Canadian Tory Leader Widens Gap Over Trudeau on Economy in Poll

(Bloomberg) -- The leader of Canada’s Conservative Party has opened up a bigger lead among voters on the question of who would be the best economic manager, underscoring the political challenges faced by Prime Minister Justin Trudeau.

Most Read from Bloomberg

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

Microsoft Orders China Staff to Use iPhones for Work and Drop Android

S&P 500 Holds Gains as Fed Bets Steady on Powell: Markets Wrap

The End of the Cheap Money Era Catches Up to Chelsea FC’s Owner

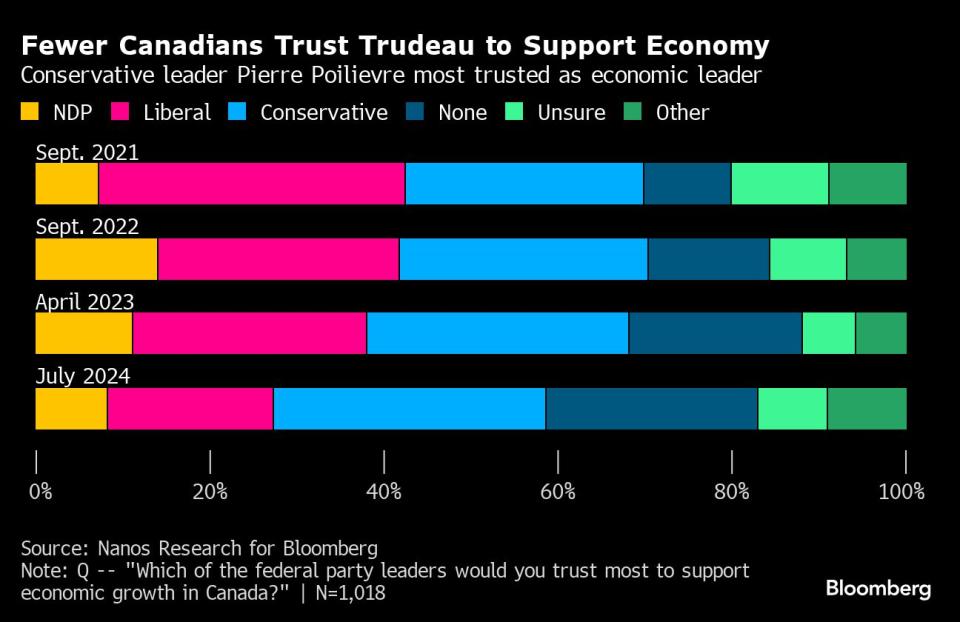

About 30% of respondents in a recent Nanos Research Group survey for Bloomberg say they trust Pierre Poilievre the most among national party leaders to support economic growth. That’s a gap of more than 10 points over Trudeau, who’s the first choice of just 19%.

It’s the widest lead yet for Poilievre on that question. In April 2023, he led Trudeau by just three points.

But nearly a quarter of Canadians say they don’t trust any of the country’s main political leaders to support the economy.

The Nanos poll also shows restrictive interest rates are still weighing on Canadian consumers, even after the Bank of Canada cut its policy rate last month: 63% say higher borrowing costs are having a negative impact on their personal spending, about the same as a year ago. The financial strain is greatest among Canadians under 55 years of age.

That spells trouble for Trudeau’s incumbent Liberal government. Economists surveyed by Bloomberg expect the central bank to lower its policy interest rate to 3.25% by September 2025 — just before an expected election — suggesting that the pressure on Canadians’ wallets is likely to ease only gradually.

Affordability is a top concern for Canadians, and while the pace of yearly inflation has decelerated to below 3% in recent months, price increases since the pandemic have substantially reduced purchasing power and higher borrowing costs have boosted debt and interest payments.

According to a Bank of Canada report earlier this year, about half of mortgages are held by borrowers who haven’t yet faced higher rates because their payments were fixed for five years. When they renew those mortgages, many will be dealing with significantly higher payments — adding to the number of Canadians impacted by the run-up in borrowing costs.

Poilievre says he’ll shrink the size of the government, cut taxes for working-class and middle-class households, and create incentives that ensure more homes are built. He has also blamed the budget deficit for making inflation worse, and promised to find savings.

Still, the Tories have yet to fully outline the specifics of their economic plan, and their pledges include many generic statements like “cutting red tape”.

The telephone and online poll of 1,018 Canadians was conducted between June 28 and July 3. The poll has a margin of error of about 3 percentage points, 19 times out of 20.

Most Read from Bloomberg Businessweek

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

Family Offices of the Ultra-Rich Shed Privacy With Activist Bets

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance