Cadence's (CDNS) Solution Power Wistron's Network Switch

Cadence Design Systems CDNS announced that Wistron has adopted an AI-powered electromagnetic in-design analysis workflow. Wistron used Cadence's Optimality Intelligent System Explorer and Clarity 3D Solver to create an 800G network switch.

Wistron has significantly enhanced design reliability and improved its turnaround time with Optimality Explorer’s AI-driven optimization technology and the Clarity 3D Solver. The Clarity 3D Solver stands out for its speed and scalability, analyzing intricate systems without sacrificing precision.

The Optimality Explorer is a generative AI-driven, in-design multiphysics system analysis and optimization solution that enables engineers to achieve configurations that lead to shorter, more efficient design cycles.

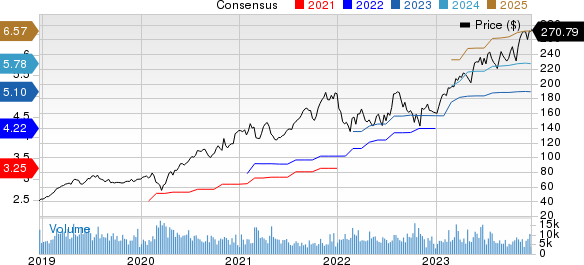

Cadence Design Systems, Inc. Price and Consensus

Cadence Design Systems, Inc. price-consensus-chart | Cadence Design Systems, Inc. Quote

Cadence is dedicated to developing software that tackles multiphysics challenges in complex electronic systems, addressing scaling demands. Wistron's adoption of Cadence's multiphysics system analysis tools accelerates design throughput and engineering turnaround time.

Cadence offers products and tools that help customers to design electronic products. The company continues to invest heavily in verification and digital design products, allowing it to launch products that address the ever-growing needs of electronics and semiconductor companies. Going ahead, the company is likely to gain from clients increasing their research and development spending in AI-driven automation.

In December, the company announced that Samsung Foundry had completed the development of a 5G networking System on Chip design using Samsung's 5LPE technology, powered by Cadence Quantus Extraction Solution and Tempus Timing Solution.

Prior to that, the company joined forces with Autodesk to expedite the development of intelligent systems. This collaboration integrates Autodesk Fusion with Cadence's Allegro X and OrCAD X platforms to facilitate two-way communication between PCB designers and mechanical engineers.

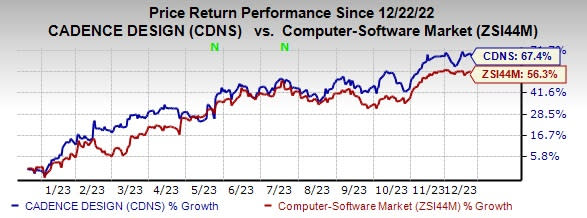

CDNS currently carries a Zacks Rank #3 (Hold). In the past year, the stock has gained 67.4% compared with the Zacks sub-industry’s growth of 56.3%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the broader technology space are Pegasystems PEGA, Flex FLEX and Watts Water Technologies WTS. Pegasystems and Flex presently sport a Zacks Rank #1 (Strong Buy), whereas Watts Water Technologies carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Pegasystems’ 2023 EPS has improved 21.2% in the past 60 days to $1.77. PEGA delivered an average earnings surprise of 1,250.2% in the trailing four quarters. Shares of PEGA have soared 51% in the past year.

The Zacks Consensus Estimate for Flex’s fiscal 2024 EPS has increased 3.6% in the past 60 days to $2.56. Flex’s long-term earnings growth rate is 12.4%.

Flex’s earnings outpaced the Zacks Consensus Estimate in each of the last four quarters, the average earnings surprise being 11%. Shares of the company have risen 19.8% in the past year.

The Zacks Consensus Estimate for Watts Water Technologies 2023 EPS has improved 3.9% in the past 60 days to $8.08. Watts Water’s long-term earnings growth rate is 7.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Flex Ltd. (FLEX) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Watts Water Technologies, Inc. (WTS) : Free Stock Analysis Report

Pegasystems Inc. (PEGA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance