Canadian Natural (CNQ) Stock Up 25.1% Since Q3 Earnings Beat

Shares of Canadian Natural Resources Limited CNQ have rallied 25.1% since third-quarter 2020 earnings release on Nov 5. Apart from Impressive results, investors are upbeat about the company’s full-year cost-management efforts. The stock appreciation is also attributable to the rising oil prices, which have risen of late following successful data from two COVID-19 vaccine studies.

Canadian Natural reported third-quarter 2020 adjusted earnings per share of 8 cents, beating the Zacks Consensus Estimate of 2 cents, attributable to increased production from North America, lower costs and higher natural gas price realizations. However, the bottom line fell from the year-ago profit of 79 cents per share. The year-over-year underperformance is due to lower weak crude oil and NGLs price realizations.

Total revenues of $3.38 billion surpassed the Zacks Consensus Estimate of $3.26 billion. However, the top line declined from third-quarter 2019 revenues of $4.67 billion.

During the quarter under review, the company, which is committed to adding shareholder value, returned C$502 million via dividends.

Canadian Natural declared a quarterly dividend of 42.5 Canadian cents a share, payable Jan 5, 2021 to its shareholders of record as of Dec 9, 2020.

Production & Prices

Canadian Natural reported quarterly production of 1,111,286 barrels of oil equivalent per day (BOE/d), down 5.5% from the prior-year quarter. Oil and natural gas liquids (NGLs) output (accounting for more than 79.5% of total volumes) decreased to 884,342 barrels per day (Bbl/d) from 931,546 Bbl/d a year ago. Crude oil and NGLs production from operations in North America including synthetic crude oil production of 350,633 Bbl/d and bitumen output of 287,978 Bbl/d totaled 638,611 Bbl/d, comparing favorably with the year-ago quarter’s 638,598 Bbl/d owing to a continued focus on effective and efficient operations.

Natural gas volumes recorded a 7.3% year-over-year decline from 1,469 million cubic feet per day (MMcf/d) to 1,362 MMcf/d in the quarter under review. Production in North America summed 1,340 MMcf/d compared with 1,425 MMcf/d in the prior year.

Canadian Natural’s realized natural gas price increased 40.9% to C$2.31 per thousand cubic feet from the year-ago level of C$1.67. However, realized oil and NGLs price plummeted 27.3% to C$40.14 per barrel from C$55.19 in the third quarter of 2019.

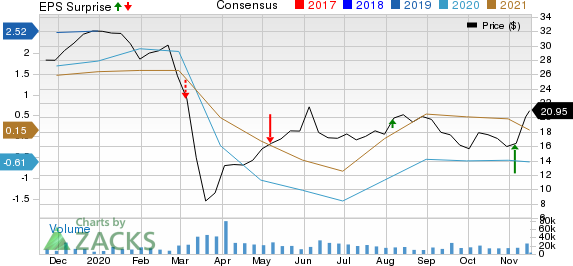

Canadian Natural Resources Limited Price, Consensus and EPS Surprise

Canadian Natural Resources Limited price-consensus-eps-surprise-chart | Canadian Natural Resources Limited Quote

Costs & Capital Expenditure

Total expenses incurred in the quarter were C$4,087 million, lower than C$4,796 million recorded a year ago. Decline in transportation costs and production expenses along with higher foreign exchange gain reduced the overall costs. Meanwhile, Canadian Natural’s Oil Sands Mining and Upgrading operating expenses increased 19% year over year to C$23.81 per barrel.

In the reported quarter, capital expenditure came in at C$771 million.

Balance Sheet

As of Sep 30, the company had C$175 million in cash and cash equivalents, and a long-term debt of C$21,048 million, representing total debt to total capital of 39.6%.

Further, the company generated free cash flow of C$467 in the third quarter.

2020 Guidance

Canadian Natural reiterates its 2020 capex at C$2.7 billion.

Zacks Rank & Key Picks

Canadian Natural has a Zacks Rank #3 (Hold), currently. Some better-ranked players in the energy space are Oasis Petroleum Inc. OASPQ, Antero Resources Corporation AR and Matador Resources Company MTDR, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Legal Marijuana: An Investor’s Dream

Imagine getting in early on a young industry primed to skyrocket from $17.7 billion in 2019 to an expected $73.6 billion by 2027.

Although marijuana stocks did better as the pandemic took hold than the market as a whole, they’ve been pushed down. This is exactly the right time to get in on selected strong companies at a fraction of their value before COVID struck. Zacks’ Special Report, Marijuana Moneymakers, reveals 10 exciting tickers for urgent consideration.

Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Canadian Natural Resources Limited (CNQ) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report

Antero Resources Corporation (AR) : Free Stock Analysis Report

Oasis Petroleum Inc. (OASPQ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance