Canada's equity market makes a modest turnaround as copper miners lead fundraising

By Divya Rajagopal

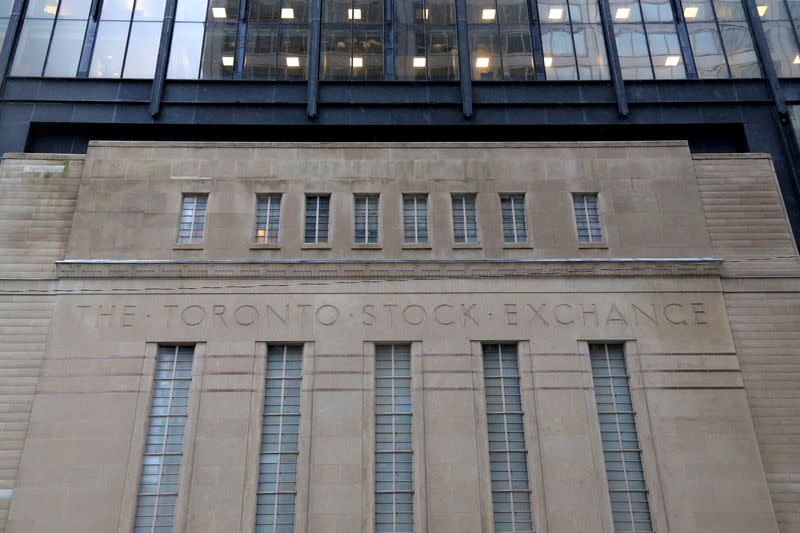

TORONTO (Reuters) - Fundraising in Canada's capital markets made a modest turnaround in the second quarter as copper miners gave a bump to depressed equity market issuance, while oil companies led the charge on debt issuance, according to data from Refinitiv.

First Quantum Minerals' capital raising worth C$1.5 billion through issuance of common shares and Capstone Copper's C$487 million worth of equity raising were highlights of the equity markets this quarter, as investors bet on the potential of a turnaround in copper prices. Fundraising through Canada's equity markets in the second quarter increased 7% from the year-earlier period.

Investors' appetite to snap up high-yield corporate debt continued as companies once again tapped the bond market due to lack of investor interest in the equity markets. As in previous quarters, high interest rates revived the corporate bond market.

Corporate Canada doubled its fundraising through the debt market by raising as much as C$35 billion from that source as the Bank of Canada continued its hawkish stance on its interest rate cuts.

Among the top borrowers for this quarter were the Coastal GasLink Pipeline by TC Energy, Canada Housing Trust No. 1, the government of Canada, Pembina Pipeline Corp and Telus Corp.

On the top M&A deals, Brookfield's C$9.4 billion acquisition of French alternative energy services company Neoen, private equity firm Advent's C$8.3 billion buyout of Canadian payment firm Nuvei Corp and Canadian Western Bank's acquisition by National Bank of Canada for C$4.8 billion topped Refinitiv's M&A rankings.

Among the dealmakers, RBC Capital Markets topped the league table for debt and equity fundraising, while TD Securities came in a close second in debt fundraising, followed by CIBC World Markets and the Bank of Nova Scotia.

(Reporting by Divya Rajagopal; editing by Jonathan Oatis)

Yahoo Finance

Yahoo Finance