior management seemed undeterred.

“This time last year, I was finalizing my own investment thesis and making my equity purchase in RBI. I was clearly excited about the opportunity last November and looking back now I can say I am far more bullish today than I was a year ago,” said Doyle, who joined the company last year after formerly being chief executive at Domino’s Pizza Inc.

“We haven’t gotten everything right this year. And, frankly, we won’t always get everything right. We’ve made a ton of progress moving each of our businesses in the right direction.”

Investors are also worried about a pot of US$150 million left over that RBI has to spend on reviving Burger King with consumers, particularly in the United States where traffic metrics fell flat this quarter. RBI spent US$33 million on advertising on its “Reclaim the Flame” campaign during the quarter in the U.S., where many franchise owners operate restaurants without the latest upgrades and technology, such as self-checkout.

But the French seem to love Burger King’s new, kiosk-only locations, and internationally, the brand is steadily growing in markets like China, Kobza said on the call.

“Q2 was really incredible,” he said, speaking of RBI’s performance in France particularly. “We were doing double-digit same-store sales, and that slowed down a little bit into Q3. But we’re still in the high single digits.”

• Email: bbharti@postmedia.com

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Yahoo Finance

Yahoo Finance