Canadian bankruptcies hit all time-low but the economy looks shaky

Far fewer Canadians filed for bankruptcy in December, according to the Office of the Superintendent of Bankruptcies.

The total number of insolvencies (bankruptcies and proposals to settle debt under conditions other than the existing terms) fell 20 per cent compared to the previous month.

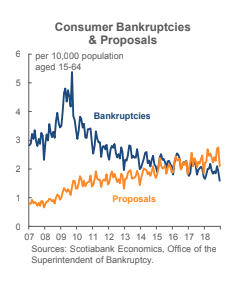

“Canadian consumer bankruptcies hit a new all-time record low as a share of the adult population,” says Derek Holt, head of capital markets economics at Scotiabank, in a research note.

“Even proposals dipped in December and while they’ve risen over time, they really haven’t budged over the past year.”

There is a fly in the ointment though. Total insolvencies in December were 3.8 per cent higher compared to the same time in 2017. There’s also a seasonal effect.

“December traditionally sees lower insolvencies as people generally wait until after the holidays to evaluate their situation. Therefore, it’s not the best month to gauge the overall picture,” Laurie Campbell, CEO at Credit Canada Debt Solutions, told Yahoo Finance Canada.

Campbell notes insolvencies have been extremely low since the financial crisis in 2009.

“However, the outlook for 2019 appears to indicate that insolvencies will rise due to a number of key factors: interest rates rising, consumer indebtedness at an all time high and the slowing of the housing market, all resulting in a shakier economy,” says Campbell.

Ontario had the most insolvencies while Nunavut had the fewest.

Business insolvencies fell 0.8 per cent compared with the 12-month period ending December 31, 2017. The biggest decreases were in manufacturing, mining, along with oil and gas extraction. The biggest increases were in construction; and real estate and rental and leasing.

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Finance

Yahoo Finance