Camden Property Trust Q1 2024 Earnings: Surpasses EPS Projections and Maintains Strong ...

Earnings Per Share (EPS): Reported at $0.77 for Q1 2024, *exceeding* the estimated $0.76, up from $0.39 in Q1 2023.

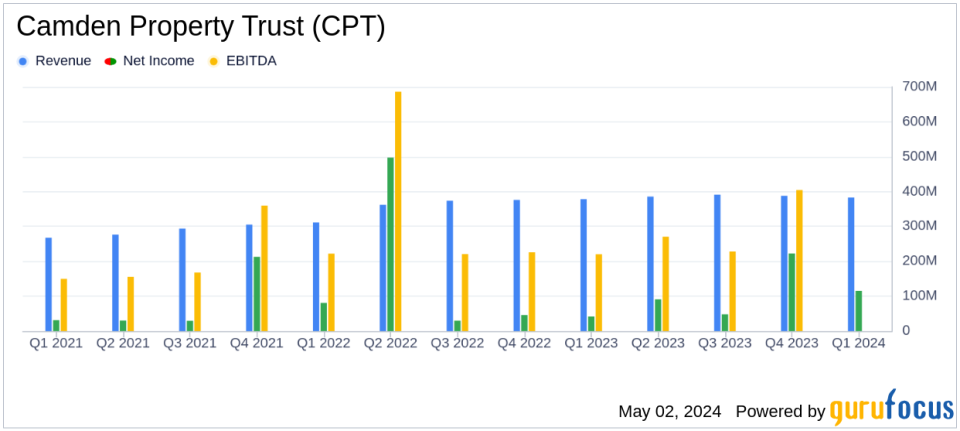

Revenue: Reached $383.1 million in Q1 2024, slightly *below* the estimate of $385.07 million, compared to $378.2 million in the previous year.

Net Operating Income (NOI): Increased by 2.3% year-over-year, although it decreased by 0.5% from the previous quarter.

Funds from Operations (FFO): Achieved $1.67 per share, *exceeding* guidance of $1.64 and up from $1.66 in Q1 2023.

Core Funds from Operations (Core FFO): Reported at $1.70 per share, *above* the guidance midpoint of $1.67.

Same Property Occupancy: Recorded at 95.0%, slightly *lower* than 95.3% in Q1 2023 but *higher* than 94.9% in Q4 2023.

Development and Disposition: Completed lease-up at Camden NoDa and began leasing at Camden Long Meadow Farms; sold a 592-apartment community for $115 million, realizing a gain of $43.8 million.

On May 2, 2024, Camden Property Trust (NYSE:CPT) disclosed its first-quarter earnings for 2024, revealing a performance that not only surpassed EPS estimates but also highlighted robust operational strengths amidst economic uncertainties. The detailed earnings can be accessed through their 8-K filing.

Company Overview

Camden Property Trust, a stalwart in the real estate sector, primarily focuses on the acquisition, management, and development of multifamily apartment communities across the United States. With a significant presence in key Sun Belt cities, the company's portfolio is heavily concentrated in dynamic markets such as Houston, Dallas, and Atlanta. Camden's revenue streams are predominantly derived from property leasing, with a strategic emphasis on short-term agreements that provide flexibility in a fluctuating real estate market.

Performance Highlights

For Q1 2024, Camden reported an EPS of $0.77, a notable increase from the $0.39 reported in the same quarter the previous year, and slightly above the analyst estimate of $0.76. This improvement reflects not only the company's effective cost management strategies but also its ability to capitalize on market dynamics to boost profitability. Furthermore, Camden's Core Funds from Operations (Core FFO) stood at $1.70 per diluted share, exceeding both the previous year's figure and the midpoint guidance of $1.67.

Operational Successes and Challenges

Camden's operational metrics remained strong with a same-property revenue increase of 2.5% year-over-year and a slight sequential growth. However, the company faced challenges such as increased property operating expenses, up by 2.9% compared to Q1 2023, and a nuanced shift in occupancy rates, which slightly decreased from 95.3% in Q1 2023 to 95.0% in Q1 2024. Despite these challenges, the management has effectively revised its 2024 outlook for property operating expense growth downward, reflecting resilience in its operational strategy.

Strategic Financial Movements

During the quarter, Camden was active in the capital markets, issuing $400 million of senior unsecured notes and managing its debt portfolio efficiently by repaying a $300 million unsecured term loan. The company also continued its share repurchase program, buying back shares worth approximately $45.7 million, underscoring its commitment to delivering shareholder value.

Liquidity and Future Outlook

As of March 31, 2024, Camden boasted nearly $1.3 billion in liquidity, positioning it well to navigate future market fluctuations and capitalize on growth opportunities. The company's guidance for Core FFO for the full year 2024 remains steady at $6.74 per share, reflecting confidence in its operational stability and market strategy.

Conclusion

Camden Property Trust's Q1 2024 results not only surpassed EPS expectations but also demonstrated a robust operational framework capable of adapting to market and economic changes. With a strategic focus on key growth markets and a solid financial footing, Camden is well-positioned to continue its trajectory of stable growth and operational excellence. Investors and stakeholders can look forward to a year of sustained performance as the company continues to navigate the complexities of the real estate market.

For more detailed information and to stay updated on Camden's financial journey, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Camden Property Trust for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance