Hot inflation sets Bank of Canada on course for another oversized rate hike

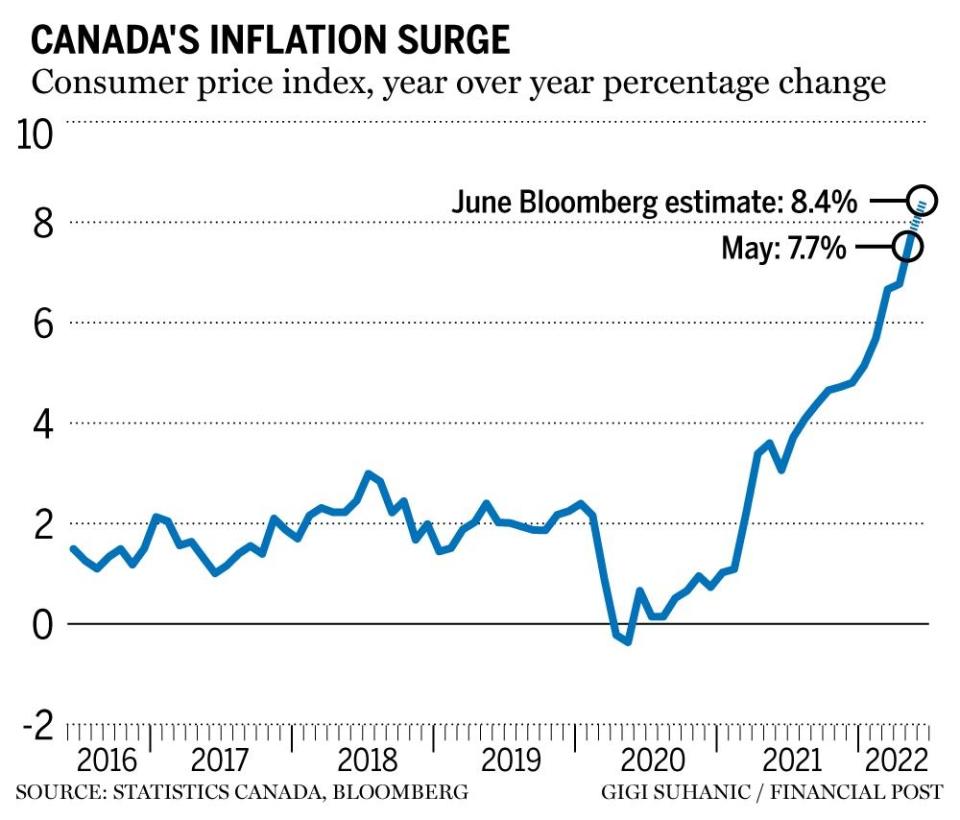

Statistics Canada’s consumer price index, the gauge the Bank of Canada uses to guide interest rates, surged to 8.1 per cent in June, the biggest year-over-year increase since January 1983. Here’s what you need to know:

Cooking with gas

The acceleration from May’s 7.7-per-cent reading was mostly the result of gasoline prices, which increased 54.6 per cent from June 2021, compared with a year-over-year gain of 48 per cent the previous month.

Oil prices peaked in early June, and have since somewhat eased, suggesting the July numbers will be less severe. However, inflation has spread well beyond gasoline stations. The consumer price index still came up with a year-over-year increase of 6.5 per cent after Statistics Canada subtracted gasoline, compared with 6.3 per cent in May.

Seven of the eight major components posted increases bigger than three per cent, which is the high end of the Bank of Canada’s comfort zone for inflation. The central bank targets two per cent.

Governor Tiff Macklem won’t be shocked by the new inflation numbers. The Bank of Canada’s latest forecast has the consumer price index averaging annual increases of eight per cent in the third quarter, and still averaging gains of about three per cent at the end of 2023. That’s way off target, which is why policymakers increased borrowing costs by a full percentage point last week.

Mild relief

Some Bay Street economists were predicting even faster inflation. It might be too soon to say for sure, but the rapid cooling of the housing market could be offsetting inflationary pressures elsewhere. Statistics Canada’s index of shelter costs increased 7.1 per cent in June, slower than the 7.4 per cent posted in May. The agency observed that real-estate agents are collecting lower commissions because prices have dropped.

In the near term, higher interest rates could exert upward pressure on shelter costs because mortgages will be rising. However, if home prices continue to fall, “this could lead higher rates to more quickly dampen high inflation in Canada relative to the U.S.,” Veronica Clark, an economist at Citigroup Global Markets Inc., said in a note to her clients. “This is a fundamental reason why we still think policy rates could reach a slightly lower terminal level in Canada than in the U.S.”

Another sign that inflation could be peaking is a deceleration in the pace of increases from month to month. The consumer price index rose 0.7 per cent from May, considerably slower than the previous monthly increase of 1.4 per cent. Commodity prices are finally responding to gravity, and that could ripple through the cost of finished goods in the months ahead.

The release “points to some potential positive news on the price front,” Randall Bartlett, an economist at Desjardins Group, said in a note, before adding that the news wasn’t so positive that it will keep the Bank of Canada from increasing the benchmark rate by either a half point or three-quarters of a point in September.

Bottom line

The cost of living is increasing faster than wages, so something has to give. The economy is almost certainly headed for slower economic growth, as higher interest rates have triggered a correction in housing markets and surging food and fuel costs are draining consumer disposable income that might otherwise be used to buttress broader consumption.

How much slower? The Bank of Canada last week predicted that gross domestic product will increase 1.8 per cent in 2023, down from 3.5 per cent this year. Bank of Nova Scotia’s economics team this week said it sees growth of 1.6 per cent next year, as pent-up demand from the pandemic offsets headwinds from higher interest rates. Royal Bank of Canada economists think we’re headed for a recession. Regardless, a soft landing is getting harder and harder to execute.

The central bank last week said more interest-rate increases are coming, and the new inflation reading suggests it will be another supersized hike when policymakers next gather in September. That would push the benchmark rate above three per cent, which could be a challenge for consumers, executives and investors who have become used to borrowing costs closer to zero.

• Email: kcarmichael@postmedia.com | Twitter: carmichaelkevin

Listen to Down to Business for in-depth discussions and insights into the latest in Canadian business, available wherever you get your podcasts. Check out the latest episode below:

Yahoo Finance

Yahoo Finance