Caesars Entertainment (NASDAQ:CZR) Reports Sales Below Analyst Estimates In Q1 Earnings

Hotel and casino entertainment company Caesars Entertainment (NASDAQ:CZR) missed analysts' expectations in Q1 CY2024, with revenue down 3.1% year on year to $2.74 billion. It made a GAAP loss of $0.73 per share, down from its loss of $0.63 per share in the same quarter last year.

Is now the time to buy Caesars Entertainment? Find out in our full research report.

Caesars Entertainment (CZR) Q1 CY2024 Highlights:

Revenue: $2.74 billion vs analyst estimates of $2.83 billion (3.1% miss)

Adjusted EBITDA: $853 million vs. analyst estimates of $916 million (6.9% miss)

EPS: -$0.73 vs analyst estimates of -$0.08 (-$0.65 miss)

Gross Margin (GAAP): 50.9%, down from 53.3% in the same quarter last year

Market Capitalization: $8.13 billion

Tom Reeg, Chief Executive Officer of Caesars Entertainment, Inc., commented, “Operating results during the first quarter in Las Vegas are a combination of record occupancy, driven by the Super Bowl and international visitation for Chinese New Year, offset by lower-than-expected hold. In our Regional segment, results reflect weather related weakness in January and early February partially offset by our new property openings. Caesars Digital delivered strong revenue growth despite lower-than-expected hold in online sports due to unfavorable outcomes for the Super Bowl and March Madness. Moving past the first quarter headwinds, we remain optimistic toward improved operating results throughout the balance of the year.”

Formerly Eldorado Resorts, Caesars Entertainment (NASDAQ:CZR) is a global gaming and hospitality company operating numerous casinos, hotels, and resort properties.

Casino Operator

Casino operators enjoy limited competition because gambling is a highly regulated industry. These companies can also enjoy healthy margins and profits. Have you ever heard the phrase ‘the house always wins’? Regulation cuts both ways, however, and casinos may face stroke-of-the-pen risk that suddenly limits what they can or can't do and where they can do it. Furthermore, digitization is changing the game, pun intended. Whether it’s online poker or sports betting on your smartphone, innovation is forcing these players to adapt to changing consumer preferences, such as being able to wager anywhere on demand.

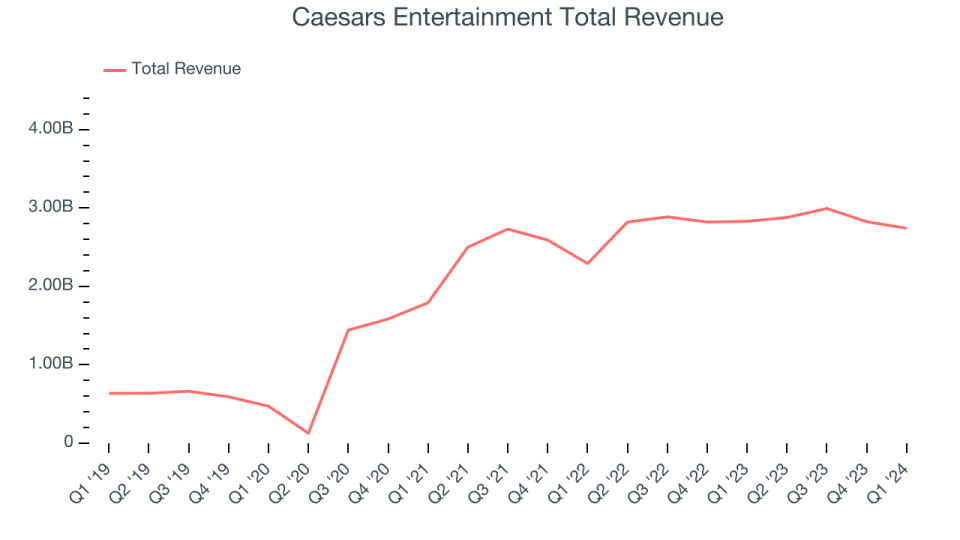

Sales Growth

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Caesars Entertainment's annualized revenue growth rate of 38.4% over the last five years was incredible for a consumer discretionary business.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Caesars Entertainment's recent history shows its momentum has slowed as its annualized revenue growth of 6.3% over the last two years is below its five-year trend.

This quarter, Caesars Entertainment missed Wall Street's estimates and reported a rather uninspiring 3.1% year-on-year revenue decline, generating $2.74 billion of revenue. Looking ahead, Wall Street expects sales to grow 3.7% over the next 12 months, an acceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

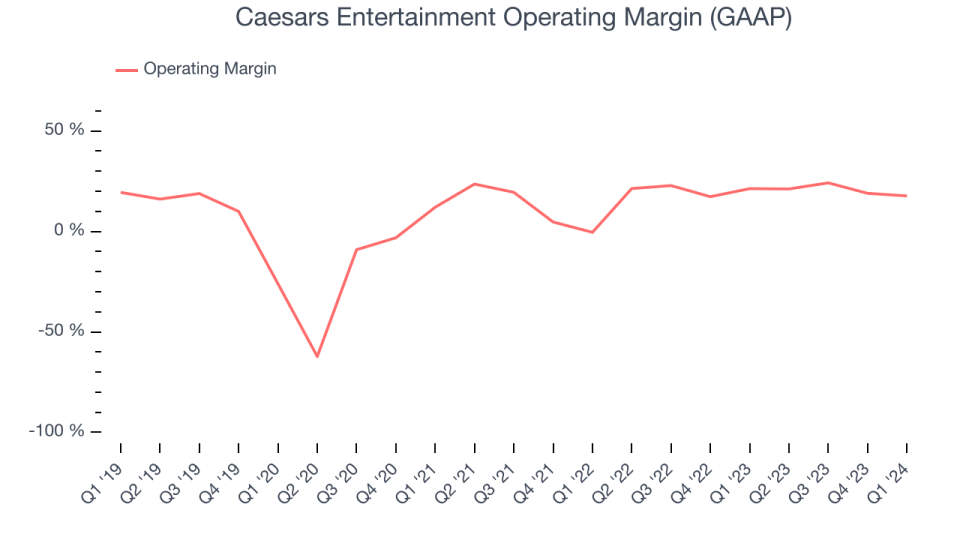

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Caesars Entertainment has been a well-managed company over the last eight quarters. It's demonstrated it can be one of the more profitable businesses in the consumer discretionary sector, boasting an average operating margin of 20.6%.

In Q1, Caesars Entertainment generated an operating profit margin of 17.7%, down 3.6 percentage points year on year.

Over the next 12 months, Wall Street expects Caesars Entertainment to become more profitable. Analysts are expecting the company’s LTM operating margin of 20.6% to rise to 22.8%.

Key Takeaways from Caesars Entertainment's Q1 Results

We struggled to find many strong positives in these results. Its revenue, adjusted EBITDA, and EPS all missed Wall Street's estimates. Overall, the results could have been better. The company is down 3.3% on the results and currently trades at $34.68 per share.

Caesars Entertainment may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance