Canadian Pacific's (CP) Q4 Earnings Miss, Revenues Beat

Canadian Pacific Railway Limited’s CP fourth-quarter 2021 earnings (excluding 16 cents from non-recurring items) of 75 cents (C$0.95) per share missed the Zacks Consensus Estimate by a penny. The bottom line dipped year over year. All per share amounts have been retrospectively adjusted to reflect the share split (five-for-one).

However, quarterly revenues of $1,618.4 million (C$2,040 million) outperformed the Zacks Consensus Estimate of $1,581.3 million. The top line increased year over year due to a rise in freight revenues.

Freight revenues, contributing 97.7% to the top line, rose 1.3% on a year-over-year basis. CP’s freight segment consists of Grain (down 13%), Coal (down14%), Potash (up 12%), Forest products (up 6%), Energy, chemicals and plastics (up 15%), Metals, minerals and consumer products (up 25%), Automotive (down 20%), as well as Intermodal (up 8%). Revenues at the Fertilizers and sulphur sub-segment were flat year over year. In the reported quarter, total freight revenues per revenue ton-miles (RTMs) rose 13% year over year. Total freight revenues per carload increased 12% from the year-ago quarter’s reported figure.

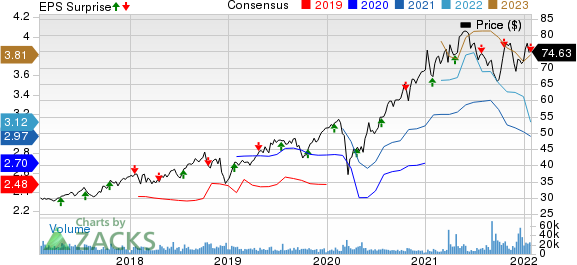

Canadian Pacific Railway Limited Price, Consensus and EPS Surprise

Canadian Pacific Railway Limited price-consensus-eps-surprise-chart | Canadian Pacific Railway Limited Quote

On a reported basis, operating income dropped 10% while total operating expenses increased 11%, year over year in the quarter under review. Adjusted operating income decreased by 6.5%. Operating ratio (operating expenses, as a percentage of revenues, on an adjusted basis) deteriorated to 57.5% in the fourth quarter from 53.9% in the year-ago quarter. Lower the value of the metric, the better.

Liquidity

Canadian Pacific, carrying a Zacks Rank #4 (Sell), exited the fourth quarter with cash and cash equivalents of C$69 million compared with C$147 million at the end of fourth-quarter 2020. Long-term debt amounted to C$18,577 million compared with C$8,585 million at the end of December 2020.

Dividend Update

Canadian Pacific’s board approved a quarterly dividend of C$0.19 per share, payable to shareholders on Apr 25, of record as of Mar 25.

Sectorial Snapshots

Within the broader Transportation sector, CSX Corporation CSX, Canadian National Railway CNI and GATX Corporation GATX recently reported fourth-quarter 2021 results.

CSX, carrying a Zacks Rank #3 (Hold), reported fourth-quarter 2021 earnings of 42 cents per share, which surpassed the Zacks Consensus Estimate by a penny. The bottom line improved in double digits year over year owing to higher revenues.

CSX’s total revenues of $3,427 million outperformed the Zacks Consensus Estimate of $3296 million. The top line augmented 21.3% year over year owing to growth across all its businesses, as well as revenues from Quality Carriers, which the company acquired in July 2021.

Canadian National, carrying a Zacks Rank #3, reported fourth-quarter 2021 earnings (excluding 2 cents from non-recurring items) of $1.36 per share (C$1.71), which surpassed the Zacks Consensus Estimate of $1.21. The bottom line increased in double digits year over year due to lower costs.

Canadian National’s quarterly revenues of $2,977.4 million (C$3,753 million) topped the Zacks Consensus Estimate of $2,917.4 million. The top line improved year over year, driven by higher freight rates and fuel surcharges.

GATX, carrying a Zacks Rank #2 (Buy), reported fourth-quarter 2021 earnings (excluding 11 cents from non-recurring items) of $1.58 per share, which surpassed the Zacks Consensus Estimate of $1.07. The bottom line surged more than 200% year over year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

GATX’s total revenues of $321 million increased 5.3% year over year, mainly due to a 5.2% rise in lease revenues, which came in at $288.4 million. Lease revenues contributed 89.8% to the top line.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CSX Corporation (CSX) : Free Stock Analysis Report

Canadian National Railway Company (CNI) : Free Stock Analysis Report

Canadian Pacific Railway Limited (CP) : Free Stock Analysis Report

GATX Corporation (GATX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance