Canadian Solar (CSIQ) Q2 Earnings Beat, Revenues Rise Y/Y

Canadian Solar Inc. CSIQ reported second-quarter earnings of 18 cents per share. The Zacks Consensus Estimate was of a loss per share of 31 cents. The bottom line, however, declined from the prior-year quarter’s figure.

Total Revenues

This solar cell manufacturer’s total revenues of $1,429.7 million beat the Zacks Consensus Estimate of $1,426 million by 0.3%. The top line also improved a solid 105% from $1,089.3 million reported in second-quarter 2020.

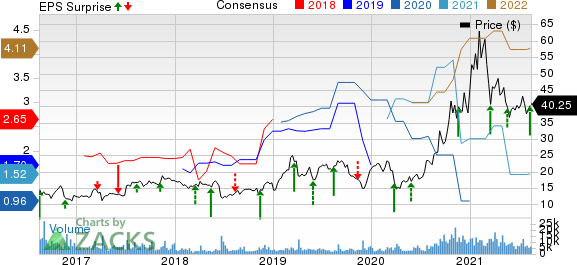

Canadian Solar Inc. Price, Consensus and EPS Surprise

Canadian Solar Inc. price-consensus-eps-surprise-chart | Canadian Solar Inc. Quote

Operational Update

Solar module shipments in the quarter totaled 3.7 gigawatts (GW), matching the higher end of the guided range of 3.5-3.7 GW. This includes 167 megawatt (MW) for the company's utility-scale solar power projects. Total module shipments increased 26% on a year-over-year basis.

Gross margin was 12.9% in the quarter, above the guided range of 9.5-10.5%.

Total operating expenses were $158.4 million, up 55.7% year over year. The increase was due to higher research and development expenses, general and administrative expenses, and selling and distribution expenses.

Interest expenses were $14.8 million, down from $17 million recorded in the year-ago period.

Financial Update

As of Jun 30, 2021, cash and cash equivalents totaled $814.2 million, down from $1,178.8 million on Dec 31, 2020.

Long-term borrowings as of Jun 30, 2021 were $530.8 million, up from $446.1 million on Dec 31, 2020.

Guidance

For the third quarter of 2021, the company expects total module shipments of 3.8-4 GW including approximately 275 MW of module shipments to its own projects. Total revenues are expected in the range of $1.2-$1.4 billion. Gross margin is expected between 14% and 16%.

For 2021, Canadian Solar reduced its total module shipments to 16-17 GW from 18-20 GW while revenues are reaffirmed in the band of $5.6-$6.0 billion. The Zacks Consensus Estimate for the same is pegged at $5.81 billion, higher than $5.8 billion, the midpoint of the guided range.

Zacks Rank

Canadian Solar currently carries a Zacks Rank #3 (Hold). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Recent Solar Releases

Enphase Energy ENPH reported second-quarter 2021 adjusted earnings of 53 cents per share, which surpassed the Zacks Consensus Estimate of 42 cents by 26.2%.

SunPower Corp. SPWR reported second-quarter 2021 adjusted earnings of 6 cents per share, which surpassed the Zacks Consensus Estimate of 3 cents by 100%.

First Solar Inc. FSLR reported adjusted earnings of 77 cents per share, which outpaced the Zacks Consensus Estimate of 60 cents for the June quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

First Solar, Inc. (FSLR) : Free Stock Analysis Report

Canadian Solar Inc. (CSIQ) : Free Stock Analysis Report

SunPower Corporation (SPWR) : Free Stock Analysis Report

Enphase Energy, Inc. (ENPH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance