Canadian Natural Resources Ltd's Dividend Analysis

Insights into Upcoming Dividends and Financial Health

Canadian Natural Resources Ltd (NYSE:CNQ) has recently declared a dividend of $1.05 per share, set to be paid on July 5, 2024, with the ex-dividend date on June 17, 2024. This announcement has drawn attention not only to the upcoming payment but also to the company's consistent dividend history, its yield, and growth rates. By examining data from GuruFocus, we can delve into the dividend performance of Canadian Natural Resources Ltd and evaluate its sustainability.

Overview of Canadian Natural Resources Ltd

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

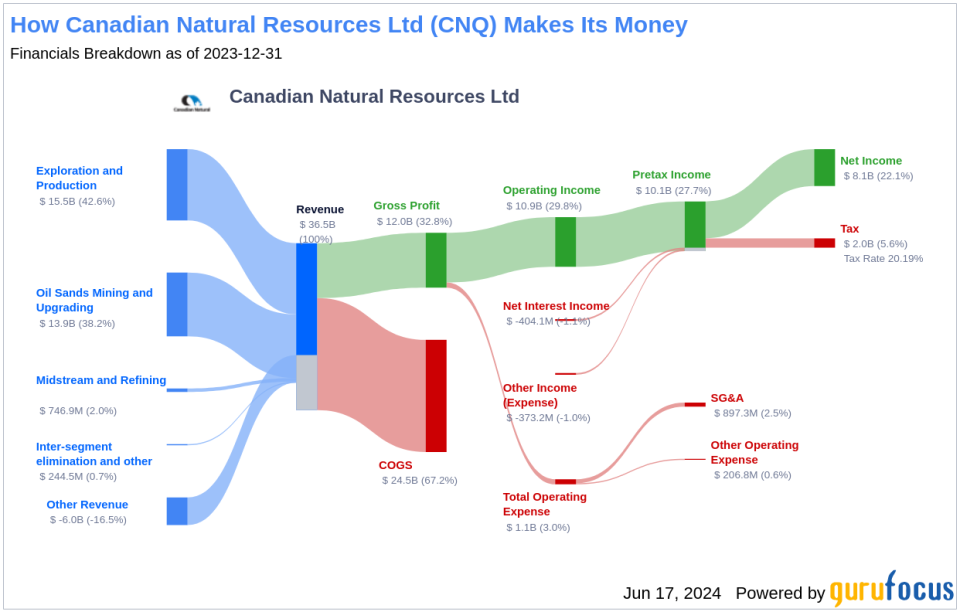

As an independent entity in the oil and gas sector, Canadian Natural Resources Ltd focuses on the exploration, development, and production of crude oil and natural gas. The company operates primarily in North America, with significant activities in Western Canada, the UK sector of the North Sea, and offshore regions in Cote d'Ivoire and South Africa. Its operations are segmented into three main areas: North America, the North Sea, and Offshore Africa, with a substantial portion of its revenue generated from North America. The company's divisions include Oil Sands Mining and Upgrading, Midstream, and Refining.

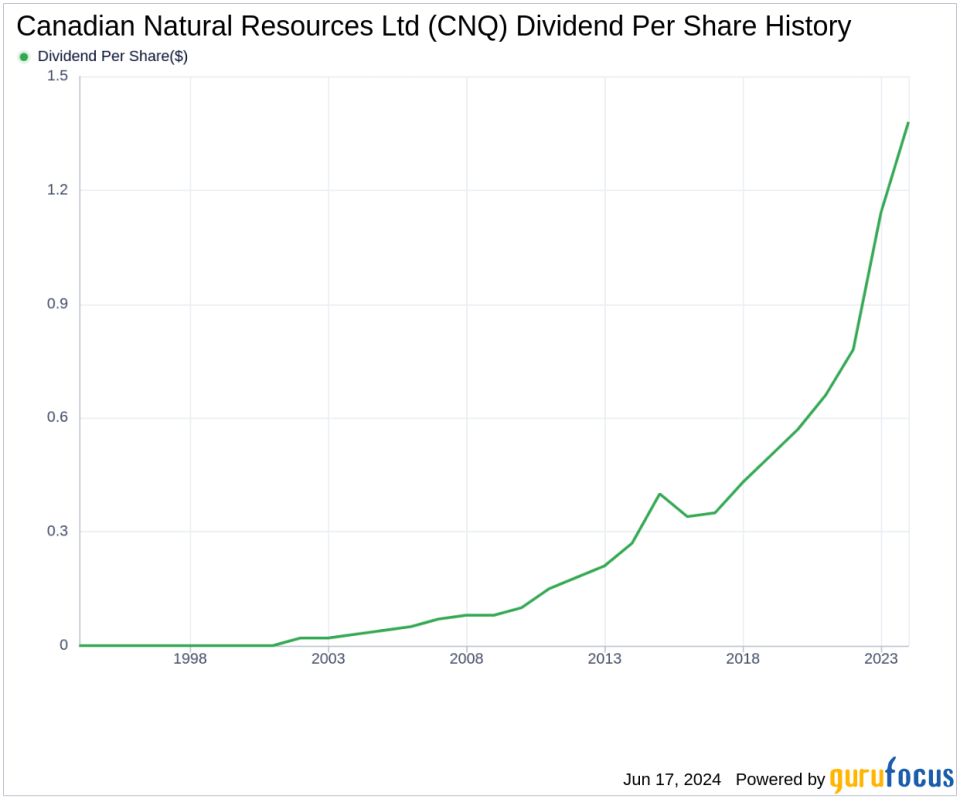

Canadian Natural Resources Ltd's Dividend Track Record

Since 2001, Canadian Natural Resources Ltd has maintained a reliable record of dividend payments, distributed quarterly. This consistent approach highlights the company's stable financial management and commitment to returning value to shareholders.

Analysis of Dividend Yield and Growth

Currently, Canadian Natural Resources Ltd boasts a trailing dividend yield of 4.21% and a forward dividend yield of 5.46%, indicating an expected increase in dividend payments over the next year. Over the past three years, the annual dividend growth rate was 29.60%, which slightly decreased to 23.60% over five years. However, looking at the past decade, the growth rate stands at an impressive 17.90% annually. As of today, the 5-year yield on cost for Canadian Natural Resources Ltd stock is approximately 12.14%.

Evaluating Dividend Sustainability

The sustainability of dividends is often gauged by the dividend payout ratio, which for Canadian Natural Resources Ltd stands at 0.52 as of March 31, 2024. This ratio suggests that the company retains a significant portion of its earnings, which supports both sustained dividend payments and potential growth. The company's profitability rank is 7 out of 10, reflecting robust earnings capacity relative to its peers, with net profit reported in 7 out of the past 10 years.

Future Growth Prospects

Canadian Natural Resources Ltd's growth rank is also favorable at 7 out of 10, indicating a promising growth trajectory when compared to its competitors. The company's revenue per share and a 3-year revenue growth rate of 35.80% annually surpass 81.35% of global competitors, underscoring a strong and improving revenue model.

Concluding Thoughts on Canadian Natural Resources Ltd's Dividends

Considering Canadian Natural Resources Ltd's consistent dividend payments, robust dividend growth rate, reasonable payout ratio, solid profitability, and strong growth metrics, the company stands out as a compelling choice for investors seeking reliable dividend stocks. For those looking to explore further, GuruFocus Premium offers tools like the High Dividend Yield Screener to discover high-yield investment opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance