Canadian National (CNI) Q1 Earnings Beat Estimates, Sales Lag

Canadian National Railway Company CNI reported first-quarter 2024 earnings of $1.28 per share (C$1.72), which surpassed the Zacks Consensus Estimate of $1.27. However, the bottom line declined 5.19% year over year.

Revenues for the first quarter of 2024 were $3.15 billion (C$4.25 billion), which missed the Zacks Consensus Estimate of $3.16 billion. This reflects a decrease of 1.19%. The decline was mainly due to lower Freight revenue per RTM, while volumes remained flat.

Volumes remained flat, mainly due to higher shipments of potash, refined petroleum products, frac sand, international intermodal and natural gas liquids, offset by lower shipments of coal, grain, forest products and crude oil.

Freight revenue per RTM decreased, mainly due to lower fuel surcharge revenues and an increase in the average length of haul, partly offset by freight rate increases.

Operating expenses for the first quarter of 2024 increased by 2% from the year-ago figure. The increase was mainly due to higher labor and fringe benefit expenses, driven by general wage increases and higher average headcount, partly offset by lower fuel prices.

The operating income for the first quarter of 2024 decreased by 7% when compared to the same period in 2023. The operating ratio, defined as operating expenses as a percentage of revenues, was 63.6% in the first quarter of 2024 compared to 61.5% in the first quarter of 2023.

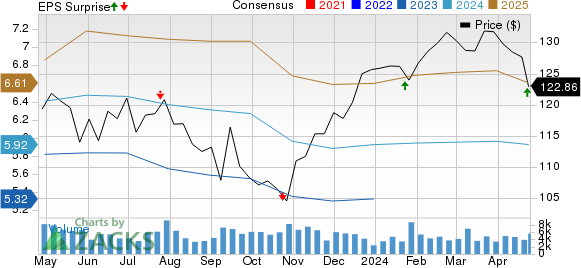

Canadian National Railway Company Price, Consensus and EPS Surprise

Canadian National Railway Company price-consensus-eps-surprise-chart | Canadian National Railway Company Quote

Segmental Highlights

Freight revenues (C$4.14 billion), which contributed 97.6% to the top line, decreased 2% year over year, wider than our anticipated fall of 1%. Freight revenues at the Petroleum and chemicals increased 4%, and Forest Products, Coal and Intermodal segments fell 3%, 16% and 5%, respectively. Revenues at the Metals and minerals, Grain and fertilizers and Automotive segments were in line with the 2023 figures.

Segment-wise, carloads in Petroleum and Chemicals, Metals and Minerals and Intermodal increased 2%, 1% and 3%, respectively. The same at Forest Products, Coal, Grain and Fertilizers and Automotive declined 4%,14%, 4% and 7%, respectively, year over year.

Liquidity

CNI exited the quarter with cash, cash equivalents and restricted cash of C$861 million and a total debt of $16.75 billion. Canadian National generated free cash flow of C$529 million during the first quarter compared with C$593 million a year ago.

2024 Outlook

CNI reaffirms its 2024 outlook and expects to deliver adjusted diluted EPS growth of approximately 10% and expects to invest approximately C$3.5 billion in its capital program, net of amounts reimbursed by customers. The company also expects the return on invested capital to be within the targeted range of 15%-17%.

CNI reiterates its longer-term financial perspective and continues to target compounded annual diluted EPS growth in the range of 10%-15% over the 2024-2026 period, driven by growing volumes more than the economy, pricing above rail inflation and incrementally improving efficiency, all of which assumes a supportive economy.

Currently, Canadian National carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Q1 Performances of Some Other Transportation Companies

Delta Air Lines’ DAL first-quarter 2024 earnings (excluding 39 cents from non-recurring items) of 45 cents per share comfortably beat the Zacks Consensus Estimate of $0.36 and improved 7.75% year over year.

Revenues of $13.75 billion surpassed the Zacks Consensus Estimate of $12.84 billion and increased 7.75% on a year-over-year basis. Adjusted operating revenues (excluding third-party refinery sales) came in at $12.6 billion, up 6% year over year.

United Airlines UAL reported a first-quarter 2024 loss (excluding 23 cents from non-recurring items) of 15 cents per share, narrower than the Zacks Consensus Estimate of 53 cents and improved 76.19% year over year.

Operating revenues of $12.54 billion beat the Zacks Consensus Estimate of $12.43 billion. The top line increased 9.71% year over year due to upbeat air travel demand. Cargo revenues fell 1.8% year over year to $391 million. Revenues from other sources jumped 10.3% year over year to $835 million.

J.B. Hunt Transport Services’ JBHT first-quarter 2024 earnings per share of $1.22 missed the Zacks Consensus Estimate of $1.53 and declined 35.45% year over year.

Total operating revenues of $2.94 billion lagged the Zacks Consensus Estimate of $3.12 billion and fell 9% year over year. Total operating revenues, excluding fuel surcharge revenues, decreased approximately 6.5% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

Canadian National Railway Company (CNI) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance