Canada's top CEOs earn 200 times an average worker's salary: report

Shortly before 11 a.m. today, the average top-earning CEO in Canada will have already earned — in less than one work day — what the average worker makes in an entire year, says a new study.

The Canadian Centre for Policy Alternatives report examined the 100 highest-paid CEOs at TSX-listed companies for 2016.

Turns out, those corporate executives had a stellar year. Their average annual compensation hit a record $10.4 million — that's more than 200 times an average worker's salary of $49,738, says the report.

It also found that top CEOs got a big pay hike. Their average compensation rose eight per cent compared to 2015, whereas an average worker's salary rose by just 0.5 per cent.

"CEOs continue, year after year, to increase that gap between them and the average worker," said David Macdonald, report author and senior economist with the CCPA, a think-tank that studies economic inequity issues.

"[They are] now making your average pay prior to your second cup of coffee," he said. "In a couple years — five years, maybe — CEOs will make your pay before breakfast."

Big bonuses

Macdonald combined base salary plus compensation, such as pensions and the granting of company shares, to tally up CEO income totals.

He found that, on average, base pay made up only 11 per cent of a CEO's compensation. The lion's share came from share grants (33 per cent), bonuses (26 per cent) and stock options (15 per cent).

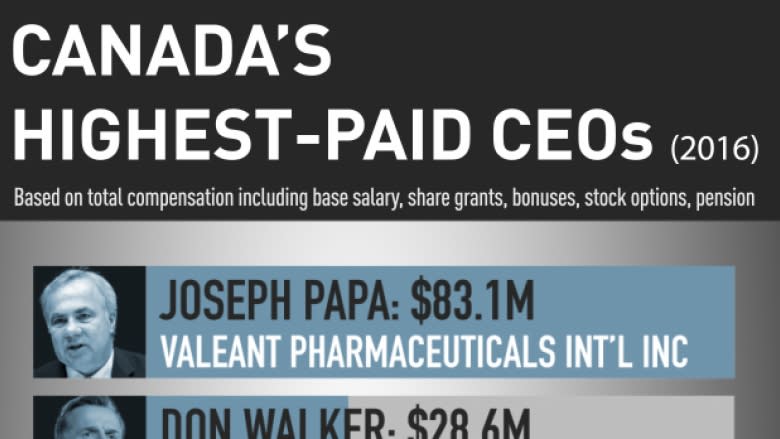

For 2016, Valeant Pharmaceuticals CEO Joseph Papa scored the top spot, earning more than $83 million in total compensation. Almost $56 million of that came from share grants.

Magna CEO Donald Walker came in second, earning $28.6 million, most of which ($26.4 million) was the result of share grants and bonus pay.

Macdonald says one way to help shrink the inequality gap is for the federal government to tax top earners at a higher rate.

He also wants Ottawa to close tax loopholes such as the stock option deduction, a tax perk where profits from stock options are taxed at a lower rate compared to regular income. Many rich CEOs benefit from the perk.

"I don't think that people object to CEOs making more than average workers, but they make over 200 times more and the gap is increasing," said Macdonald.

"That's what gets Canadians up in arms."

'False comparison'

While some Canadians may take issue with what top CEOs are making, Carleton University business professor Ian Lee isn't one of them. He says their compensation is justifiable and shouldn't be compared to an average worker's salary.

Lee says top players in any industry — from sports to entertainment to big business — always make far more than the average person because they offer rare and sought-after talent.

"Comparing them to an ordinary person is like comparing apples to kumquats," he said. "It's a false comparison."

Lee points to the late Hunter Harrison as an example of a top executive earning his worth.

Harrison scored the fifth highest CEO income in 2016, earning almost $19 million in total compensation as head of Canadian Pacific Railway.

He previously served as CEO of Canadian National Railway, and generated big profits at both companies through cost-cutting measures such as layoffs.

"Whatever people think of his actual tactics, there is no question that he turned around two [companies] in a way that was truly remarkable," said Lee.

"The salary they paid him, it was cheap," Lee says, considering the returns.

Harrison died on Dec. 16 at age 73.

Gender disparity

Along with income inequality, Macdonald has concerns about the gender gap he found in his study.

Out of the 100 top-earning CEOs, only three were women:

- #12 Linamar's Linda Hasenfratz: $14.6 million total compensation.

- #66 Transalta's Dawn L. Farrell: $7.4 million total compensation.

- #94 Atco and Canadian Utilities Limited's Nancy Southern: $5.4 million total compensation.

Just two women made the same CCPA list in 2015 — Hasenfratz and Farrell. Macdonald isn't encouraged by the addition of one more woman for 2016.

"I think it's extraordinarily difficult for women to gain access to this group," he said. "It's clear there's no movement on this."

Macdonald expects to find some positive movement on average worker income when minimum wage rises to $15 later this year in Alberta and by 2019 in Ontario.

According to his report, the lowest wage for the richest CEOs in 2016 was $2,489.62 an hour.

Yahoo Finance

Yahoo Finance