Caesars Entertainment (CZR) Q4 Earnings Miss, Improve Y/Y

Caesars Entertainment, Inc. CZR reported mixed fourth-quarter 2021 results, wherein earnings missed the Zacks Consensus Estimate, but revenues beat the same. However, both the top and the bottom lines improved on a year-over-year basis. Following the results, shares of the company increased 4.5% during the after-hours trading session on Feb 22.

The company witnessed a solid performance of its rebranded Caesars Sportsbook. It stated that Caesars Sportsbook is currently live in 22 states and jurisdictions, out of which 16 provide mobile wagering.

Tom Reeg, CEO of Caesars Entertainment, stated, “Our quarterly operating results reflect new fourth quarter records for Adjusted EBITDA and Adjusted EBITDA margin in both our Las Vegas and Regional segments. Caesars Sportsbook continues to exceed our expectations for new customer registrations, deposits and market share, especially in recently launched jurisdictions.”

Earnings & Revenue Discussion

In the quarter under review, adjusted loss per share (EPS) was $1.14, wider than the Zacks Consensus Estimate of loss of 81 cents. In the prior-year quarter, the company had reported an adjusted loss of $1.70 per share.

Net revenues during the quarter under review were $2,591 million, which surpassed the Zacks Consensus Estimate of $2,584 million. In the prior-year quarter, the company had reported net revenues of $1,585 million.

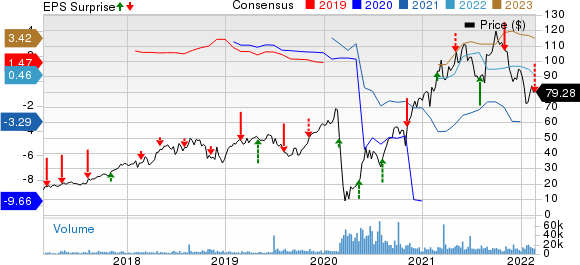

Caesars Entertainment, Inc. Price, Consensus and EPS Surprise

Caesars Entertainment, Inc. price-consensus-eps-surprise-chart | Caesars Entertainment, Inc. Quote

Segmental Performance

During the fourth quarter, net revenues from the Las Vegas segment were $ 1,040 million compared with $447 million reported in the year-ago quarter. The segment’s adjusted EBITDA was $483 million compared with $90 million in the prior-year quarter.

Coming to the Regional segment, net revenues during the quarter were $1,364 million compared with $1,028 million in the year-ago quarter. The segment’s adjusted EBITDA totaled $430 million compared with $262 million in the prior-year quarter.

Net revenues from the Caesars Digital segment in the fourth quarter were $116 million compared with $37 million in the prior-year quarter. The segment’s adjusted EBITDA came in at $(305) million against $6 million reported in the year-ago quarter.

In the Managed and Branded segment, net revenues during the quarter were $72 million compared with $66 million in the prior-year quarter. The segment’s adjusted EBITDA amounted to $18 million compared with $13 million in the prior-year quarter.

Balance Sheet

As of Dec 31, 2021, the company’s cash and cash equivalents were $1,070 million compared with $1,776 million as on Dec 31, 2020.

Net debt as of Dec 31, 2021, stood at $13,253 million compared with $13,247 million as of Dec 31, 2020.

Zacks Rank & Key Picks

Caesars Entertainment has a Zacks Rank #4 (Sell).

Some better-ranked stocks from the Zacks Consumer Discretionary sector are Crocs, Inc. CROX, Cedar Fair, L.P. FUN and Ralph Lauren Corporation RL.

Crocs flaunts a Zacks Rank #1 (Strong Buy). The company has a trailing four-quarter earnings surprise of 36%, on average. Shares of Crocs have increased by 4.4% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for CROX’s 2022 sales and EPS indicates a rise of 48.6% and 22.1%, respectively, from the year-ago period’s levels.

Cedar Fair sports a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 16.3%, on average. Shares of Cedar Fair have gained 17.6% in the past year.

The Zacks Consensus Estimate for FUN’s 2022 sales and EPS suggests growth of 32.6% and 612.7%, respectively, from the year-ago period’s levels.

Ralph Lauren flaunts a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 94.1%, on average. Shares of Ralph Lauren have increased 10.1% in the past year.

The Zacks Consensus Estimate for RL’s 2022 sales and EPS suggests growth of 40% and 381.2%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Cedar Fair, L.P. (FUN) : Free Stock Analysis Report

Caesars Entertainment, Inc. (CZR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance